How to close an American Express account

Key takeaways

- You can close an American Express credit card by calling the number on the back of your card, chatting with the card issuer or mailing a notice to a specific address.

- Make sure you have a plan for your rewards before you close your account. If you fail to redeem them within a specific timeline, you’ll forfeit all your points.

- An account closure could negatively impact your credit score, so it’s wise to consider other alternatives before closing your credit card.

American Express boasts some of the best rewards credit cards on the market today, ranging from cash back credit cards to luxury travel rewards credit cards and everything in between. However, there may be situations where you don’t want to keep your Amex card for the long haul. Maybe you’re scaling down the number of rewards credit cards you have or are tired of the temptation credit cards bring to your life. Or, perhaps you’re no longer offsetting a high annual fee with card perks.

Whatever the reason, there are some steps you need to take to close a credit card account. Keep reading to find out what it takes to close out an American Express credit card, as well as some alternative options to consider.

How to close an American Express credit card

The good news about closing a credit card account with American Express is that there are multiple ways to get the job done. If you’re ready to close your Amex card account, you have three options to consider:

1. Call American Express

If you prefer to handle your credit card business over the phone, you can call American Express to cancel your account with a live customer service representative. American Express says you can reach a live representative by calling the number on the back of your card, but you can also call collect at 1-336-393-1111 if you’re outside the United States.

When you are connected with customer service, all you need to do is explain that you want to cancel your account. Be prepared to share your account information, such as your credit card account number and your address with ZIP code.

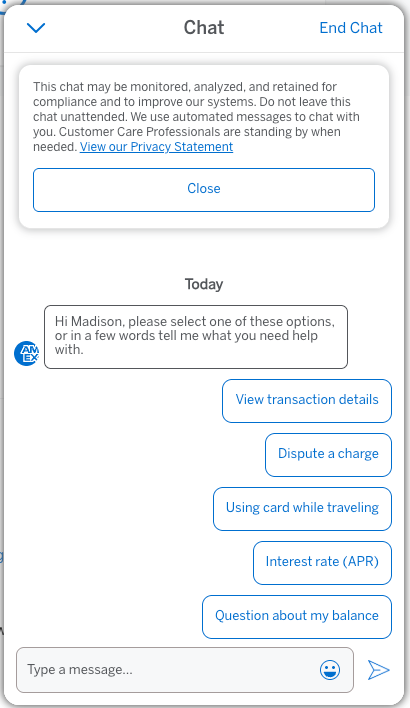

2. Chat with Amex

You can also reach out to American Express via their online chat function, which is easily accessible once you log into your American Express credit card account online or via mobile. Here are the steps you can take to cancel your credit card account this way:

- Log into your account at AmericanExpress.com.

- Find the “chat” button in the bottom right-hand corner of your screen.

- Click “chat” and tell the representative you want to close your account.

Once again, you should be prepared to offer information that can help verify your identity, like your mailing address and zip code.

3. Send a letter in the mail

You can also send a request to cancel your account via mail if you prefer. Make sure to include applicable information in your letter, including your account number, name and address. You can mail your letter to American Express using the following address:

American Express

PO Box 981535

El Paso, TX 79998

Does closing an Amex credit card affect your credit score?

While closing a credit card account may not have a significant impact on your credit score, it could cause your score to drop temporarily — even if your account is in excellent standing.

Closing a credit card can reduce your overall available credit, which could cause your credit utilization ratio — which accounts for 30 percent of your FICO score — to increase.

Additionally, the length of your credit history makes up 15 percent of your FICO score, and closing an account can eventually shorten that history. But credit card accounts in good standing remain on your credit report for 10 years.

Bankrate’s take: Many experts suggest keeping old credit card accounts open, even if you’re not using them regularly.

What happens after you close an Amex card?

There are several considerations to keep in mind before calling to close your Amex card. First, check if you still have a balance on the credit card. If so, you can still close your American Express credit card, but know that you’ll need to continue making payments until your account is paid in full.

American Express will continue charging interest on your closed credit card account until this is complete. If you want to pay down your debt without any interest charges, you may want to look into a balance transfer credit card that offers an introductory 0 percent APR for a limited time.

Additionally, if you close your American Express credit card, and you have rewards in your account, you will forfeit your points balance after enough time has passed.

However, you can get around this if you have another American Express credit card that offers the same type of rewards. For example, you could cancel your American Express® Gold Card without losing your American Express Membership Rewards points, so long as you also have an open The Amex EveryDay® Credit Card* account where those points can live.

Options to consider before canceling your Amex credit card

If you were initially wondering how to close your American Express credit card account, but you’re considering alternatives, here are a few moves you could make instead.

Put your card away for safekeeping

If you have an Amex credit card that doesn’t charge an annual fee, then you can always stash it away in a safe or a sock drawer. Your account can keep adding depth and history to your credit report that way, and it won’t hurt your credit if you don’t use the card.

However, if you do decide to stash your card away and don’t log into your account page frequently, you should take the time to set up account alerts. That way, you’ll know right away if someone tries to use your card number for a fraudulent purchase, and you can call to report it.

Request a product change

Also, know that American Express may let you switch to a different credit card without closing your account. This is called a product change, and it’s a common move for consumers who want to get away from credit cards that charge an annual fee.

Just know that you can only upgrade or downgrade your Amex card to another option that earns the same type of rewards. If you have a card that earns American Express Membership Rewards points but charges an annual fee, for example, you can likely switch to a card that earns the same type of points (instead of cash back) without an annual fee.

The bottom line

You can close a credit card account any time you want, but you should think over the advantages and disadvantages before you do. It’s possible keeping your old account open could be a boon for your credit, and you could always consider a product change instead of account closure.

Whatever you do, make sure your decision to keep or close your credit card account is an informed one.

*All information about The Amex EveryDay® Credit Card has been collected independently by Bankrate. The card details have not been reviewed or approved by the issuer.

Frequently asked questions about closing an Amex account

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.