How to send money with a credit card

Key takeaways

- Sending money with a credit card can be convenient, but it typically comes with fees and higher-than-usual interest rates that can add up for big transactions.

- Apps like Cash App, PayPal and Venmo allow you to send money through their platforms with a credit card, while Apple Cash, Google Pay and Zelle don’t.

- Card issuers — such as Amex, Chase and Citi — support card loans that can be lower-cost alternatives for cardholders.

Your credit card can be a convenient way to send money, but it’s typically a more expensive option than sending money from your bank account. Before you use your card to send money, you’ll need to understand the fees and interest rates you face for each option. We explore the different ways you can send money with your card, including lower-cost alternatives.

1. Use a peer-to-peer payment app

Several peer-to-peer payment apps allow you to link your credit card and transfer money to approved recipients. Transaction fees vary by app, and fees can add up, especially for large transactions.

Here’s what you can expect with popular payment apps.

| Payment app | Credit card fee | How to send money |

|---|---|---|

| Cash App | 3% of your transaction | Link your credit card within the app and tap Pay & Request |

| PayPal | 2.9% of your transaction + fixed fee based on your currency (30 cents for USD) | Link your credit card within the app and tap Pay or send money |

| Venmo | 3% of your transaction | Add your credit card as a payment method and tap Pay/Request |

Payment apps like Apple Cash, Google Pay and Zelle do not allow you to send money using a credit card. Instead, these apps require a linked bank account or debit card to transfer money.

Garrett Yarbrough, a credit cards expert and writer at Bankrate, considered using his credit card for peer-to-peer transactions, but changed his mind when he saw the fee.

“I’m always wary of saving my debit card or bank account details with apps or websites,” Yarbrough shares. “I initially meant to only add a credit card with my Venmo account for security purposes, but my hand was forced once I discovered sending money that way would stack a staggering 3 percent fee onto each transaction. Even the constant Venmo Credit Card* offers I see don’t include a waiver for the 3 percent credit card payment fees.”

Unless you’re in a pinch and can’t draw money from your bank account, I honestly can’t recommend using your credit card to send money through a peer-to-peer service app due to the high cost.— Garrett Yarbrough, credit cards writer at Bankrate

2. Get a cash advance

A cash advance is a short-term loan borrowed against your credit card’s credit limit. You can initiate a cash advance with your PIN at an ATM or local bank branch.

But cash advances come with fees and interest rates that are significantly higher than what you’ll pay for typical purchases — close to 30 percent variable APR with some cards. And unlike purchases, cash advances don’t come with a grace period. This means the amount you borrow begins accruing interest immediately.

Before you take out a cash advance, carefully review your card’s fine print for the cash advance APR and transaction fee. This information features prominently in your card’s Schumer box under interest rates, interest charges and transaction fees.

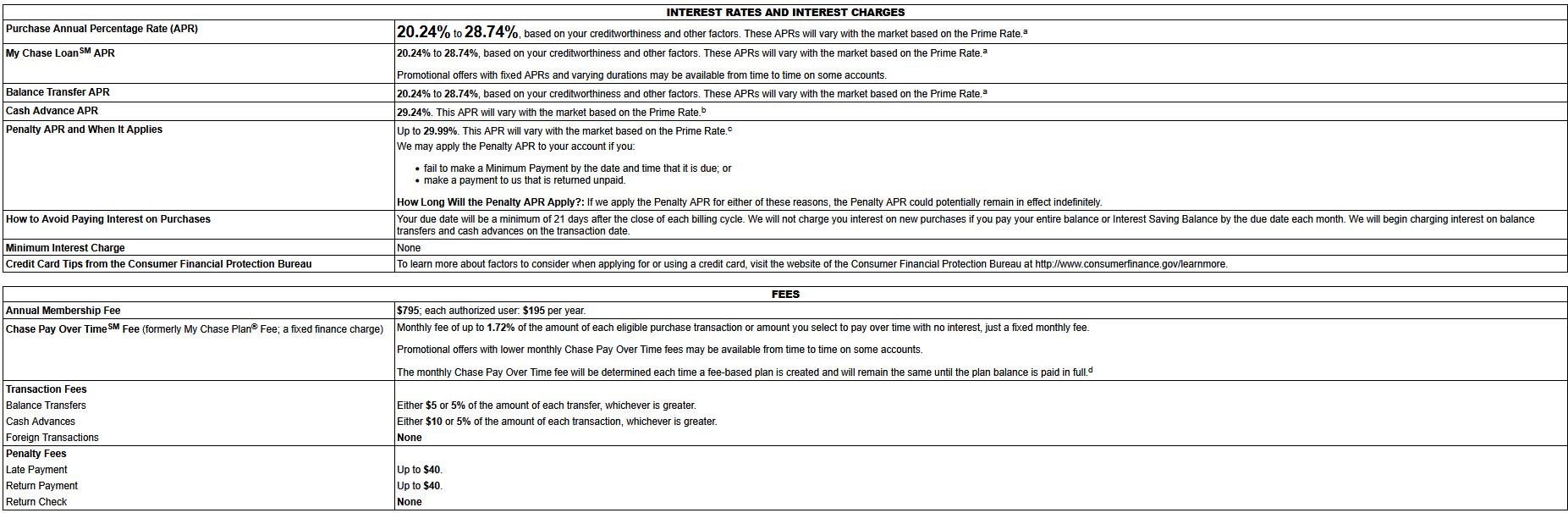

This is an example of a Schumer box for the Chase Sapphire Reserve® card at the time of writing:

In this example, the card lists the cash advance APR as 29.24 percent variable and the cash advance fee as, “Either $10 or 5% of the amount of each transaction, whichever is greater.”

3. Complete a wire transfer

Though a costly option, you can pay for a wire transfer with your credit card. Wire transfer fees can be as high as $50 or more, depending on the transfer company and whether your recipient is domestic or international.

Keep in mind: Most credit card issuers treat wire transfers as a cash advance — meaning you’re charged a cash advance fee and a higher interest rate that applies immediately.

Lower-cost alternatives for sending money with a credit card

Many issuers are introducing new ways for cardholders to tap into their credit line to send money to friends and family. An alternative to a cash advance, these card loans allow eligible cardholders to borrow against a card’s credit limit and repay the loan monthly, sometimes with set repayment terms.

Unlike an advance that comes with a higher-than-usual APR, the amount you borrow is subject to your card’s purchase APR or a lower rate, depending on the issuer.

| Issuer loan | How it works | Limits |

|---|---|---|

| Amex Send | Send money to Venmo or PayPal recipients through Amex Send, and amount appears on your statement, subject to card’s purchase APR | Send up to $10,000 per transaction, subject to rolling 30-day transaction limits |

| My Chase Loan | Borrow against credit limit with fixed monthly payments at rate lower than your card’s standard APR, with funds deposited to your bank account in 1 to 2 days | Minimum $500, with maximum depending on your monthly spending, creditworthiness and other factors |

| Citi Flex Loan | Borrow against your credit limit at your card’s purchase APR, with money received as a direct deposit or check | Minimum $500, with maximum depending on your income, credit limit and other factors |

Keep in mind: You won’t earn rewards on these transactions, nor will you typically earn rewards on other peer-to-peer transactions like those done through a third-party app.

What should I consider when sending money with a credit card?

Before sending money with a credit card, weigh any convenience against the total potential costs by asking these questions:

- Does my issuer have any preferred platforms for sending money via credit card? Amex, Chase and Citi are a few credit card issuers that support a lower-cost way to borrow against your credit limit without the need for a cash advance. Check out what they offer first before going to a third-party app.

- What fees will I be charged for a cash advance or wire transfer? If a cash advance is your only option, expect either a flat cash advance fee or a transaction fee expressed as a minimum flat fee or percentage of your transaction — for example, 5 percent with a $10 minimum. And with cash advances, you’ll also have to worry about the cash advance APR that kicks in immediately. If you’re considering something like a wire transfer, that also comes with fees you have to be aware of.

- What fees will I be charged for using a peer-to-peer app? Apps like PayPal or Cash App allow you to send money with a credit card at fees that are typically around 3 percent of your transaction — but don’t forget, this might not be the only fee you run into. Your issuer will likely process this transaction as a cash advance, which means you’ll also be paying a cash advance fee — and dealing with the cash advance APR that kicks in immediately after sending.

- How long will it take to send someone money with my credit card? Sending money with your card will likely only take a few seconds. However, depending on your platform and your issuer, it could take much longer — several days, even.

- Do I really need to use my credit card to send someone money? Sometimes, the easiest solution is to simply find another payment method. There are plenty of ways to send money to others via your bank account or a debit card without incurring additional fees. A popular option is Zelle, which can be linked directly within your bank’s online portal. Mia Altholz, an analyst at Bankrate, prefers to use Zelle for this reason.

I trust Zelle when I have to transfer large sums of money like rent each month. It’s already in my Chase app. It’s easy to confirm the contact who I’m sending the money to, and I like that it gives me confirmation that the person received the funds sent.

— Mia Altholz Analyst at Bankrate

The bottom line

When it comes to sending money with a credit card, don’t let convenience overshadow the potential costs. Cash advances and peer-to-peer apps like Cash App, PayPal and Venmo allow you to send money fast, but they also include fees that can add up significantly, depending on your transaction amount. And if your issuer processed your third-party peer-to-peer transaction like a cash advance, you’ll be paying even more fees on top of what you already paid via the app.

If you’re a cardholder with Amex, Chase or Citi, you may be able to take advantage of lower-cost card loans that allow you to borrow against your credit limit at your typical purchase APR — or lower rates, depending on the issuer. The best way to send money while avoiding fees and higher interest rates, however, is to simply not use a credit card at all. If possible, try to use your debit card or bank account instead.

*Information about the Venmo Credit Card has been collected independently by Bankrate. The card details have not been reviewed or approved by the issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

How to choose a gas credit card

What is the best time of year to send money to your family?