Cashless cash stuffing provides the best of both budgeting worlds

If you’re a TikTok user, you’ve probably seen some videos about cash stuffing, in which crisp dollar bills are counted and slid into sleek, labeled pouches. While some viewers are drawn in simply for the aesthetic, others are inspired by the highly practical benefits of this form of budgeting.

Cash stuffing isn’t a new concept, but it’s a trendy term for the age-old practice of envelope budgeting — which involves placing cash into envelopes for each category in your budget, such as housing, food, transportation and utilities.

A benefit of cash stuffing is you’re less likely to make impulse purchases when your money is assigned a purpose and tucked into labeled envelopes. Some find it helps them live within their means, without the stress of coming up short of bills or other expenses each month.

Cash stuffing doesn’t come without major downsides, however. Simply put, money in the bank is often safer, and the bank pays you interest. Fortunately, however, you can practice “cashless cash stuffing” to get the best of both budgeting worlds.

Drawbacks of cash stuffing

Two significant downsides of keeping your money at home in envelopes are:

- Your money won’t earn interest.

- Funds might not be recovered if lost or stolen.

You’re missing out on interest

First and foremost, cash stuffed into an envelope isn’t earning any interest. Conversely, it’s not difficult to find a high-yield savings account that earns an annual percentage yield (APY) of 5 percent or greater.

For example, say you’re able to devote $300 to savings every month. If you deposit that amount regularly into a savings account that earns 5 percent APY, in one year you’d have earned around $83 in interest. That’s $83 more than you’d have by just keeping the cash at home in an envelope.

Your money’s safer in the bank

There may be no way to recover cash if it becomes lost or stolen from your home. Rather, it may be safer to keep your money in a federally insured bank account. This way, your money is safe if the financial institution fails, as long as your balance is within the limits and guidelines.

When banks carry this insurance, it’s provided through the Federal Deposit Insurance Corp. (FDIC). For credit unions, this insurance is through the National Credit Union Association (NCUA). Having this insurance means your deposit accounts are insured for up to $250,000 per depositor, per insured bank or credit union, for each account ownership category.

“Keeping cash around the house means more than just missing out on interest, but exposes you to the risk of loss or theft,” says Greg McBride, CFA, Bankrate chief financial analyst. “Money in a high-yield savings account with a bank or credit union will earn interest but also be protected by federal deposit insurance.”

Methods of cashless cash stuffing

Fortunately, there are ways to categorize portions of your money while still keeping it safe and earning interest. In other words, you can reap the benefits of cash stuffing without holding onto the cash.

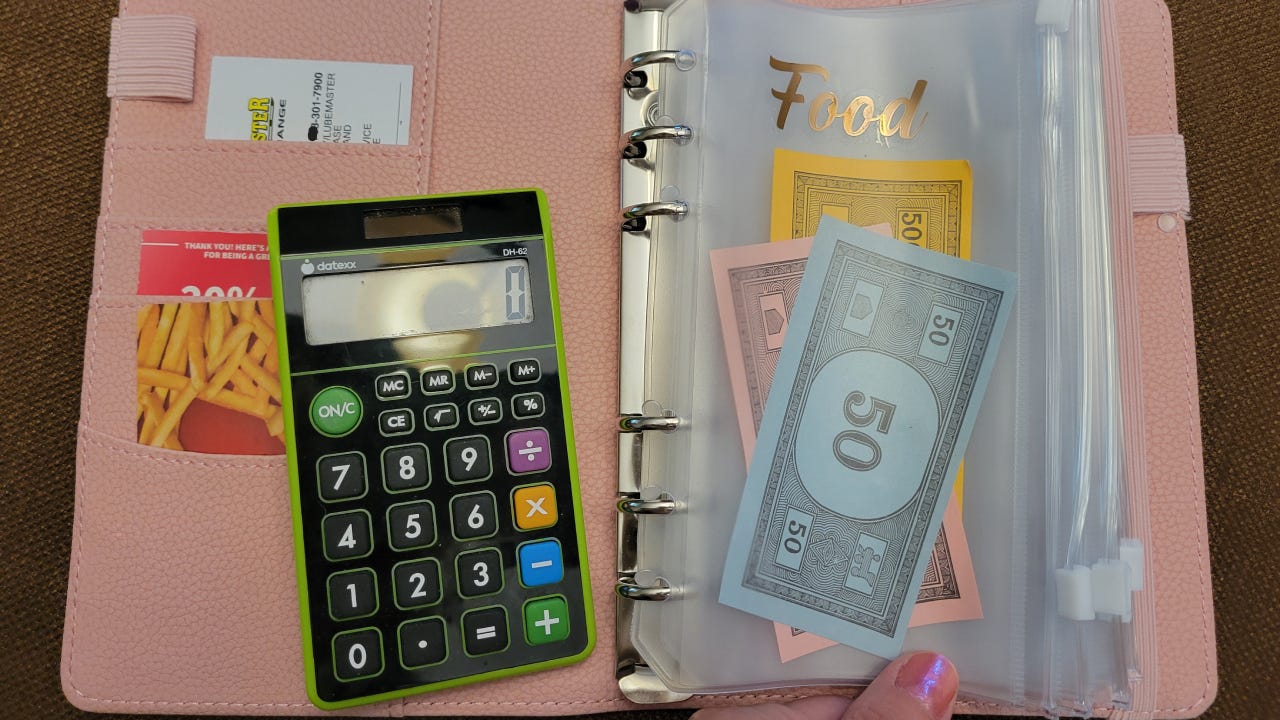

Use play money

One way to categorize your money without keeping cash is to insert play money — or any paper placeholder of your choice — into envelopes. This helps you to visualize how much you’re devoting to each of your monthly expenses, while your real money is safely in the bank, earning interest.

Every payday, insert placeholders into the envelopes instead of real money, allocating the amount you’ll need for mortgage or rent, food, gas and so on. As money is spent, remove the placeholders from the envelopes. When nothing is left in a given envelope, you’ve spent your allotted amount for the month.

Use a budgeting app

You can incorporate the tried-and-true envelope budgeting method with modern technology by downloading a budgeting app that helps you categorize your spending. Some such apps even sync with your bank accounts to conveniently provide a full picture of your spending and saving.

For example, the GoodBudget app is based on the envelope budgeting method. For each of your spending categories, money can only be taken from the corresponding envelope. Envelopes can also be dedicated to savings categories, and the app allows multiple devices to sync to the account.

The PocketGuard app lets you create custom spending categories, and it uses them to break down how your money is being spent. It also lets you know how much spending money you have left throughout the month.

Open an account with spending categories

Various banks provide their customers with budgeting tools, and some of these may appeal to those who value the envelope method. For instance, Ally Bank checking account holders can create up to 30 spending buckets, allowing you to reserve money in the account for upcoming expenses. The app automatically subtracts money from each bucket as you spend.

Similarly, Huntington Bank checking account users have various in-app budgeting tools. Customers can set up spending categories, while establishing spending limits as well as alerts on how much has been spent per category.

Bottom line

The age-old method of envelope budgeting provides various money management benefits, but it comes with certain risks. By using real envelopes and money placeholders, a digital budgeting app or a bank account with spending categories, you can still benefit from categorizing your spending while enjoying the safety and interest-earning opportunities of money in the bank.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.