The Signature Bank collapse: What you need to know

After federal regulators closed the failed New York-based Signature Bank on March 12, all deposits were transferred to the newly formed Signature Bridge Bank, N.A. Depositors have access to their money in the same manner as before, including the use of debit cards, ATMs and check writing.

In a joint statement the day the bank was shuttered, the Federal Deposit Insurance Corp. (FDIC), the Federal Reserve and the U.S. Treasury Department said all deposits would be guaranteed at both Signature Bank and Silicon Valley Bank (SVB), which collapsed two days prior.

Regulators said guaranteeing of the insured and uninsured deposits would not be at the expense of taxpayers.

Signature Bank was shut down after its customers withdrew billions of dollars in the wake of the collapse of SVB. Along with the run on deposits, the bank’s stock saw its biggest one-day decline on March 10 — of 23 percent — since the bank went public in 2004. As a result, trading was halted that day for volatility.

The extraordinary choice to protect both insured and uninsured funds was made because regulators determined the failure of the two regional banks posed a significant risk to the entire U.S. banking system.

Latest updates

Flagstar bank to purchase Signature deposits and loans — March 19

Flagstar Bank, a subsidiary of New York Community Bancorp, entered into an agreement with federal regulators on March 19 to purchase deposits and loans from Signature Bridge Bank, N.A.

Signature’s 40 former branches will operate under Flagstar Bank on March 20 under their usual business hours, the Federal Deposit Insurance Corp. (FDIC) announced. Customers of Signature should continue to use their current branch until they receive notice that full-service banking is available at Flagstar’s branches, according to the FDIC announcement.

“Depositors of Signature Bridge Bank, N.A., other than depositors related to the digital banking business, will automatically become depositors of the assuming institution,” the statement read. “The FDIC will provide these deposits directly to customers whose accounts are associated with the digital banking business.”

The transaction included the purchase of around $38.4 billion of the assets of Signature Bridge Bank, N.A., which includes loans of $12.9 billion acquired at a discount of $2.7 billion. Around $60 billion in loans remains in receivership for later disposition by the FDIC, the statement read.

When the FDIC shuttered Signature Bank on March 12, the agency created Signature Bridge Bank, N.A. and transferred all deposits to the newly formed bridge bank.

The bridge bank, called Signature Bridge Bank, N.A., had been created by the Federal Deposit Insurance Corp. (FDIC) after Signature Bank collapsed on March 12. Depositors had access to their money in the same manner as before, including the use of debit cards, ATMs and check writing.

Why did Signature Bank fail?

Regulators shuttered Signature Bank on March 12 after its depositors had withdrawn billions following the collapse of SVB, another regional bank, two days prior. Signature’s stock also sank in its last day of public trading before the bank was shuttered. Its demise marked the third-largest bank failure in U.S. history.

In their announcement, regulators stated Signature Bank was closed in order to protect depositors and the FDIC was appointed as receiver of the bank. The bank had more than $110 billion in assets and nearly $89 billion in deposits at the end of 2022, according to the New York Department of Financial Services.

Founded in 2001, Signature Bank was a full-service financial institution based in New York with 40 branches in New York, Connecticut, California, Nevada and North Carolina. It notably was one of only a handful of banks allowing customers to deposit cryptocurrency (crypto) assets, a business it entered into in 2018.

Who is affected by Signature Bank’s failure?

Signature Bank was seized by regulators on March 12, and on March 13 customer accounts had automatically been transferred to the newly formed, FDIC-operated bridge bank called Signature Bridge Bank. Depositors can continue to use the same checks, debit cards and ATM cards they used prior to the bank’s failure.

On a larger scale, the failures of Signature and SVB have sparked worries about the stability of the U.S. banking system. Waning investor confidence has caused stocks to experience significant losses in market value at regional banks as well as big banks.

Consumer sentiment and behavior will be impacted negatively by the failures of banks such as Signature and SVB, says Mina Tadrus, CEO of Tampa, Florida-based investment management firm Tadrus Capital. “Investors may become less trusting of these companies and more cautious in the future when deciding which financial institutions to work with,” he says.

Signature Bank commonly worked with crypto clients as well as real estate companies. It said in a recent press release that more than 80 percent of its deposits came from “middle market businesses, such as law firms, accounting practices, healthcare companies, manufacturing companies and real estate management firms.”

A prominent client the bank had cut ties with in 2021 was former President Donald Trump. The bank had provided Trump and his business with checking accounts as well as financing for various ventures. Trump’s daughter Ivanka Trump was a member of the bank’s board of directors between 2011 and 2013.

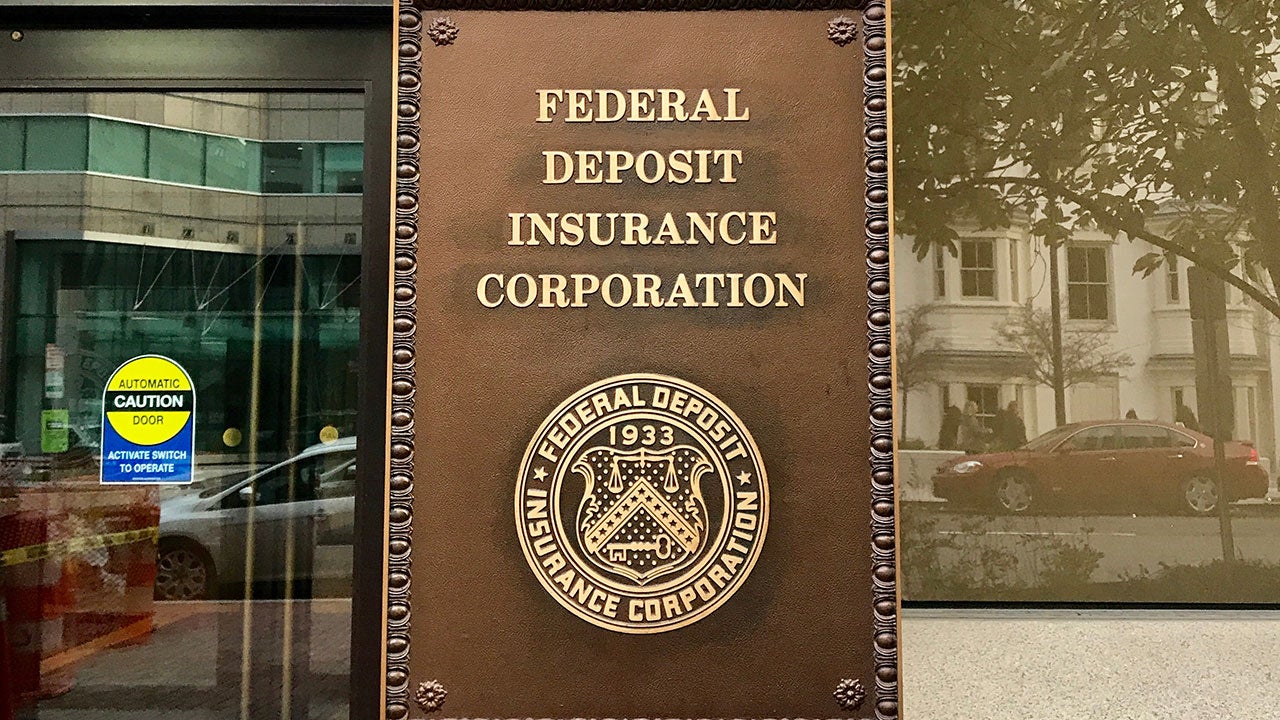

Is the government bailing out Signature Bank?

Regulators announced on March 12 that both insured and uninsured deposits at Signature Bank would remain available to its customers, as is also the case with SVB. More than $79 billion (around 90 percent) of deposits at Signature were not insured by the FDIC, according to The New York Times.

Although the FDIC has made exceptions with Signature and SVB, its standard policy is to insure up to $250,000 per depositor, per FDIC-insured bank, per ownership category. The FDIC is an independent government agency that gets its money from its member banks, which pay premiums to cover their customers’ deposits.

Coverage of the deposits — both insured and uninsured — will not be borne by taxpayers, according to regulators as well as President Joe Biden.

“No losses will be — this is an important point — no losses will be borne by the taxpayers,” Biden said in televised remarks on March 13. “Let me repeat that: No losses will be borne by the taxpayers. Instead, the money will come from the fees that banks pay into the Deposit Insurance Fund.”

Treasury Secretary Janet Yellen echoed Biden’s message in her March 16 testimony before the Senate Finance Committee. “Importantly, no taxpayer money is being used or put at risk with this action,” Yellen said. “Deposit protection is provided by the Deposit Insurance Fund, which is funded by fees on banks.”

Any losses to the Deposit Insurance Fund to cover uninsured depositors would be recovered by a special assessment on banks, regulators said. They also stated that parties who aren’t protected in the failure of the two banks are shareholders and some debtholders.

Is my money safe in my bank?

Having money in deposit accounts at an FDIC-insured bank means your funds are covered automatically. While you don’t need to do anything further to ensure coverage, you should make sure the amount of money you have deposited doesn’t exceed the coverage limits.

The FDIC covers deposits up to $250,000 per bank, per depositor, per ownership category. If your money is in an FDIC-insured bank, it will be covered up to this limit. You can find out if your bank is insured by going to the FDIC’s BankFind tool. From there, you can search for your bank’s name. The tool shows detailed information for all FDIC-insured banks, including branch locations and operating status.

If your deposits exceed the coverage limit at your bank, you can obtain additional coverage by opening additional accounts at a separate FDIC-insured bank.

Many credit unions offer similar deposit insurance through the National Credit Union Administration (NCUA), which is a U.S. government agency that provides protection through the National Credit Union Share Insurance Fund (NCUSIF).

Accounts covered by FDIC insurance include savings accounts, checking accounts, certificates of deposit (CDs) and money market deposit accounts. Things that aren’t covered include stock or bond investments, mutual funds and crypto assets.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.