Chase bans certain BNPL transactions

Chase will soon stop allowing its credit cardholders to use their cards to pay off third-party buy now, pay later (BNPL) loans, according to a consumer letter referenced on Reddit. The excerpt reads:

“Effective October 10, 2024, you will not be able to use Chase credit cards to pay for third-party Buy Now Pay Later (“BNPL”) installment plans. Payments to these installment plans (e.g., Klarna, AfterPay, etc.) using your Chase credit card will be declined.

“If your Chase credit card is used for any of these recurring BNPL plans, please update the payment method with your BNPL provider to avoid any missed payments or late fees (if applicable).”

It appears that Chase debit cards will still be able to be used to pay BNPL lenders.

Why is Chase making the change?

This seems to be a case of the bank prioritizing its own services over those offered by external rivals.

“Chase is doing something that other banks are slowly and methodically implementing: pushing customers to their own financial products,” Alex Beene, financial literacy instructor at the University of Tennessee at Martin, told Newsweek.

Chase Pay Over Time (formerly known as My Chase Plan) is the bank’s version of buy now, pay later. Purchases of $100 or more are eligible. Cardholders simply pay for the eligible purchase with their Chase credit card as usual. After the transaction posts to their account, the cardholder can opt into a “Pay Over Time” installment plan if they choose.

Soon, Chase cardholders will be able to sign up for Pay Over Time purchases of $50 or more within the Amazon.com checkout experience. They will need to select their Chase credit card with “financing offers available” during checkout.

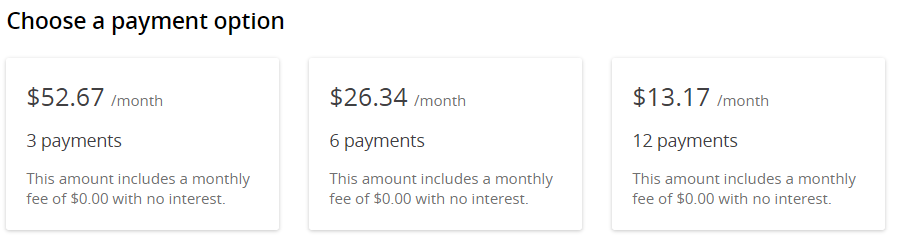

I recently logged into my Chase Freedom Flex®* account and noticed that Pay Over Time isn’t charging any fees or interest at the moment. For example, I was offered these three Pay Over Time options for a $158 purchase:

This must be a temporary promotion celebrating the relaunch of Chase Pay Over Time with the new name. The previous My Chase Plan service technically didn’t charge interest, but its monthly plan fees were often comparable to a 7 to 10 percent interest rate (if expressed as an annual percentage rate). That’s still a lot lower than the average credit card rate of 20.79 percent or my Freedom Flex purchase APR of 23.24 percent. Of course, you can avoid interest entirely by paying in full before the due date.

Other established credit card issuers have their own BNPL approaches

Chase Pay Over Time is similar to American Express Plan It and Citi Flex Pay. The two-step process of paying with a credit card and opting into an installment loan afterwards is a little clunky (as opposed to the more straightforward process offered by the likes of Affirm and Afterpay). But there are also consumer advantages, such as earning rewards and the familiarity of using an existing payment card.

The advantage for the card issuers is obvious: gaining a foothold in the rapidly growing BNPL market. eMarketer forecasts that total BNPL spending in the U.S. will grow about 12 percent this year to approximately $81 billion. That’s still small relative to the size of the credit card market — Americans currently owe $1.14 trillion on their credit cards, according to the Federal Reserve Bank of New York — but it’s a competitive threat worth watching. Nearly 4 in 10 U.S. adults have tried BNPL, according to Bankrate’s 2024 Buy Now, Pay Later survey.

There’s another possible reason Chase is limiting external BNPL usage

Paying off debt with debt represents a potential risk. That’s why Capital One stopped allowing its credit cards to be used for BNPL transactions in 2020. “These kinds of transactions can be risky for consumers and the banks that serve them,” a Capital One spokesperson told Reuters.

Capital One customers can still use their debit cards and checking accounts to pay Affirm, Afterpay, Klarna and other BNPL lenders. And unlike Chase, American Express and Citi, Capital One does not offer its own installment payment option.

It’s hard to argue with Capital One’s position. Allowing its credit cards to be used for BNPL purchases effectively puts the card issuer in a secondary lending position. It’s conceivable that someone who didn’t have the money to pay off a BNPL loan could satisfy that financial obligation by paying it off with a credit card only to leave the credit card issuer holding the bag.

And many BNPL users do run into trouble. The aforementioned Bankrate survey found that 56 percent of BNPL users have experienced a problem at some point, led by overspending (29 percent), missing a payment (18 percent) and difficulty returning items or getting a refund (also 18 percent).

The bottom line

The fact that Chase and other major credit card issuers are expanding their proprietary buy now, pay later offerings is a sign that the BNPL industry continues to gain traction. Some people like knowing exactly how much they owe and precisely how long the plan will last (a contrast with credit card minimum payments which can drag on forever).

Just don’t lose sight of the total cost of ownership. It’s easy to trick yourself into spending $50 here and $50 there via BNPL. All of a sudden you’ve spent way more than you planned.

As long as the purchase fits within your budget, BNPL is a worthy tool in your financial toolbox. Many people are mixing and matching different payment methods (BNPL, credit cards, debit cards, cash, etc.) for different purposes. Ultimately, more choices are a good thing for consumers.

Have a question about credit cards? E-mail me at ted.rossman@bankrate.com and I’d be happy to help.

*The information about the Chase Freedom Flex® has been collected independently by Bankrate. The card details have not been reviewed or approved by the issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.