How to request a credit line increase with Discover

Key takeaways

- You can request a credit line increase with Discover by filling out a form online or via the issuer’s mobile app, or by calling the number on the back of your credit card.

- Discover takes a variety of factors into consideration when deciding to approve or deny your request, including your credit profile, income level and housing information.

- Before you request a credit line increase from Discover, make sure your income level and credit score are in a good place and your Discover account is in good standing.

Your credit limit is a major factor in your credit health. If you use your credit cards responsibly, you are often rewarded with higher credit limits and more purchasing power. If you’re stuck with low credit limits, you might not have the ability to make as many purchases, earn as many rewards or use your available credit to boost your credit score.

Many of today’s best credit cards regularly offer credit limit increases — but if you haven’t received a credit limit increase in a while, you can always request one. Knowing how to increase your credit limit gives you the ability to fund major expenses, earn rewards like cash back on those purchases and build your credit score.

If you have a Discover credit card, you can request a credit limit increase online or over the phone. There is no stated Discover card maximum credit limit, which means you can always ask for a little bit more — but when should you ask for a credit increase with Discover, and how much credit should you ask for?

Let’s take a look at everything you need to know about requesting a Discover credit limit increase, including what you should do before you make your request and what you should do if your Discover credit limit increase request is denied.

Who is eligible for a credit line increase from Discover?

When should you apply for a credit increase? Many people ask for a credit increase if they are planning to make a big purchase or are hoping to use their credit limit increase to boost their credit score.

But not everyone who requests a credit increase from Discover will be able to get one. Discover says that those who are eligible for a credit line increase would likely include:

- Those with a good debt-to-income ratio.

- Those with a positive payment history and an account in good standing.

- Those with a strong credit score who have had the card for longer.

- Those with a reliable employment history.

If you meet at least one of the criteria on Discover’s list, you might be eligible for a Discover credit limit increase.

What to do before you apply for a credit increase

Discover wants to know that you will be able to handle your new credit limit responsibly and won’t use it to run up a bunch of debt that you can’t pay off. That’s why it’s a good idea to time your credit limit increase request with an increase in your financial stability. If you have recently increased your income or improved your credit score, for example, you might be more likely to see your credit limit increase request approved.

Here’s what to do before you request a Discover credit limit increase:

Know your current credit limit

Before you request a credit line increase, you should know your current credit limit, as well as your current credit utilization ratio. That way, you know how much credit Discover has already approved on your credit card and how much of that credit you’re currently using.

Log in to your Discover online account or Discover mobile app to view your credit limit, which should appear at the top of the screen.

Decide exactly how much credit you want

Increasing your available credit can boost your credit score and improve your purchasing power, so you might be tempted to ask for a large amount of credit at once — but don’t make a request that’s so large it’s likely to be declined. If you have a $5,000 credit limit, it’s better to request an increase to $6,000 than it is to request an increase to $10,000.

Keep in mind: You may not even get to suggest a number. When you apply for a Discover credit limit increase online, for example, Discover will determine how much of a credit line increase to offer you based on your application, not your request.

To give you an idea of how much of an increase you might get, you can compare your credit report at the time you were given your original credit limit to your current credit report. Your credit is a major factor in how issuers determine your credit limit when you apply for a card, so this could give you a good reference point.

Check over your credit score and your Discover account

You should know your credit score and make sure your account is in good standing before you contact Discover. If your credit score has fallen since you first applied for the credit card, Discover might not want to raise your credit limit. Likewise, if you’ve missed payments or have done other things to put your account in bad standing, Discover might not want to take the risk of offering you more credit.

How to apply for a credit line increase online or via mobile app

Requesting a credit line increase from Discover is a relatively simple process. Just follow these steps:

Reach out to the issuer

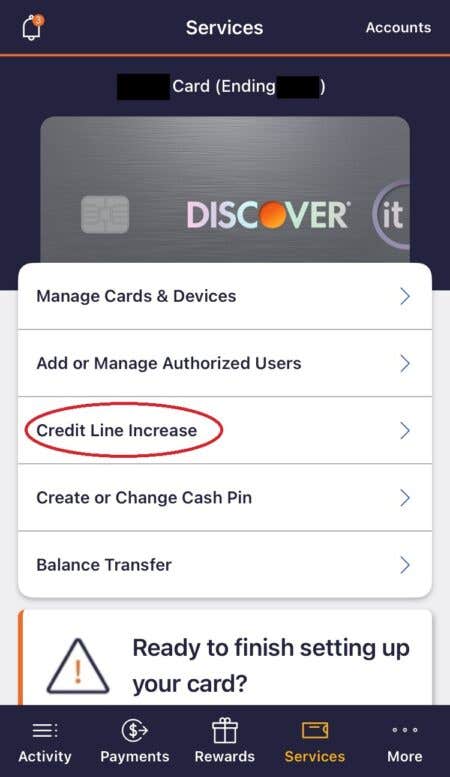

If you’re using the Discover app, select “Services” from the bottom toolbar, followed by “Credit Line Increase.”

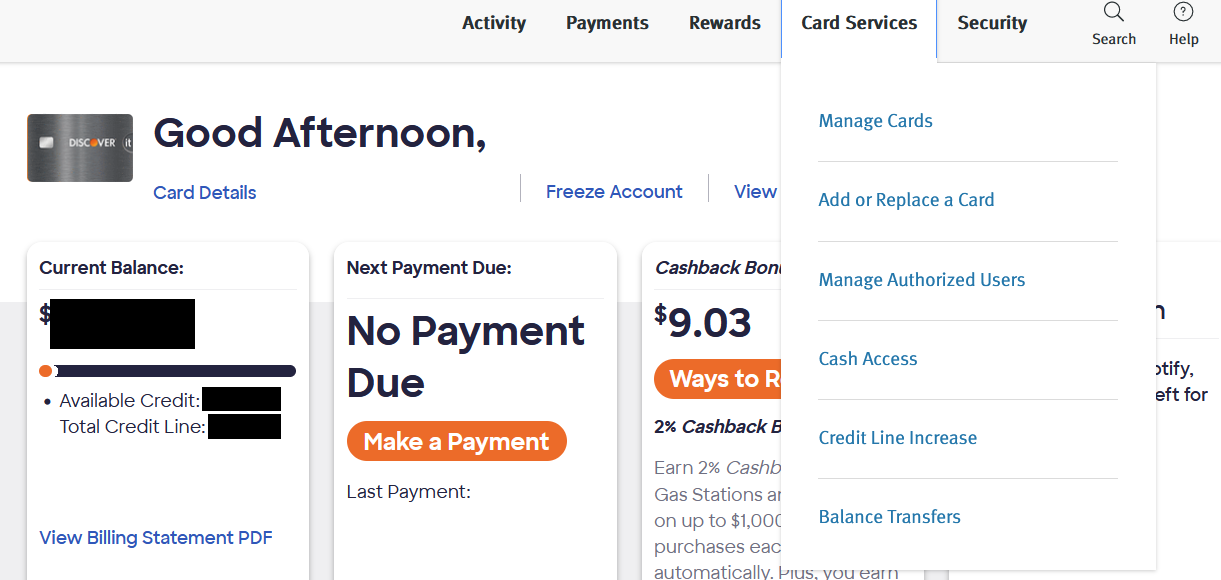

If you’re requesting a Discover credit limit increase online, select “Card Services” from the page menu at the top, followed by “Credit Line Increase.”

Provide Discover with any necessary information

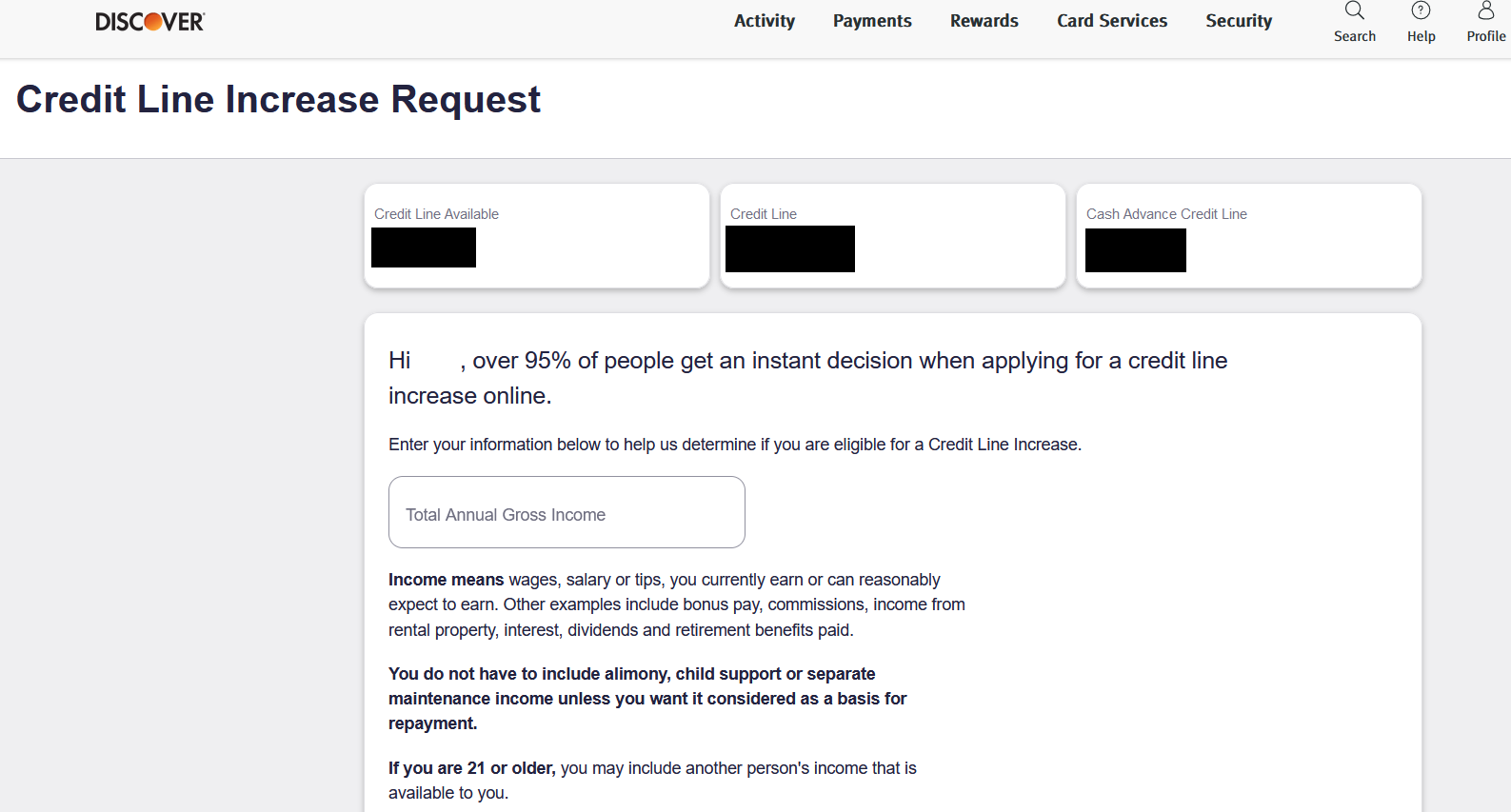

If you’re requesting your credit line increase online or via the mobile app, you’ll be directed to a Credit Line Increase Request form. This form will ask you for information like your total annual gross income and your monthly housing payment.

Give Discover permission to perform a hard credit inquiry if needed

A Discover credit limit increase request might involve a hard credit inquiry, which could drop your credit score by a few points, but Discover will only proceed with that part of the application after receiving your consent. In many cases, Discover will proceed with your request by doing a soft credit inquiry instead, which won’t impact your score.

How to apply for a credit line increase over the phone

Requesting a credit line increase over the phone is pretty simple. You just have to:

- Call customer service. Call the number on the back of your credit card or their customer service line at 1-800-347-2683.

- Verify your identity. The Discover representative might ask you to verify your identity before proceeding.

- Answer the representative’s questions. You may be asked why you want Discover to increase your credit limit. You should also be prepared to provide your total annual gross income, as well as your monthly housing/rent payment.

- Submit your request. The representative may need additional information from you, such as consent to perform a hard inquiry, before processing your request.

How long does a Discover credit line increase take?

While there isn’t an official statement on how long a Discover credit line increase takes to process, Discover does provide guidance on how long it might take to get approved. “Over 95% of people get an instant decision when applying for a credit line increase online,” according to Discover’s Credit Line Increase Request form. In some cases, it may take a few days to learn whether your credit limit request will be approved (and you may have to answer additional questions about your finances before Discover can make the final decision).

Many credit line increase requests are implemented by issuers as soon as the request is approved. So, if you request a Discover credit limit increase and get approved, your new credit limit could take effect that same day.

Other ways to increase your credit limit with Discover

Requesting a credit limit increase on your Discover credit card is one way to increase your credit limit with Discover, but it isn’t your only option. Here are some additional ways to increase your credit limit:

Apply for a new Discover card

If you want to increase your available credit with Discover, you don’t necessarily have to request a credit limit increase on an existing Discover credit card — you can also apply for a new Discover card.

Taking out a new Discover card gives you an additional line of credit, which can help you increase your total available credit and potentially boost your credit score. A new Discover card can also help you access additional credit card rewards.

If you have a cash back rewards card like the Discover it® Cash Back, for example, you might want to consider applying for the Discover it® Miles. That way, you can earn both cash back rewards and travel rewards on your purchases.

Look out for an automatic credit limit increase

Discover may automatically increase your credit limit depending on your account history and creditworthiness. If you consistently make on-time payments on your Discover card account, for example, you might be more likely to receive an automatic credit limit increase than someone who regularly misses payments.

If you want an automatic credit limit increase from Discover, do your best to practice good credit habits and keep your credit score as high as possible.

What to do if your Discover request is denied

If your Discover credit limit increase request is denied, it’s a good idea to wait before requesting another credit limit increase. In fact, Discover suggests waiting several months before submitting a new request. Here are a few actions you can take while you wait:

Improve your credit score

Discover is more likely to increase your credit limit if your credit score improves. If you want to improve your credit score as quickly as possible, focus on making on-time payments on all of your credit accounts and paying down your outstanding debt.

Since your payment history makes up 35 percent of your FICO credit score and your credit utilization ratio makes up 30 percent, making on-time payments and paying off your credit card balances can give your credit score a significant boost.

Keep in mind: Your creditworthiness might not be the primary reason why your credit line increase request was denied. Many credit issuers tighten credit limits during economic downturns, for example, making it harder for individual cardholders to access higher credit limits.

Increase your income

Discover is more likely to increase your credit limit if you can prove that your income has gone up. It might be time for you to take on a side hustle or start hunting for a new job. You should also reevaluate your current income — maybe you didn’t factor in the tips you make at work, or maybe you haven’t been including your yearly bonus. These things can give Discover a more accurate idea of your income.

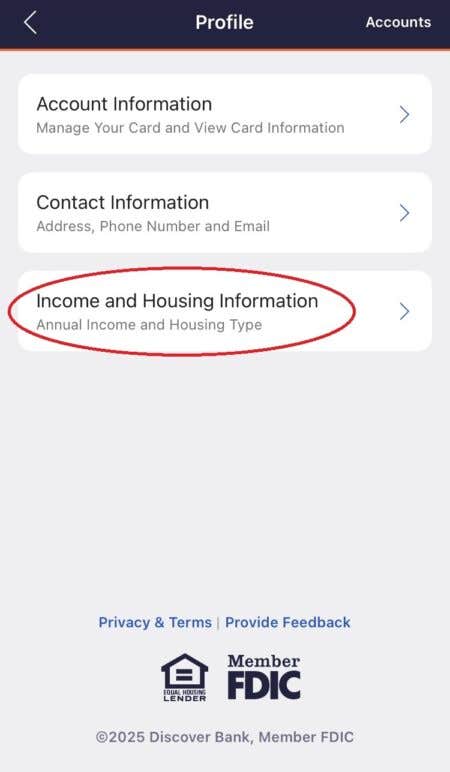

After you’ve increased your income, make sure to update your Discover account with your new gross annual earnings. If you’re using the Discover app, follow these steps:

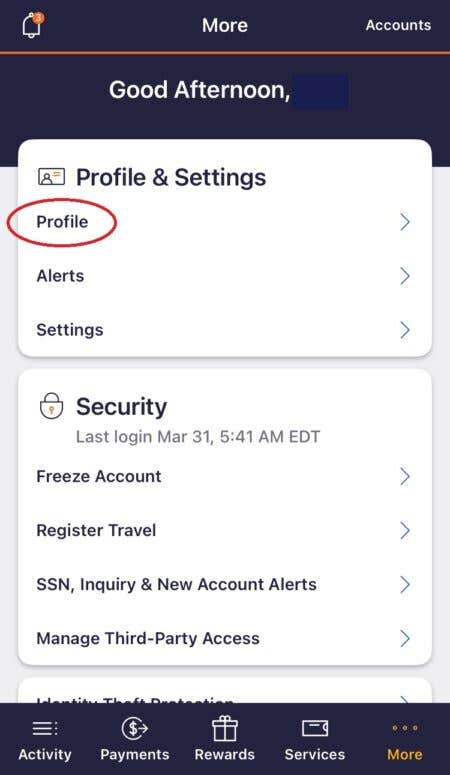

- Select “More” from the toolbar at the bottom of the screen.

- Select “Profile.”

- Select “Income and Housing Information” and update whatever needs to be changed.

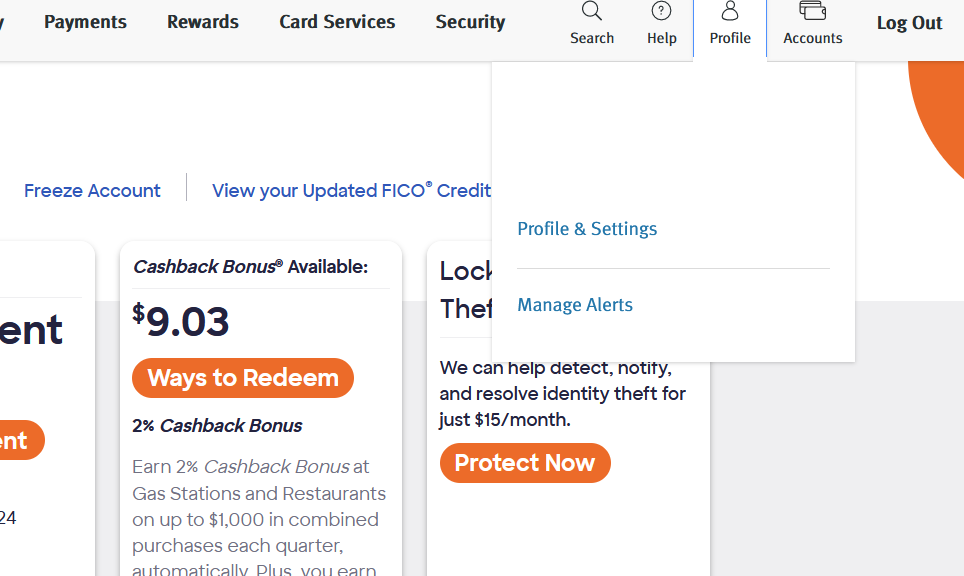

If you’re logging into Discover through a web browser, follow these steps:

- Select “Profile” in the top right corner of the home screen.

- Select “Profile & Settings” from the dropdown.

- Scroll down to the Income and Housing Information section and select “Edit Income and Housing Info.”

Once your income information is updated, you might be ready to request another credit line increase — or Discover might increase your credit limit automatically.

Apply for a credit card from a different issuer

Instead of requesting another Discover credit line increase or applying for a new Discover card, you might want to consider a credit card from a different issuer.

Credit card issuers have different methods of setting credit card limits, and you might be able to get the credit you need by applying for a credit card that isn’t issued by Discover. If you already have a credit card issued by another major lender, that issuer may also be more likely to grant your next credit limit increase request.

The bottom line

You can request a credit limit from Discover online, through the issuer’s mobile app or over the phone by calling the number on the back of your credit card.

However, your ability to successfully be approved for a credit limit increase — whether from Discover or another issuer — all comes down to your ability to manage your credit accounts responsibly. If your credit habits aren’t great, you’re probably going to have a harder time increasing your credit limits. If you practice good credit habits, credit card issuers are likely to reward you with additional credit.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.