A complete guide to Amazon financing and payment plans

Key takeaways

- Amazon offers multiple payment plans, including Amazon Monthly Payments with no interest or fees, and credit card options for longer payment periods.

- Flexible payment plans offered by third-party companies, such as Affirm and Klarna, are also available for Amazon purchases.

- It is important to carefully consider which payment option is best for your situation to ensure you make your payments on time.

From fashion to furniture, you can purchase almost anything on Amazon. There are times when you may want to stretch out your payments over time to cover your purchase. Fortunately, there are plenty of options — many of which can help you avoid interest and costly fees.

Does Amazon have payment plans?

Shoppers may be surprised to learn that yes, Amazon does have payment plans. The installment payment plans are offered through Amazon, Amazon store-branded credit cards or through a third party.

If you prefer a 0% financing option, then an Amazon Monthly Payment Plan, a 0% promotional offer through an Amazon store card or a credit card with a 0% introductory APR will be your best bet.

Types of Amazon payment plans

Whether your goal is to stretch out payments for as long as possible or to pay nothing in interest, there are multiple Amazon financing opportunities available.

Amazon Monthly Payments

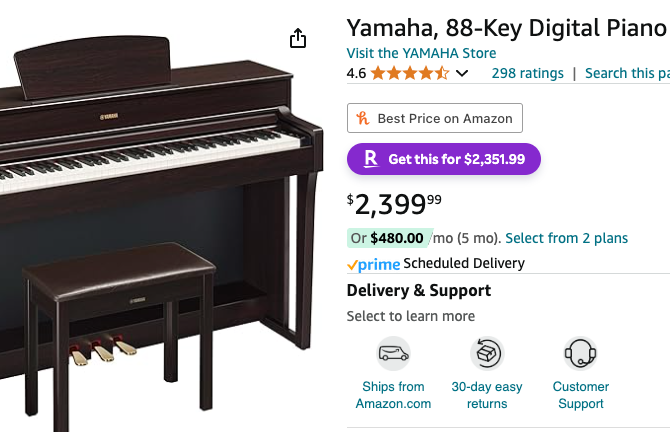

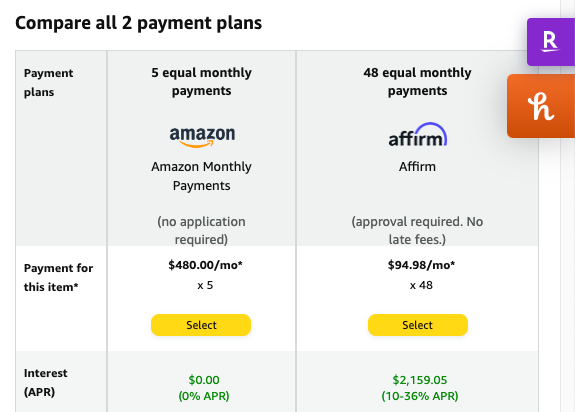

One of the first programs worth considering is Amazon Monthly Payments — that is, if it’s available for the particular product you are purchasing. The Amazon Monthly Payments program allows you to pay over the course of four months (five total payments). You can typically determine if the item you want is eligible for a payment plan by checking the options offered under the price on the product page.

With this program, you simply select the monthly payment option at checkout (if offered). Once selected, Amazon breaks up the payments into five installments. The first payment is due when the product ships out and includes all shipping, handling and taxes. There are four subsequent and equal payments charged to your account every 30 days, which are around 20 percent of the purchase price.

The beauty of this program is that it’s not based on your credit score, which means there is no credit pull required. Eligibility is based on your purchase history with Amazon and the price of the product and is offered at the discretion of Amazon. Furthermore, there are no interest charges or fees for using this payment option.

Amazon credit cards

Perhaps you need a bit longer to make payments for your purchase, or the product you need is not eligible for Amazon Monthly Payments. If so, the Prime Visa or Amazon Store Card* could be an alternative.

Amazon Equal Pay

If you own an Amazon Store Card (or open up a new account), you could be eligible for Amazon Equal Pay. This plan offers 0 percent financing and breaks up a purchase between six and 24 months of equal payments, without incurring interest charges.

As noted above, Amazon Equal Pay is available with both Amazon cards, but the terms and conditions are different depending on which card you have. For either one, you will not be charged interest as long as you make your payments on time and in full, and the total amount is charged when the item ships, but then your installment payment is part of your monthly minimum payment requirement.

Amazon Special Financing

Amazon Special Financing is simply a deferred interest payment plan, but it could be useful if you prefer to make larger payments at once versus equal monthly installments. With this financing option, you receive a 0% APR for six to 24 months (depending on the purchase size), and you can avoid interest charges by paying the account balance before the end of the promotional period. Special financing is typically more so available to Amazon Store cardholders, but Amazon Prime Visa cardholders may also qualify.

However, you will be responsible for any interest charges for the payment period if you do not pay the entire balance before the final due date — even by a single penny. Given the higher interest rates with these cards, your purchase could become pricey if you cannot meet the due date.

| Number of months | Minimum purchase amount |

|---|---|

| 6 | $50 |

| 12 | $600 |

| 24 | On select purchases |

Additional Amazon financing options

Citi Flex Pay

Thanks to Citi Flex Pay, those with an eligible Citi credit card can pay select Amazon purchases over time with either a 0% APR or low interest rate, depending on your payment plan, when using Amazon Pay at checkout.

For Amazon purchases over $50, Citi will let you break up your payments into equal monthly payments between three and 24 months. To take advantage of this payment plan, simply select your Citi card as your payment choice when using Amazon Pay to complete an Amazon purchase.

| Monthly payment plan | Purchase minimum | Promo APR |

|---|---|---|

| 3 months | $50 or more | 0% |

| 6, 12, 18 or 24 months | $50 or more | 10.74% |

| 48 months | $600 or more | 12.74% |

Amex’s Pay It, Plan It

Similar to Citi, there are flexible payment plans for American Express cardholders. The American Express Pay It, Plan It program offers the ability to break up purchases of $100 or more over time. You’ll be charged a monthly fee, but there are no interest charges.

Credit cards that offer 0% intro APR offers

Another route for paying over time involves choosing a credit card with a 0% introductory APR. Numerous credit cards entice new users with long promotional periods, so check out Bankrate’s list of the best 0% interest credit cards to find a suitable option for you.

Buy now, pay later plans

Amazon Monthly Payment is a buy now, pay later (BNPL) option. However, if it isn’t offered on your product or does not meet your payment needs, you could choose a third-party BNPL provider. Not all buy now, pay later companies work with Amazon, but here are a few available for consideration.

Which is the right Amazon financing option for me?

The first decision you have to make is to determine how long you realistically need to pay off your purchase. While the Amazon Monthly Payments option is convenient, it may not give you as much time to pay for the purchase as the Equal Pay or Special Financing options do.

On the other hand, if you’re concerned about a hard credit pull or establishing another credit card in your name (that you may have trouble qualifying for or paying on time), a BNPL service may be the better choice.

Whichever option you choose, thoroughly knowing your payoff plan ahead of time is key.

The bottom line

Amazon shoppers may not realize how many choices are available to them to stretch payments out a little further. Finding the right Amazon payment plan for your budget has never been easier — but do so with caution. Know your payoff goal beforehand and keep track of payment due dates to avoid paying more than you initially intended.

*The information about the Amazon Store Card has been collected independently by Bankrate. The card details have not been reviewed or approved by the issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Discover rewards program guide

Your guide to everything 0% intro APR