How to request a credit line increase with Bank of America

Key takeaways

- Before requesting a credit limit increase, it’s important to know your current credit limit, how much credit you want and your credit score.

- You can request a Bank of America credit limit increase online, via the mobile app or by phone, and in some cases, you may be eligible for an automatic increase.

- If your credit limit increase request is denied, you can consider other options such as applying for a new credit card or using a balance transfer.

Requesting a credit line increase can be a smart move, and that’s true whether you need access to more credit or have other goals in mind, like improving your credit utilization ratio. But how do you go about requesting a credit limit increase with Bank of America? For the most part, all you have to do is ask. However, not everybody knows how to increase their credit limit — and many people don’t know that getting a higher credit limit can be as simple as making a request online.

Here are the steps to take before making your credit limit increase request with Bank of America, what to do if your credit limit increase request is denied and how to increase the odds of getting a credit line increase from Bank of America.

What to consider before requesting a higher credit limit

Before you request a Bank of America credit card limit increase, it’s important to consider what will happen to your credit score.

- The request itself could lower your credit score: Lenders often perform a hard credit inquiry, which temporarily lowers a credit score, before deciding whether to approve a credit limit increase request. If your credit score is on the border of good and fair, you might want to avoid any unnecessary credit inquiries.

- A higher credit limit could improve your credit score: Even though a credit limit increase request might ding your credit score temporarily, a credit limit increase can help improve your credit score if used responsibly. Thirty percent of your FICO credit score comes from your credit utilization ratio, which compares your available credit to your current debt. If you increase your credit limit without increasing your debt, your credit score could go up.

What to do before you ask for a credit limit increase

Before you contact Bank of America to request a credit limit increase, take the following steps:

Make sure you know your current credit limit

You can usually find your Bank of America credit limit by checking your monthly credit card statement or logging into your online account.

Once you find this information, compare your credit limit to your available credit — or the amount of credit you have leftover after you subtract your credit card balances. If you have very little available credit left, your chances at a Bank of America credit line increase are much slimmer. With that in mind, consider paying your balances down before asking for a larger credit line.

Find out whether you’re eligible

Bank of America does not explicitly state its eligibility guidelines regarding credit limit increases. That said, there are a few common factors that lenders look for when deciding whether to increase your credit limit. These include:

Decide how much credit you want

In some cases, credit card issuers determine how much of a credit increase to offer you. In other cases, you’ll be asked how much credit you want, so try to have an answer ready.

Don’t make your credit limit increase request too large; if you have a Bank of America credit card with a $5,000 credit limit, for example, it’s better to ask for an increase to $7,500 than it is to ask for your credit limit to be bumped all the way up to $10,000.

Money tip: Don’t let your new credit turn into debt you can’t pay off. If you want to increase your credit limit in order to make more purchases on your credit card, make sure you have a plan to pay off those purchases as quickly as possible — otherwise, you could find yourself in serious credit card debt.

How to request a higher credit limit with Bank of America

In some cases, you might be able to get a higher credit limit with Bank of America without having to ask. Like many other credit card issuers, Bank of America regularly issues automatic credit limit increases to its most creditworthy cardholders. If you are eligible for an automatic increase, you may receive a notification via email or through your online account management page.

If you haven’t received a notification or don’t want to wait for an automatic increase, you can still request one yourself. There are three ways to request a higher credit limit with Bank of America — over the phone, online or via mobile app.

Over the phone

To request your credit limit increase over the phone, follow these steps:

- Call the number on the back of your card. You can also call Bank of America’s customer service at 800-732-9194.

- Speak with a representative about your request. Be prepared to provide income information and the reason why you are requesting additional credit.

- Ask questions before proceeding. Once you’re speaking to the representative, you can ask about things like whether Bank of America needs to perform a hard inquiry for this request and whether any changes will be made to your other credit card accounts.

Online

To request your credit increase online, you’ll have to do the following:

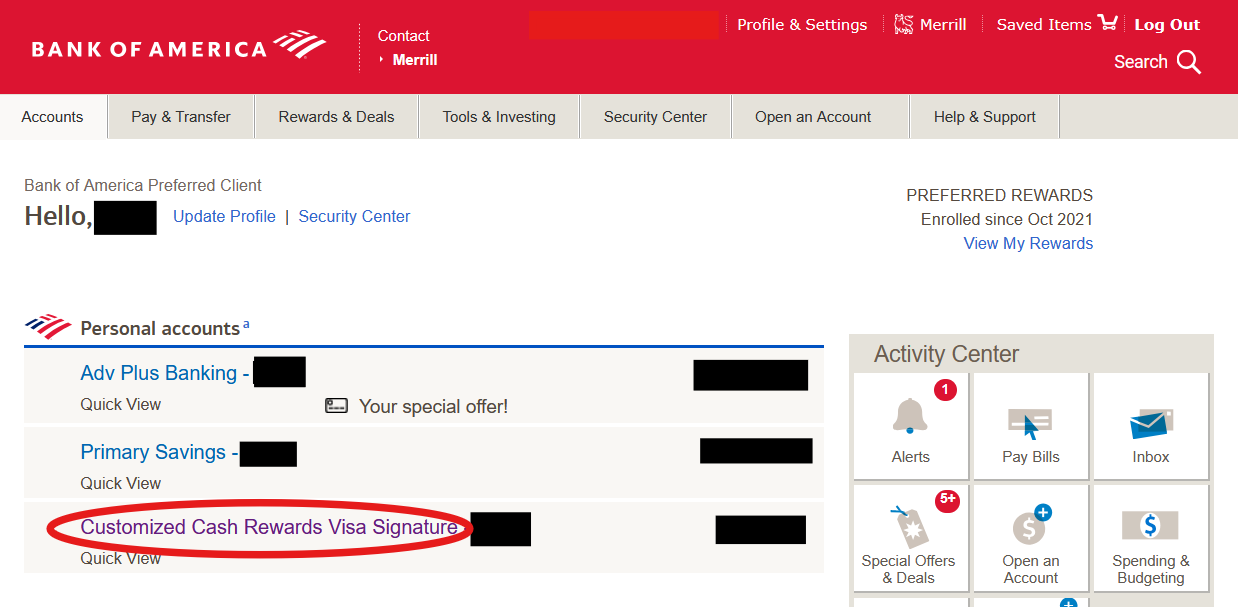

- Log into your account. From there, click on the name of the credit card you want to update.

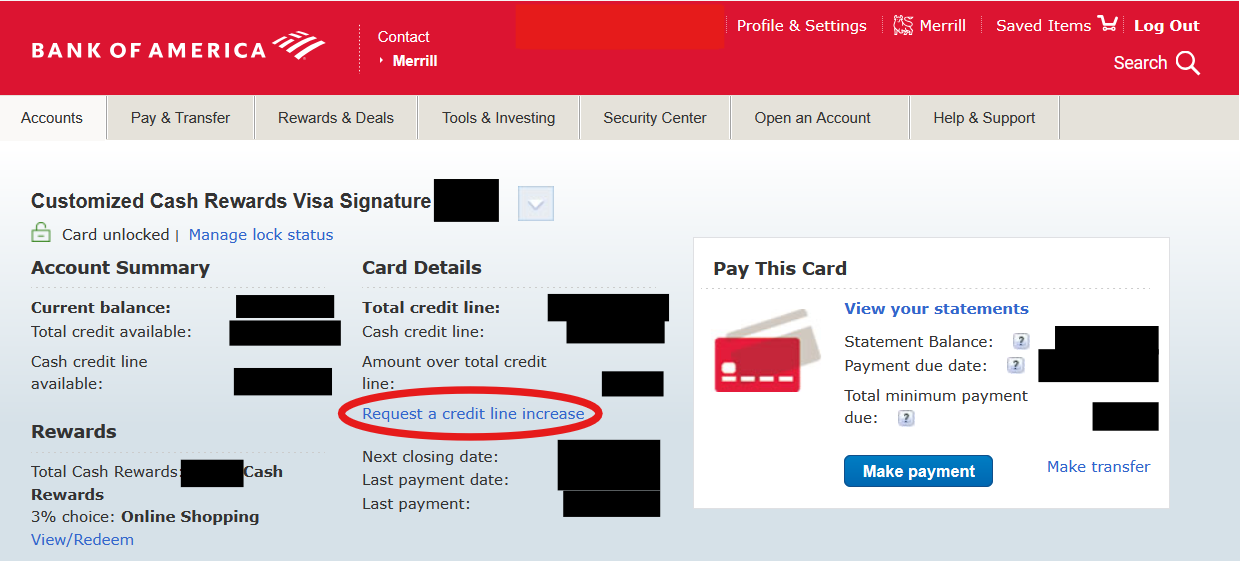

- Navigate to the “Card Details” section of your account summary. From there, you’ll select “Request a Credit Line Increase.”

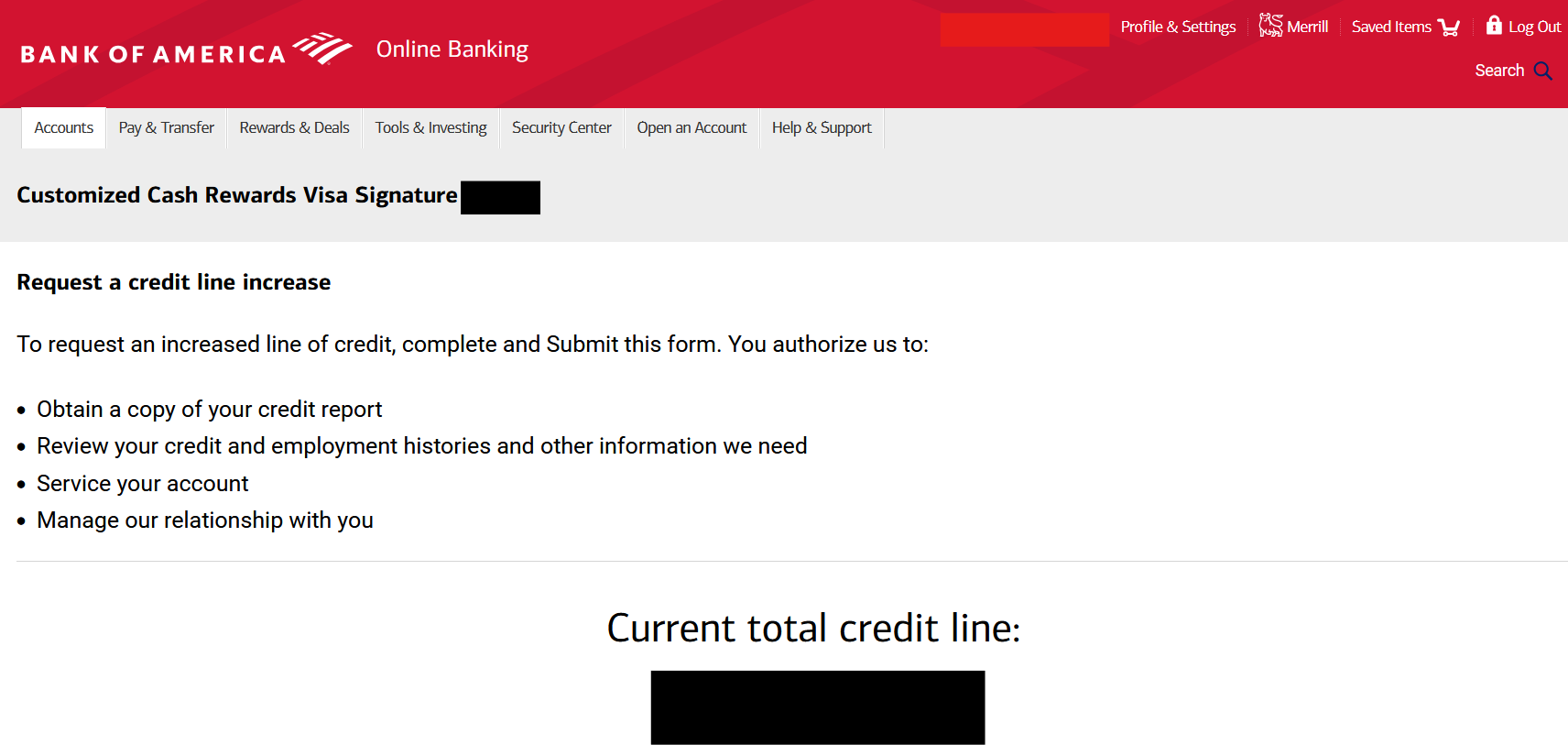

- Complete Bank of America’s “Request a credit line increase” form. Be prepared to share details such as your occupation, income and housing payment information.

If you don’t see the option to request a credit line increase, you might not be eligible for one at this time.

Via mobile app

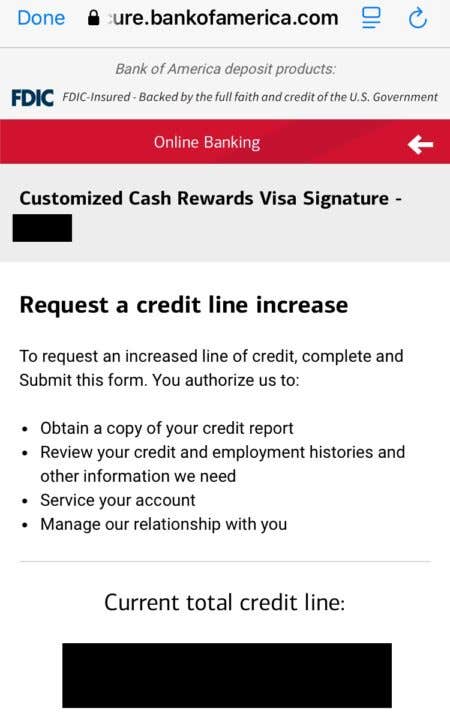

Requesting your credit through your mobile app works similarly to requesting it online. Here are the steps:

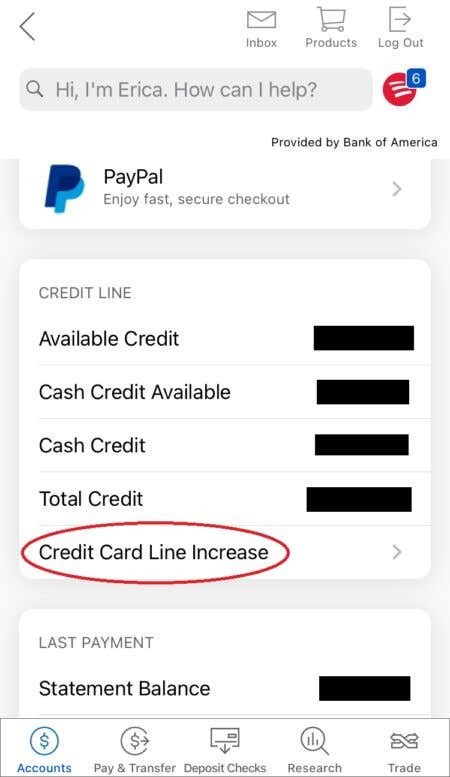

- Log into your mobile app. Once there, select the credit card you wish to update in the “credit cards” section.

- Scroll down to the “Credit Line” section and tap “Credit Card Line Increase.” This will take you to a form on a secure web page that shows your current credit line.

- Complete Bank of America’s “Request a credit line increase form.” Be prepared to share details such as your occupation, income and housing payment information.

Getting your credit line increased might not be as straightforward as you think. On their request form, Bank of America notes that they may instead move credit “from an account with a lower APR and/or fee structure to a higher annual rate and/or fee structure without increasing your overall credit limit.” So, while your credit limit for one card might increase, your credit limit for another card might decrease.

What to do if Bank of America denies your request

If you are ultimately denied a Bank of America credit line increase, here are some options to help you get the additional credit you need:

- Wait six months before you make another request: If you plan to request another credit limit increase with Bank of America, wait at least six months (and consider using that time to improve your credit score).

- Request a credit limit increase with a different card issuer: Some lenders are stricter about issuing credit limit increases than others. If Bank of America does not grant your credit limit increase request, you might be able to increase your credit limit through another credit card issuer. (If you have a Chase credit card, for example, here’s how to increase your credit limit with Chase.)

- Apply for a new credit card: Sometimes the best way to increase your overall credit limit is by applying for a new credit card. Whether you apply for a top rewards credit card or a card that offers easy approval, a new credit card can increase the amount of credit available to you (and, if used responsibly, help boost your credit score). If your credit isn’t that great, consider applying for a credit card for fair credit.

- Consider a balance transfer credit card: If your Bank of America credit card balance is so high that you’re worried about going over your credit card limit, you might want to apply for a balance transfer card. The best balance transfer credit cards offer a 0 percent introductory APR on balance transfers for up to 21 months, which can help you pay down your outstanding credit card balances without the burden of added interest.

The bottom line

If you want more available credit for any reason, you can request a Bank of America credit line increase through your online account, your mobile app or by calling the number on the back of your credit card. Increasing your credit limit can help you build credit and might boost your credit score, but don’t forget that your new available credit could quickly turn into new debt.

If Bank of America grants your credit line increase request, make sure to use your increased credit limit responsibly. If your credit limit increase request is denied, wait at least six months before making another credit line increase request with Bank of America.

The Bank of America content in this post was last updated on March 25, 2025.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.