How to get a cash advance with Capital One

Key takeaways

- Capital One credit cards offer cash advances at ATMs and bank branches.

- Fees are generally either $5 per transaction or 5 percent of the transaction amount, whichever is greater.

- Cash advances do not have a grace period, which means the advance starts accruing interest immediately.

- Cash advance interest rates range from 29.24 percent to 31.24 percent, depending on the card.

A Capital One credit card cash advance is one way to get cash when you really need it — you’re essentially borrowing cash from your line of credit and promising to pay it back later.

Although cash advances are rarely the best option due to their high fees and even higher interest rates, they can be helpful in situations where you might not have enough money in your bank account to cover a cash-only expense.

Let’s examine how Capital One cash advances work and what to consider before requesting one, including a breakdown of the fees associated with cash advances.

What is a cash advance?

A cash advance allows you to get cash from a credit card. Instead of using your credit card for purchases, you can request an advance on your credit limit in cash. Most people use ATMs to get cash advances, but you can also request one inside a bank branch.

A cash advance allows you to access cash in situations where credit cards are not accepted. If you’re buying a money order, for example, you’ll need to pay in cash, and if you don’t have a debit card (or sufficient funds in your checking account to use your debit card), a cash advance can provide the money you need.

It’s generally better, however, to get cash from a debit card or checking account rather than requesting a cash advance on a credit card. Cash advances come with fees and high interest rates, and interest on cash advances begins accruing immediately after the transaction is completed.

If you’re considering requesting a cash advance because you need to cover an expense that you can’t pay for out of your checking account, you might want to consider a personal loan instead. In many cases, the rates for personal loans are lower than those for cash advances, meaning that the right personal loan could save you a significant amount of money over time.

How to get a cash advance with Capital One

To get a Capital One credit card cash advance, begin by locating an ATM. You do not need to use a Capital One ATM for a cash advance, although ATMs outside the Capital One or AllPoint networks may charge you an additional fee for using a Capital One credit card.

You’ll follow three basic steps:

- Insert your Capital One credit card into the ATM and enter your card’s PIN.

- Select the “Cash Advance” option (you may have to select “Credit” first).

- Follow the steps to request a cash advance.

If you want to make a cash advance but don’t have your PIN, you can request one online by following these steps:

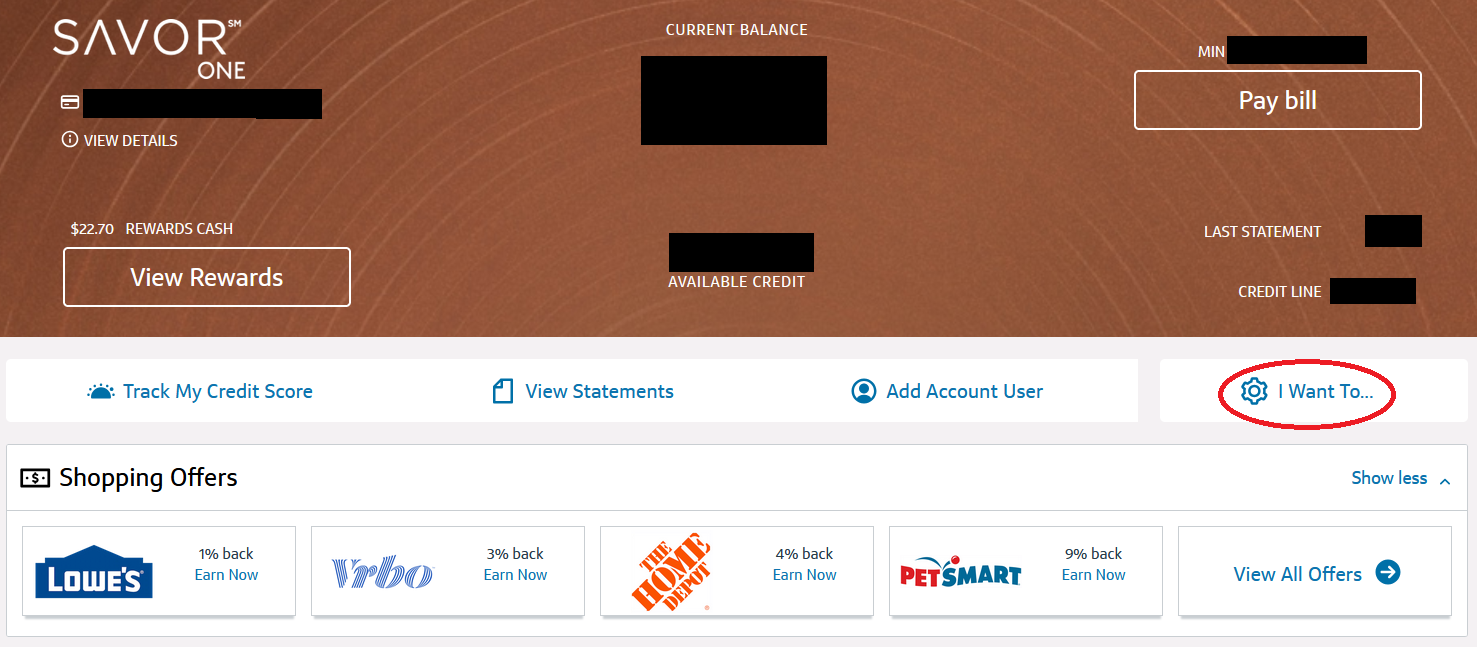

- Log in to your Capital One account and select the credit card you wish to use for a cash advance.

- Select the “I want to…” menu button with the gear icon next to it.

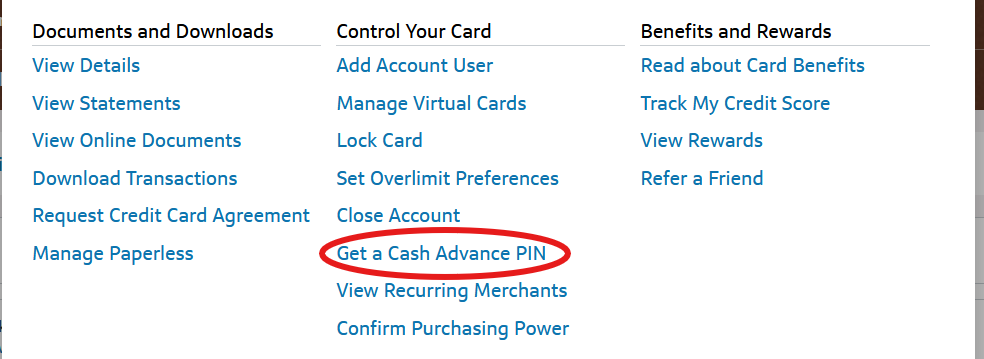

- Scroll to the “Control Your Card” section and choose “Get a Cash Advance PIN.”

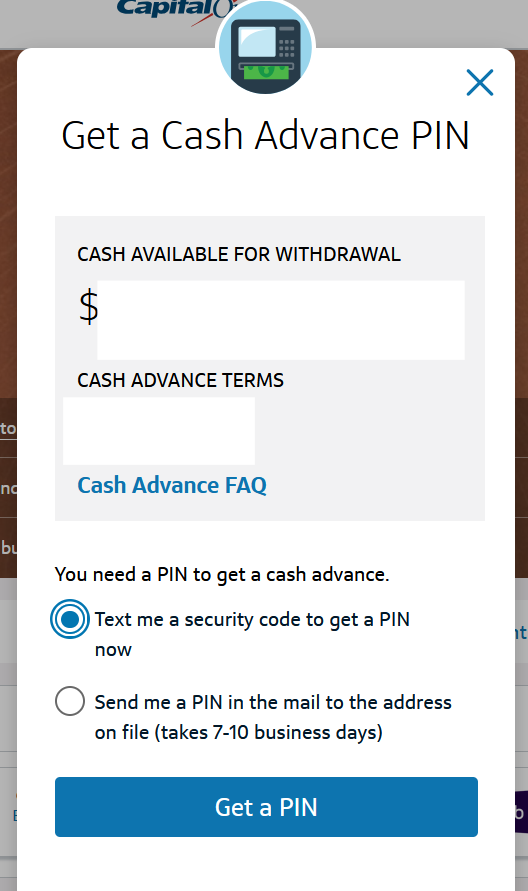

- Choose to either get your PIN in the mail or get it immediately by using a security code and your phone.

- Select “Get a PIN” and follow the rest of the instructions.

If you don’t want to deal with a PIN, try going inside the bank branch. If the bank lobby displays the Visa or Mastercard logo, you should be able to take out a cash advance with a bank teller. All you’ll need is your Capital One credit card and a government-issued photo ID, such as a driver’s license. After your cash advance is complete, you’ll receive your cash from the ATM or the bank teller.

What you need to know before getting a cash advance

Cash advances can help you in a pinch, but they can also be quite costly. Here’s what you need to know before you get a cash advance:

Which Capital One cards offer cash advances?

All Capital One credit cards currently offer cash advances, including several popular cash back credit cards, travel credit cards and business credit cards.

Here’s a breakdown of the cash advance fees and APRs associated with each card:

| Card name | Cash advance offered? | Cash advance fee | Cash advance APR (variable) |

|---|---|---|---|

| Capital One Platinum Credit Card | Yes | $5 or 5 percent | 28.99% (Variable) |

| Capital One Platinum Secured Credit Card | Yes | $5 or 5 percent | 28.99% (Variable) |

| Capital One VentureOne Rewards Credit Card | Yes | $5 or 5 percent | 28.49% (Variable) |

| Capital One Venture Rewards Credit Card | Yes | $5 or 5 percent | 28.49% (Variable) |

| Capital One Venture X Rewards Credit Card | Yes | $5 or 5 percent | 28.49% (Variable) |

| Capital One Venture X Business | Yes | $5 or 5 percent | None (this is a charge card) |

| Capital One Quicksilver Cash Rewards Credit Card | Yes | $5 or 5 percent | 28.49% (Variable) |

| Capital One QuicksilverOne Cash Rewards Credit Card | Yes | $5 or 5 percent | 28.99% (Variable) |

| Capital One Quicksilver Secured Cash Rewards Credit Card | Yes | $5 or 5 percent | 28.99% (Variable) |

| Capital One Quicksilver Student Cash Rewards Credit Card | Yes | $5 or 5 percent | 28.49% (Variable) |

| Capital One Savor Cash Rewards Credit Card | Yes | $5 or 5 percent | 28.49% (Variable) |

| Capital One Savor Student Cash Rewards Credit Card | Yes | $5 or 5 percent | 28.49% (Variable) |

| Capital One Spark Cash Plus | Yes | $5 or 5 percent | None (this is a charge card) |

| Capital One Spark Miles for Business | Yes | $5 or 5 percent | 30.49% (Variable) |

The bottom line

Getting a cash advance from your Capital One card is a straightforward process, especially since all Capital One credit cards permit cash advances and charge the same fee for them. You should be able to get your cash advance at an ATM, provided you have a PIN ready. If you need to request a PIN, the process becomes a bit more complicated, but it is still easy to do online through your account. Alternatively, you can visit a bank and work with a teller if getting a PIN is not possible.

Just be careful — any cash advance you get from your card will incur a cash advance fee and a hefty APR that takes effect immediately. This means your balance will start accruing interest with no grace period, so you should only get a cash advance if you know you’ll be able to pay it off quickly.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

How to get a business line of credit

What is a merchant cash advance?