How to request a credit line increase with Chase

Key takeaways

- You can request a credit limit increase with Chase online or over the phone. You can also receive a targeted offer or receive an automatic limit increase.

- Requesting a credit limit increase with Chase can help with financing, flexibility and building credit.

- To be eligible, you should have a good credit score, low debt to income ratio and good account history.

- Wait at least six months after account opening before requesting an increase with Chase.

Expanding your available credit, boosting your credit score or financing a large purchase are all excellent reasons to request a higher credit limit. And if you have a Chase credit card, the process of requesting a credit line increase is simple as long as you’re eligible. A short online request form or a quick call to Chase customer service could help you secure a higher credit limit within minutes.

Before you request your credit line increase with Chase, you’ll want to know what it takes to get approved and what your options are if you’re denied.

Who is eligible?

Typically, credit card issuers pay attention to three factors when considering your eligibility for a credit line increase:

- Debt-to-income (DTI) ratio

- Account history

- Credit score

If there’s a lapse in any of these areas, it could impact your chances of getting approved for a credit limit increase. Let’s say you have a credit score that’s seen better days due to a few late payments on your Chase credit card. Since that affects both your account history and your credit score, you may find it difficult to qualify for a Chase credit card limit increase. Instead, you’ll want to make sure all of your payments are made on time and your credit score is in the good to excellent range.

If you find yourself below the threshold, take steps to build your credit score before asking for an increase. You should also keep in mind that a credit limit request may come with a hard credit pull, which could temporarily drop your score by up to 10 points.

Bankrate’s take: If you just received your new Chase credit card in the mail and aren’t satisfied with the credit limit, be patient; you won’t be eligible for a credit limit increase just yet. Wait at least six months before asking for Chase to increase your credit limit for better odds at approval.

But even with good credit and a solid account history, you’ll still need to have the income to match. So what income do you need? Your income should outpace your debt by a significant margin. As a rule of thumb, Chase suggests keeping your debt to income ratio at or below 43 percent. A more ideal debt to income ratio is around 36 percent.

What to consider when requesting a higher credit limit

Before you decide to request an increased credit limit with Chase, there are a few aspects to consider.

- Your current credit limit. Log in to your Chase account to find out your current limit or check your credit card statement.

- How much of an increase you want. Avoid requesting an absurdly high credit limit increase. Instead, have a reasonable amount in mind and be prepared to back up your request with proof of responsible credit use.

- Eligibility. Your account history, DTI ratio, and credit score are the three main factors impacting your eligibility for a credit increase. It’s also a good idea to check your credit score before contacting Chase.

How to request a higher credit limit with Chase

If you want Chase to increase your credit limit, you can always ask — but that isn’t the only way to increase your limit. Here are four ways to boost your Chase credit limit and increase your purchasing power.

Request a credit limit increase

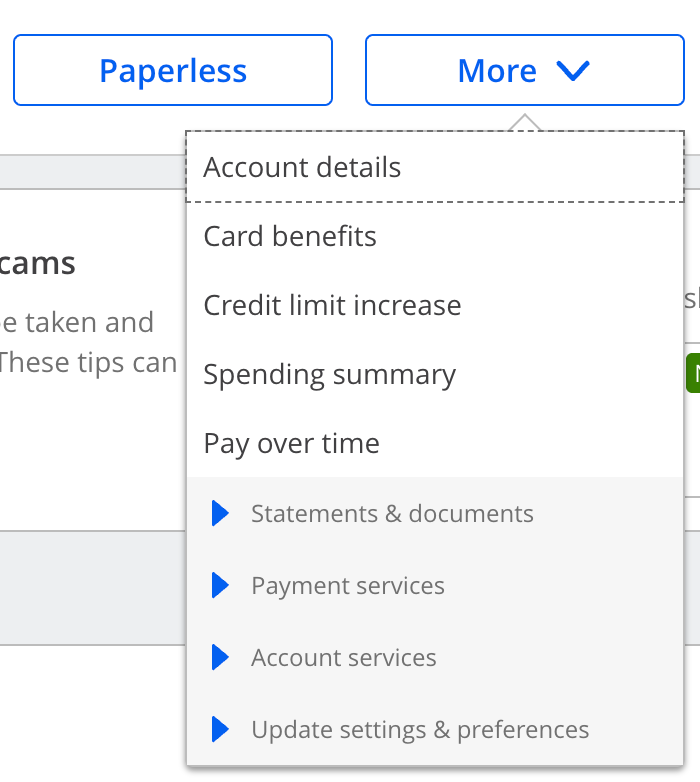

If you’d like to request a credit limit increase, you can call the number on the back of your Chase credit card to do so, or log into your Chase account and request it under the manage account option or ‘More.’

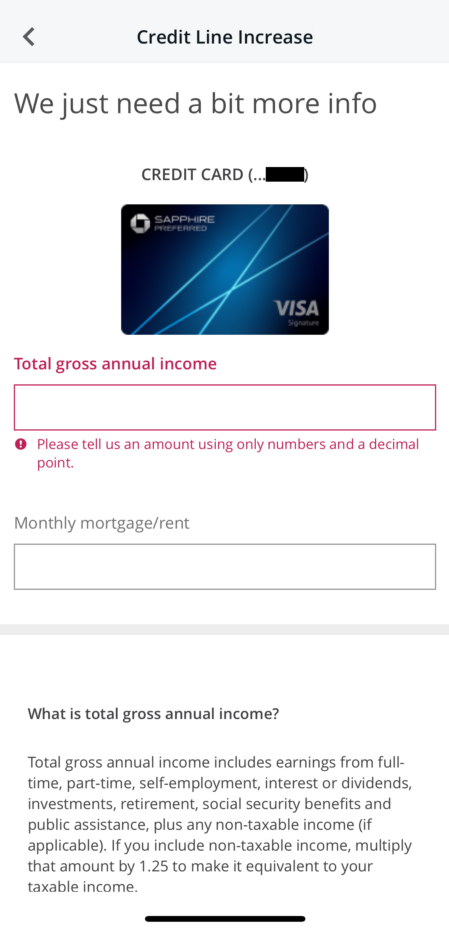

If you have multiple cards, you can choose which you’d like to request a credit limit increase for. From there you’ll be asked to input information regarding your gross annual income and your monthly rent or mortgage payment.

Bankrate’s take: If you’ve placed a freeze on your credit, you’ll want to unfreeze it before submitting your credit line increase with Chase to avoid processing delays.

If you call in, be prepared to discuss the credit limit you’d like Chase to apply to your account as well as your current income, employment status and reason for requesting more credit. This is your opportunity to prove you can manage your increased line of credit responsibly.

Receive an automatic credit limit increase

Chase cardholders in good standing may occasionally receive an automatic credit limit increase. To increase your odds of earning an automatic limit increase from Chase, you should be sure to manage your current Chase credit accounts responsibly, make on-time payments and avoid carrying high balances.

You can also boost your odds of earning an automatic credit limit increase by updating your income with Chase. If you recently got a promotion, took a new job or otherwise increased your income, it’s a good idea to let Chase know. You might get a credit limit increase as a result.

Apply for a new Chase card

Sometimes the easiest way to increase your credit limit is to apply for a new credit card. Opening up a new Chase credit card won’t increase the credit limit on your old Chase cards, but it’ll give you an additional line of credit to use. Having that extra available credit could even increase your credit score.

Among the advantages of having multiple credit cards is the ability to earn more sign-up bonuses and rewards with additional credit cards. The Chase Ultimate Rewards program can be especially lucrative, especially for frequent travelers, and combining multiple Chase cards gives you options to maximize your rewards.

In some cases, you may be able to get preapproved for a new Chase credit card without affecting your credit score. That said, you should keep Chase’s 5/24 rule in mind before you apply. If you’ve already taken out five credit cards in the past 24 months — regardless of whether those cards were from Chase or another issuer — Chase is likely to decline your application.

Respond to a targeted credit limit increase offer

Sometimes Chase will automatically increase your credit limit, or ask you if you’d like a credit limit increase. Responding to these targeted credit limit increase offers is a great way to build your credit. These kinds of offers should appear when you log in to your Chase account, though you may also get an email notifying you of a new or outstanding offer. If you accept the offer, the increased credit limit is automatically applied to your account.

How often does Chase increase credit limits?

Chase may automatically increase your credit limit every six to 12 months if you’re a borrower in good standing. Whether Chase will automatically increase your credit line depends on several factors, including your credit score, account history and credit utilization.

It’s a good idea to use no more than 30 percent of your available credit, with an ideal utilization ratio of under 10 percent. Keep in mind that this guideline primarily applies to revolving balances that stay on your card from month to month.

How long does a credit line increase take?

In many cases, it only takes a few minutes to learn the results of a credit line increase request. Once you’ve been approved for a credit line increase request, it should be applied to your account immediately.

What to do if your request is denied

If your credit line increase request is denied, you still have options. Here are three ways to manage your credit after getting denied for a credit limit increase:

- Improve your credit score. If your credit score is keeping you from getting the credit limits you want, try to boost your score. In many cases, you can raise your credit score in just a few months. Focus on making on-time payments and paying down your outstanding balances in order to increase the likelihood that your next credit limit request will be approved. Once your credit is where you want it to be, a credit limit increase can raise your score further.

- Consider applying for a different credit card. If you requested a credit limit increase with Chase and got denied, you might want to consider increasing your available credit by applying for a card from another issuer. If your credit score isn’t great, consider applying for one of the many credit cards for bad credit or credit cards for fair credit — otherwise, you run the risk of another denial. If your credit score is good, applying for another card could help you continue to build a positive credit history.

- Try a balance transfer. If you were hoping to use a credit limit increase to free up some space on a credit card, you might want to consider a balance transfer instead. Balance transfer credit cards allow you to transfer old balances from existing cards and often with at least six months of an introductory 0 percent APR to help you pay off those balances without paying interest. The best balance transfer credit cards offer 0 percent intro APR periods that last between 12 and 21 months, giving you abundant time to pay off your transferred balances.

The bottom line

Preparing to finance a big purchase, expanding your available credit and improving your credit utilization are all good reasons you might request a credit limit increase from Chase. It’s simple to do, either online or over the phone. Just be sure you’re eligible for the increase before making the request or you could wait for Chase to offer you one automatically.

If Chase denies your credit limit increase request, don’t despair. Work on your credit and consider trying again in a few months. In the meantime, there are many ways to obtain an additional line of credit, especially if you use your current lines of credit responsibly. To see if you prequalify for credit card offers without affecting your credit score, you can use Bankrate’s CardMatch tool to get matched with a card that best fits your needs.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.