How to do a balance transfer with Bank of America

Key takeaways

- You can complete a balance transfer online with Bank of America after you’re approved for an eligible card or if you already have a card with an intro APR offer.

- Most Bank of America balance transfers are completed within two to four days, but it might take up to 14 days for new accounts.

- When choosing a Bank of America balance transfer card, determine whether you’d rather have a longer intro APR offer and no ongoing rewards or a shorter intro APR offer and ongoing cash back rewards.

Paying off credit card debt can seem overwhelming, especially when that debt comes with high interest rates. To start tackling that debt, it’s smart to take advantage of a balance transfer credit card with a 0 percent intro annual percentage rate (APR) offer.

Several Bank of America credit cards come with intro APR offers, and transferring your balance with one of these cards should be easy. Go this route, and you can pay off your credit card debt without paying interest for a limited time — as long as you pay it off before the intro APR offer expires. If you don’t pay it all off by then, you’ll start paying a variable APR on any remaining balance.

Here’s what to know if you’re planning on using a Bank of America card for a balance transfer, as well as how to complete the process.

What to know before transferring your balance to a Bank of America card

Transferring your balance to a Bank of America card with an introductory APR offer should be an easy process, but before you get started, you should still do some prep work. Before you transfer your balance, follow these tips:

- Make sure you’re transferring from a different issuer: You cannot transfer debt from one Bank of America credit card to another Bank of America credit card.

- Don’t forget to transfer your balances within the given time frame: For new Bank of America cardholders, you must transfer your balances within the first 60 days of account opening if you want to take advantage of any intro APR offers.

- Start thinking about your repayment plan before you make the balance transfer: You’ll need to pay off your balances before your intro APR period ends to avoid paying interest. Once the intro APR period is over, you’ll begin paying the regular variable APR on any balance left on the card.

- Factor the balance transfer fee into your repayment plan: You will typically pay a 3 percent or 4 percent balance transfer fee for each balance you transfer.

- Avoid transferring any balance you have disputed with your issuer as being erroneous, fraudulent or duplicative: If you transfer a disputed transaction, you’ll lose certain dispute rights on that charge.

How to transfer a balance to a Bank of America credit card

The easiest way to complete a Bank of America balance transfer is online, though you can also do so over the phone. You can complete a balance transfer after you’re approved for a new, eligible card or if you already have a card with an intro APR offer.

How to do a balance transfer online with a new card

- Fill out an application for the balance transfer card you’re interested in. If you’re already a Bank of America customer, you can log in to complete this step faster.

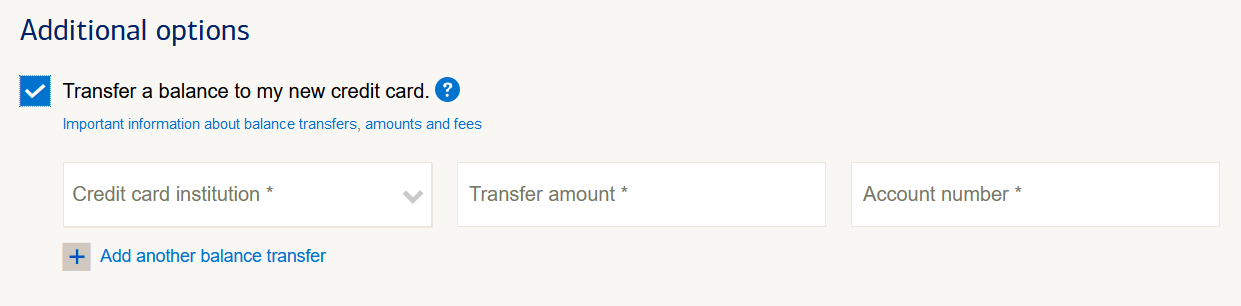

- Go to the “Additional Options” section and check the “Transfer a balance to my new credit card” box. Once checked, the application will show more boxes for you to fill out, such as a box for the name of your other card’s issuer, the amount you want to transfer and the account number of your other card.

- Fill out those boxes and add any additional balance transfers if necessary. Keep in mind that you don’t know what your credit limit will be yet, so if the total amount you request exceeds your new card’s credit limit, Bank of America might only fulfill the first balance transfer request you listed or might only fulfill a partial request. They might even deny your request outright.

- Submit your application with the balance transfer request. If Bank of America approves your balance transfer, it will transfer your balance as requested, starting with the first transfer listed.

How to do a balance transfer online with an existing card

If you already have a Bank of America card, you can check to see if you’re eligible for an intro APR offer on balance transfers. If you have an eligible card and want to transfer a balance to it, follow these steps:

- Log in to your account. You should see your credit card account listed once you log in.

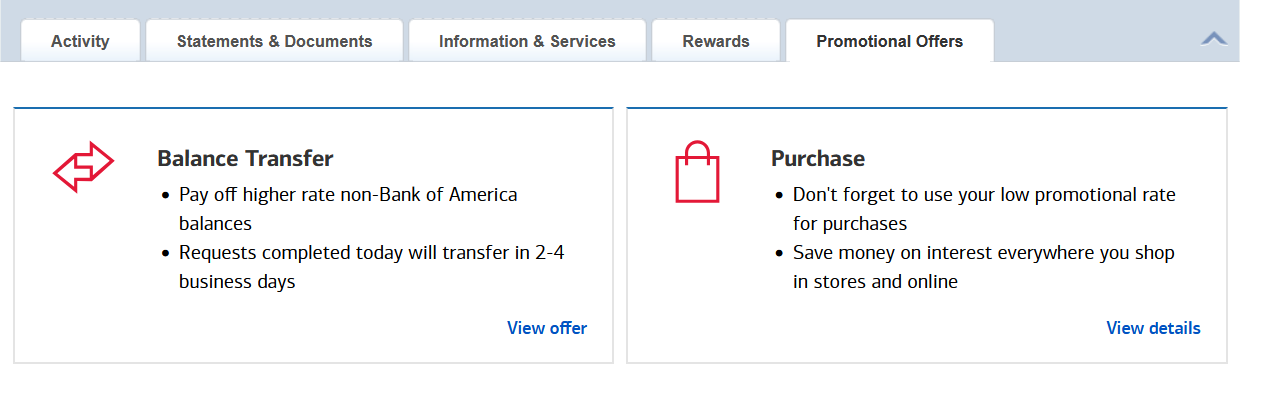

- Click on your credit card account page and navigate to the “Promotional Offers” tab. This tab should display your available introductory APR offers.

- Choose “View Offer” and follow the instructions to complete your transfer. Provide the account number of the credit card from which you’d like to transfer the balance, as well as how much of the balance you’d like to transfer and the credit card issuer’s name.

- Submit your transfer request. If you have another request to make, you’ll have to go through this process again.

Keep in mind: Just like doing a balance transfer alongside your credit card application, you need to keep your credit card limit in mind when you submit your request. If you exceed your credit limit, Bank of America might only fulfill part of the request or deny the request outright.

How to do a balance transfer over the phone

Once you’re approved for your balance transfer card, you can start your balance transfer over the phone by following these steps:

- Call the number on the back of your card. If you don’t yet have your card, you can call the company’s customer service line.

- Talk to the representative about your request. They will likely ask you to verify your identity.

- Provide the balance transfer information and account details needed to complete the request. Make sure to factor in the balance transfer fee and your credit limit when you do your math.

- Wait for the balance transfer to finish processing. You should also ask for a follow-up email about your call before hanging up with the representative.

What happens after submitting a balance transfer request?

Most Bank of America balance transfers are completed within two to four days, but it might take up to 14 days for new accounts, according to the issuer. You’ll know you’re successful when you see the transferred balance appear in your Bank of America credit card account.

Be sure to keep making payments on the credit card you transferred the balance from until the balance transfer is complete. If a payment comes due while your transfer is in progress, pay it promptly. If you don’t, you’ll run the risk of getting hit with late fees and penalty APRs.

Best Bank of America cards for balance transfers

Bank of America® Customized Cash Rewards credit card

Bank of America® Unlimited Cash Rewards credit card

The bottom line

If you’re dealing with high interest debt, applying for a credit card with a 0 percent intro APR offer for balance transfers is a viable option to avoid those fees. Many Bank of America cards have intro APR offers on balance transfers, allowing you to pay off debt over time without accruing interest.

Be sure to determine what you’re looking for in a card — such as an extra-long intro APR period or a shorter intro APR offer with cash back rewards — before applying. The more you understand what you want from one of the best balance transfer credit cards, the easier it will be to determine which card is best for you.

Frequently asked questions about BofA balance transfers

*The information about the BankAmericard® credit card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer. All information regarding Bank of America credit cards was last updated on February 21, 2025.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.