Second $1,200 stimulus check and reduced unemployment insurance boost: How HEALS Act could affect you

Another massive round of economic stimulus might soon be on the way as the U.S. economy continues to fight through the devastating coronavirus-induced downturn.

U.S. Senate Republican leaders on Monday unveiled a draft $1 trillion package known as the “HEALS Act” that proposes trimming extended unemployment benefits, issuing a second round of direct payments, replenishing small business loans and providing firms with tax credits for operating during the pandemic, among other key provisions that could impact your wallet.

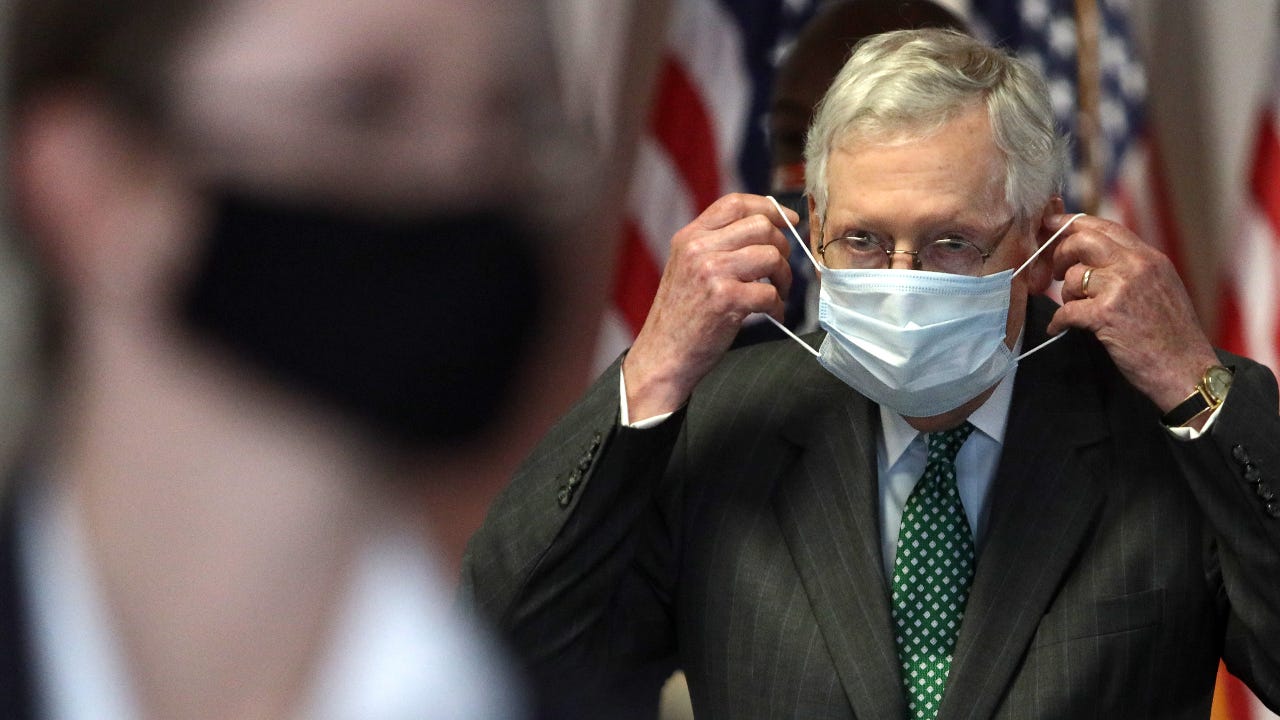

“The pandemic is not finished, the economic pain is not finished, so Congress cannot be finished either,” said Senate Majority Leader Mitch McConnell, a Republican from Kentucky, in a Monday speech on the Senate floor.

But the GOP proposal sets the stage for a divisive clash among party lines, and the clock is ticking. The bill omits a payroll tax cut previously championed by President Donald Trump and differs dramatically from the $3 trillion-plus HEROES Act that the House of Representatives passed in May, days before the CARES Act-backed extended $600 unemployment benefits are set to expire.

Here’s what you need to know about the proposal, including the provisions that could impact your wallet and the likelihood that they’re passed.

1. Another round of $1,200 (or more) stimulus payments

The most wide-sweeping impact to your wallet, another round of direct stimulus payments could be in the works, if the HEALS Act is passed.

The bill structures eligibility similarly to the first round in March. Individuals with incomes of $75,000 or less a year and couples making up to $150,000 a year are eligible for $1,200 payments or $2,400, respectively, with an extra $500 reserved for individuals or households with a dependent.

Separate from the CARES Act, the HEALS Act would allow for parents caring for a dependent of any age, including college-aged dependents, to still receive a $500 payment. Meanwhile, the proposal also ensures that those who have died prior to January 1, 2020, do not receive a check. Individuals in prison for all of 2020 or those incarcerated at the time that the Treasury department processes the checks cannot receive a stimulus payment, nor can they claim it as a 2020 tax credit.

Both parties back stimulus payments, meaning it’s likely going to make it into the final draft of the bill, though the amount is considerably less generous from Democrats’ previous proposals.

The House’s HEROES Act proposed more generous checks of up to $6,000 per family, $2,400 per married couple and $1,200 per dependent for up to three children, while a separate proposal from Sens. Kamala Harris (D-Calif.) and Bernie Sanders (I-Vt.) floated sending monthly payments of $2,000 to Americans making less than $120,000.

2. Extended unemployment benefits (but less generous than the CARES Act)

The CARES Act secured 39 weeks of unemployment benefits for most Americans and provided an extra $600 in weekly payments, an extension that’s been deemed by many as the most generous in history. But states as early as Saturday started lapsing that extra $600 check, and many economists have warned it could have dire consequences for the economy and Americans if they end altogether.

Joblessness is the highest since the Great Depression, and what’s perhaps one-tenth of the workforce is still drawing benefits, according to the most recent jobless claims report from the Department of Labor.

The HEALS Act would provide another unemployment insurance (UI) extension, though it wouldn’t be as generous as what those who are currently unemployed are used to getting.

Until October, states would provide an extra $200 per weekly check, instead of $600. During that two-month timeframe, states would transition over to a new UI system — one that provides Americans with up to 70 percent of their wages through unemployment benefits, meaning every weekly check amount would be different. If states need more time to get up and running, they could apply for a waiver that would give them an extra two months, meaning in some cases, Americans could be getting an extra $200 in their checks all the way up until December.

States would also be given an extra $2 billion in total funds to help them upgrade their systems to be better equipped at handling a surge in claims and adjusting wage replacement levels, according to a summary distributed by Senator Chuck Grassley, a Republican from Iowa.

But all of this tees up a heated debate between Republicans and Democrats, who are unlikely to accept this sharp reduction. Democrats have pushed for reinstating the original $600 weekly extension, though Republicans have feared it could deter many Americans from going back to work.

3. A second round of Paycheck Protection Program (PPP) funding

The HEALS Act would refill the pot of funding for the Paycheck Protection Program (PPP), a small business rescue program that provides firms with forgivable loans for keeping their employees on the payroll.

On top of the $130 billion left unspent when the window closed on June 30, lawmakers’ proposal would provide an additional $60 billion to the pot of funding. The HEALS Act would mandate that only firms with fewer than 300 employees are able to qualify, amid criticism that larger firms took advantage of the program when it was first brought to fruition in March. To be eligible for a loan, firms must prove that their gross revenue has fallen by at least 50 percent.

The HEALS Act would also create a new tranche of loans available for firms in low-income communities. Those businesses would be able to apply for a loan maturing in 20 years that would offer up to two times their annual revenue, or a maximum of $10 million, according to a summary text provided by Sen. Marco Rubio, a Republican from Florida, who chairs the Small Business and Entrepreneurship committee. Businesses with up to 500 employees whose revenues have fallen by at least 50 percent this year would be eligible.

4. Tax credits

The HEALS Act acknowledges President Trump’s push for tax credits that could incentivize consumer spending and hiring. The bill would boost the employee retention tax credit (ERTC), an added measure that could increase your job security in the months ahead. It would also establish a 100 percent deduction on businesses who pay for their employees to eat out during the pandemic.

5. Gives states, municipalities more flexibility over federal funding

States and municipalities have been hit hard during the coronavirus pandemic, as unemployment and health care costs soar at a time when retail tax revenues have fallen. Economists have warned that these funding shortfalls could weigh on the rebound from the pandemic.

The HEALS Act wouldn’t provide any additional funding for states and municipalities, but it would give these jurisdictions more flexibility in how they use an existing $150 billion pot of money established through the CARES Act. States could use it, for example, to cover revenue shortfalls, but only for ones that occurred in the 2019 fiscal year. They couldn’t use those funds to replenish “rainy day” savings or pension benefits and must distribute a quarter of coronavirus relief funds (CRF) down to counties and cities in need first.

But these provisions might not get past Democrats. The HEROES Act earmarked about $1 trillion in funds for these hard-hit corners of the country, and it could be a no-compromise part of their agenda.

“The bill’s [HEALS Act’s] failure to provide any aid to state and local governments is a glaring weakness,” says Thea Lee, president of the Economic Policy Institute. “This will mean drastic cuts to essential services like health care, education, and public safety right when people need them the most.”

6. No payroll tax cut

President Trump and other White House officials have pushed for a payroll tax cut, but Republicans rejected any such proposal in the HEALS Act. But that’s unlikely to be a deterrent against signing the final care package.

Critics have pointed out that it doesn’t solve the problem of helping those who are still unemployed, and the president softened his tone after several GOP lawmakers pushed back against the idea, says Mark Hamrick, Bankrate’s senior economic analyst and Washington bureau chief.

“The president’s early suggestion that the legislation should include a payroll tax cut was ill-advised and unpopular, including even among members of his own party in the Senate,” according to Hamrick. “When the White House finally understood that political dynamic, the president backed down from his advocacy of the payroll tax cut notion.”

Bottom line

With all sides of the aisle having their own priorities and demands, the HEALS Act still has several hurdles before even coming close to passage. And even if that happens sooner than later, Americans are likely going to see a lapse in their unemployment benefits.

Months after the passage of the CARES Act, many states hadn’t started paying out their extra $600 benefits, while the additional Pandemic Unemployment Assistance (PUA) program hadn’t been officially online either. That’s likely still to be the case, even with additional funding for such administrative changes.

“Unfortunately, there’s a risk that there is a lapse in extended benefits because the Senate failed to act earlier,” says Hamrick. “Even when something is signed into law, there will again be a delay in implementation at the state level, where the unemployment payments are processed. We saw all kinds of horror stories as states tried to accommodate, but too often failed to respond quickly to the massive demand in benefits earlier this year.”

McConnell stressed Monday the urgency of charging ahead, adding that the U.S. economy has “one foot in the pandemic and one foot in the recovery. The American people need more help. They need it to be comprehensive. And they need it to be carefully tailored to this crossroads.” Yet, the top GOP lawmaker also said this bill could be Congress’ last in response to the pandemic, though the year is far from over yet.

“Ironically, the same dynamic that’s causing stress and delay in forging broad agreement will likely be what ultimately helps foster final passage on some form of legislative relief. That dynamic is the looming election,” Hamrick says. “If Republicans were ultimately blocking passage with the outbreak still raging and the economy still struggling, some voters would be further outraged. The package has already been delayed even though the democratically controlled House passed a massive $3 trillion measure in May.”

Featured image by Alex Wong of Getty Images.

Learn more:

- Stimulus checks: What consumers should consider doing with the money

- Survey: More than a third of Americans have delayed financial milestones because of pandemic

- Mortgage relief guide: Forbearance programs; freeze on foreclosures, evictions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.