One of the newest next-gen bank app features is centuries old

It’s one of the few things even the most daring digital banking apps can’t do: accept cash deposits.

But during the pandemic, that limitation started to wash away with a workaround. Though popular mobile-first banking apps already let customers make cash withdrawals at ATMs, these disruptors, known as neobanks, started to embrace another retro feature: letting customers deposit cash at tens of thousands of grocery stores, pharmacies and other retailers across the country. Some locations charge a fee for a cash deposit. Others don’t.

In 2020, Current added an option to let customers place cash into their digital accounts at the local Walgreens, 7-Eleven, Walmart and more, as did Varo Bank. In December 2021, Chime rolled out a similar free feature at Walgreens locations, expanding on its existing partner retailers that also accept cash deposits.

The timing of the rollouts might feel surprising. For the last two years, in the middle of a public health crisis, bank branches have been running on leaner hours if not closed. As a result, consumers embraced digital banking more than ever. Yet, cash still played a part in the way in which some earn income, and retailers like Walgreens remained open.

“If you get paid with cash, you need a way to deposit it even if you want to continue to spend it digitally,” says Joshua Stephens, vice president of product management at Current, a popular neobank for 20-somethings.

“So, as much as we know that it’s important, the world is becoming more digital first,” he says. “It’s important to solve the problems our members have.”

The pandemic may have also heightened the need for consumers to deposit cash. During lockdowns, cash lost favor among plenty of small businesses that paused or stopped accepting the form of payment, often citing the national coin shortage as one reason why. In so doing, it only upped the reasons why consumers might need to deposit cash where they bank.

“As much as we like to think cash is maybe going by the wayside, it is not for everybody,” says Les Whiting, chief financial services officer at H&R Block.

The next-gen banking customers who still need to deposit physical cash

Bartenders, food servers, valet drivers, nail technicians and contractors are among the types of workers still earning portions of their income in cash. Neobanks, or challenger banks, are focused on mobile banking but court these types of consumers on a larger quest to improve their customers’ financial health.

It’s hard to say where cash is coming from with precision, but it’s clear it’s part of consumers’ income. “Plenty of people work in industries where they receive cash,” says Paul McAdam, senior director of banking and payments intelligence at J.D. Power.

So as the realm of banking options expands — with more nuanced options, fewer fees and all kinds of digital features — these next-gen bank brands still need to address some of the old-school needs for customers who skew younger and are less financially secure than the broader population.

“It’s not an ‘or,’ it’s an ‘and,’” says Whiting of H&R Block. “We see millions of deposits a year and hundreds of millions of dollars of cash deposited into the H&R Block family of financial products.”

Though the tax preparation-chain’s challenger bank, Spruce, only debuted in January, Whiting says the data already shows a strong uptake of customers depositing cash into their accounts.

The quest for more digital customers requires cash access

The demand for what many consider legacy helps to reveal a bank branch trend: Making a deposit is the main reason why branch visits persist. According to J.D. Power’s research, 71 percent of those who visited a branch via a lobby or drive-thru lane did so to make a deposit, a percentage that could include checks or cash; the research firm didn’t specify.

That doesn’t mean branches are bustling or that consumers plan to pay for things with physical cash — far from it. But those who are comfortable banking only online may still earn income in cash and need a place to put it.

Currency still accounted for 20 percent of all payments in 2021 — up from 19 percent in 2020 and down from 26 percent in 2019, according to the Federal Reserve’s 2022 annual payment study.

Strikingly, the amount someone carries in a wallet perked up from pre-pandemic days. In 2021, the average consumer carried $67, down from $76 in 2020 but up from $60 in 2019, the payments study found.

“The reality is for a bank to be closer to its customer, they have to make access to cash easier physically,” says Abhijit Chaudhary, chief product officer of Green Dot, which launched a digital bank in 2021 and also offers its in-person financial-services network to neobanks.

For a neobank, adding the feature removes a deal breaker for someone who may have reservations about signing up for an online-only bank account.

Depositing cash with a digital twist during a pandemic

Though some consumers worried about the safety risks of taking cash out at the ATM during the early days of the pandemic, Current discovered its customers still needed a place to plop physical currency. In the summer of 2020, Stephens says it was the most requested feature.

When Current rolled out in-person cash deposits in September, the neobank included a tech hook: To make a deposit at, say, a 7-Eleven or Walgreens, a customer fires up the mobile app to scan a barcode with the checkout teller. A customer can deposit up to $500 a transaction — up to $1,000 per day — and the funds quickly hit their accounts. The monthly limit is $10,000. There is, however, a $3.50 transaction fee.

Since adding the option, Current estimates that 10-15 percent or so of its 4 million members use it at any given time. “It’s not an overwhelming majority of our audience but it’s not nothing,” Stephens says.

At Chime, customers can make up to three cash deposits of up to $1,000 each to their accounts every 24 hours. The maximum amount each month is $10,000, according to its website. Transactions are free at some retailers, like Walgreens, while others, like CVS and Walmart, charge fees. Unlike Current, the transaction requires a debit card instead of a mobile app.

The substitute bank branch for next-gen banking apps

In a way, these retailer partnerships are bank branch stand-ins for neobanks.

“It’s not reasonable for a digital bank to open 5,000 or 2,000 branches to support every single customer that they may have across the country,” says Francisco Alvarez-Evangelista, an advisor in Aite-Novarica Group’s retail banking and payments practice. “So they found the best applicable route and decided to develop partnerships with retailers that already support some sort of financial services in their locations.”

Of course, not every online bank lets customers deposit cash. Ally Bank and Discover, for example, make ATM access available but don’t yet permit their customers to deposit cash. Others, like Spruce by H&R Block, Oxygen and GO2Bank by Green Dot, launched by letting their digital customers make in-person deposits.

Decisions are based on company strategy as well as settling on the best path for digital banks that want to keep their fee model low.

For Green Dot, Chaudhary says cash access was obvious because it’s imperative to its customer base. That helps explain why its locations are undoubtedly convenient: 96 percent of the country is covered in a 3-mile region of a Green Dot location, he says.

“A lot of people spoke about this new wave of digital coming with COVID where people are going to access digital mediums more and more,” Chaudhary says. “But the reality is cash deposits and cash withdrawals are still the same. … Until that changes, until our population of gig workers changes or our population of people who get paid weekly changes, we will always see this huge cohort of people who are dependent on these needs.”

What to watch out for when depositing cash into your neobank account

For consumers seeking to deposit cash into a neobank account, there are considerations to weigh.

Watch out for fees

Many retail partners charge for cash-deposit services and the amount varies. Some locations don’t charge anything at all, while others charge a few bucks. If you need to make regular cash deposits, find the lowest cost option. Contact your neobank to confirm prices.

Double check the retailer offers the service

Not every retailer location lets you deposit cash.

“There could be a CVS location, which is next to your house, which does support it, but the one next to it, 2 miles away, doesn’t support it,” Chaudhary says.

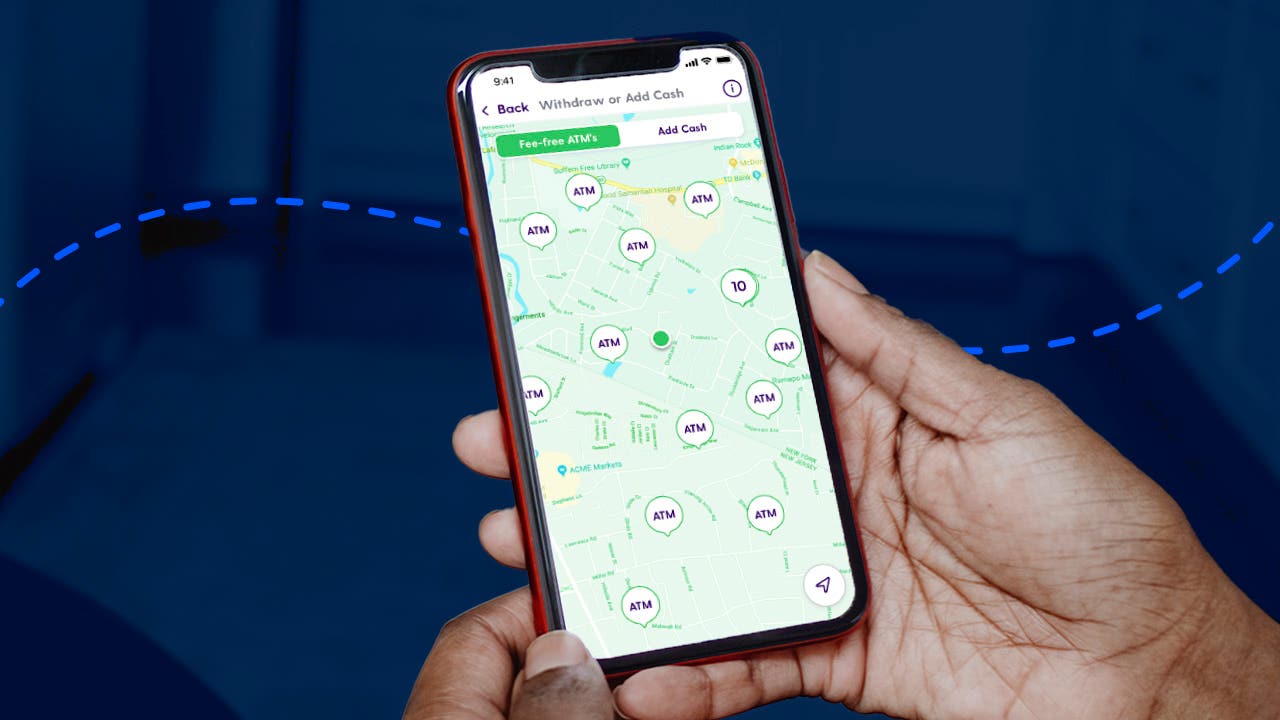

To find out beforehand, sign into your mobile banking app and look at the location map to see which retail partners let you deposit cash.

As time goes by, cash will die – but it will take years

Cash may be on a steady decline, but it won’t vanish overnight.

“Nothing happens like that,” Current’s Stephens says. “Things are a much longer timeframe.”

As cash endures, some of the newest challenger banks have taken notice and embraced letting their customers deposit cash. In January 2020, for example, Oxygen introduced a digital banking app that lets customers deposit cash at retailers, including Walgreens and Kroger.

Though the neobank is focused on helping customers accomplish tasks on the mobile app, it saw the feature as crucial.

“Some people want to use cash,” says Ryan Conway, senior vice president and head of business development of partnerships at Oxygen. “They need to be able to not only access it but also deposit it. Without that, you are missing a really critical element.”

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.