How to do a Discover balance transfer

Key takeaways

- Discover offers intro APR periods for balance transfers on most of its cards, and the process can be done online, using the mobile app or over the phone.

- Balance transfers can improve your credit score by increasing the amount of credit available to you and lowering your credit utilization ratio.

- It’s important to pay off the transferred balance before the intro period ends, as the amount you still owe will accrue interest at the regular APR.

Are you struggling with high-interest credit card debt? You’re not alone. The average credit card interest rate currently sits at just over 20 percent, but not everyone is fortunate enough to have an average interest rate. If you have bad credit, your credit card interest rates could be hovering around 30 percent. This can lead to an overwhelming amount of interest if you carry a balance.

Many credit card issuers offer balance transfer cards, including Discover. So, how do you make a balance transfer with a Discover credit card? Whether you prefer to handle the process online, with your mobile app or over the phone, it only takes a few quick steps to complete. Here’s what you need to know:

3 ways to do a Discover balance transfer

If you don’t have a Discover credit card, you’ll first need to select one. Once approved, you’ll have to wait: Discover states that a new account must be open for 14 days before the issuer will process a balance transfer request.

Once you’re ready, you can complete the following kinds of balance transfers with your Discover card:

1. Online balance transfer

This type of balance transfer is simple and can be done with the following steps:

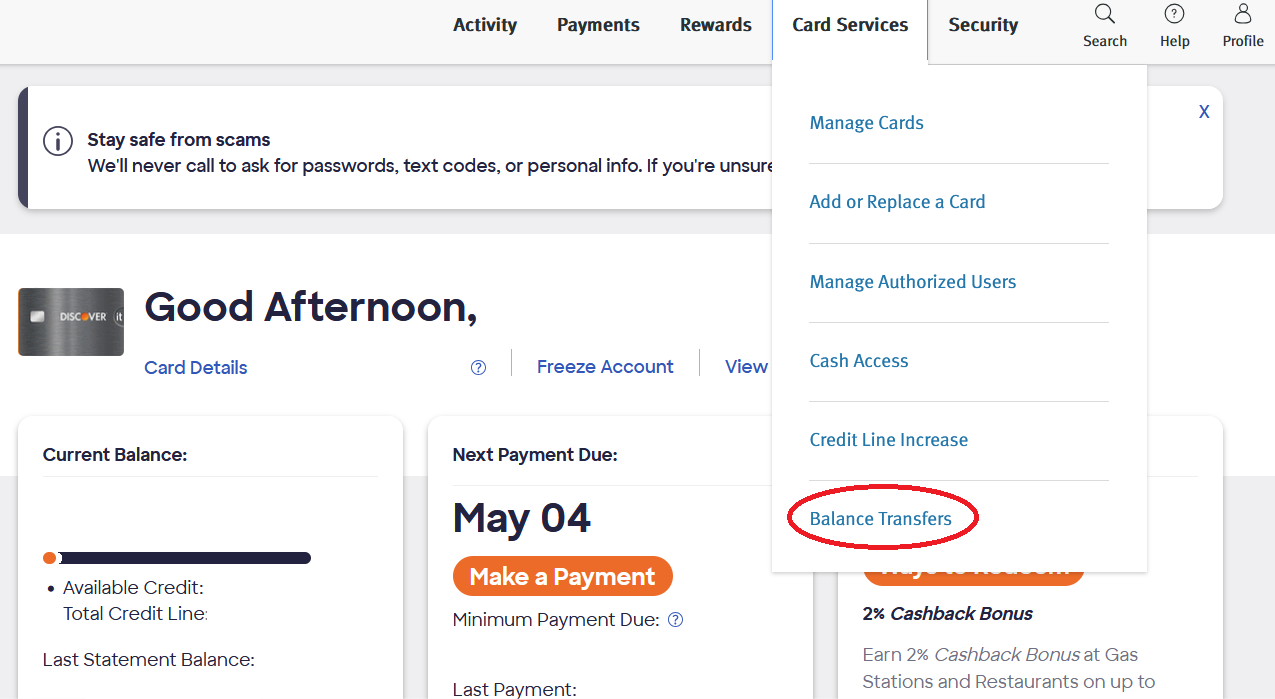

- Log in to your Discover account. Look for the drop-down menu under “Card Services” and select the “Balance Transfers” option.

- Find out which type of balance transfer you want to complete. Depending on which Discover credit card you have and what special offers are currently associated with that card, you might be taken to a page that asks you to choose between two options for a balance transfer. Discover will try to estimate how much money you’ll save with each option, but make sure you use the “Customize savings calculations” button to determine which option would be better for the balance you plan to transfer to the card.

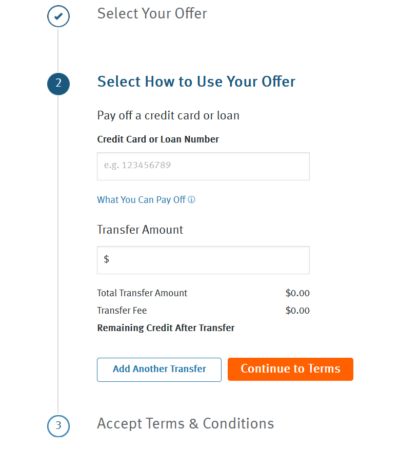

- Tell Discover your balance transfer details. These include where you’re transferring the balance from and how much you plan to transfer to your new card. You’ll want to have your credit card or loan account number ready.

- Complete the balance transfer. You must accept the terms and conditions to complete the balance transfer process. If applicable, you will also be charged a balance transfer fee once the balance transfer is processed.

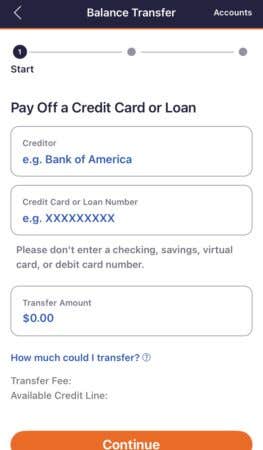

2. Mobile app balance transfer

If you’re using the Discover mobile app, the process is nearly identical to how you’d perform the balance transfer online. Keeping those same steps in mind, you just have to:

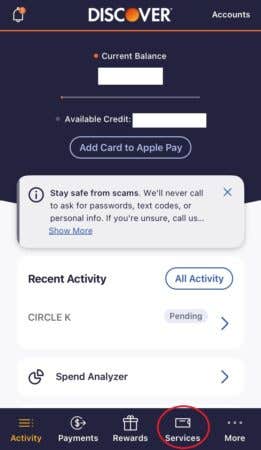

- Log into your mobile app.

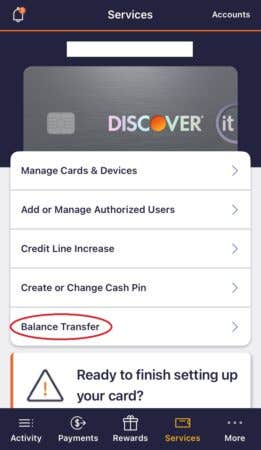

- Select “Services” at the bottom of your screen to locate the balance transfer link.

- Follow that link to review any special balance transfer offers.

- Complete your balance transfer following the same prompts as you would for an online transfer.

3. Phone call balance transfer

You can also complete a Discover balance transfer over the phone. Call the number on the back of your card or the customer service line at 1-800-347-2683. Then, just follow the steps provided by Discover customer service. To help make the process smoother, you should have your balance transfer details ready, such as the number for the account you’re transferring the balance from and the account you’re transferring.

How long does it take to process a Discover balance transfer?

According to Discover, most balance transfers are processed within four days. If you have the mobile app, you can check by going to the balance transfer link located under the “Services” tab and then clicking on “Status.”

Discover suggests checking back on the accounts you transferred balances from to ensure you don’t owe any additional interest that may have accrued between when you started the balance transfer process and when it was completed. It could take up to 30 days for that interest to appear in your credit card accounts, so keep track of those accounts and make sure you pay off any interest charges.

Is a Discover balance transfer worth it?

If you have a large credit card balance that you’re hoping to pay down, a balance transfer is a worthwhile way to make payments on that balance without paying interest. You can also transfer multiple balances from different cards to your Discover credit card. As long as you don’t go over your Discover card’s credit limit, you can keep transferring balances to it — but you’ll want to keep any balance transfer fees in mind as you do so.

By consolidating your debt and getting that debt paid off within the 0 percent introductory APR period, you’ll be able to save money on interest charges and raise your credit score simultaneously. With less debt and a new credit card added to your wallet, you’ll have a lower credit utilization ratio, which is good for your credit score. By completing on-time payments each month, you’ll also build a good credit history, which can raise your score even further.

However, balance transfer credit cards aren’t for everyone, and you should consider the pros and cons before deciding to get one. If you have a relatively small amount of debt or a balance transfer card will just enable you to sink further into debt, you might be better off not applying for one.

The bottom line

Completing a Discover balance transfer is simple. You can do it online, through the Discover mobile app or over the phone. No matter how you choose to do your balance transfer, you’ll need to be prepared with details like where you’re transferring the balance from and how much you want to transfer.

But figuring out how to do a Discover balance transfer is the easy part of the process — the hard part is coming up with a plan to pay off your transferred debt and sticking to it. When making those calculations, you’ll also likely have to factor in a balance transfer fee. Using Bankrate’s balance transfer calculator can help you get started on a debt payoff plan that pairs well with your specific Discover credit card.

Frequently asked questions about Discover balance transfers

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.