Ally Bank rolls out new features making it easier for consumers to save

Here’s something for people who are struggling to set aside money for the future.

Ally Bank announced on Wednesday that it’s introducing a number of new savings tools. The features were released to a small pool of customers in the fourth quarter of 2019. But starting today, they’re available to all Ally customers with an online savings account.

The new tools should be a good resource for consumers who need help meeting their savings goals. It’s also a plus given that Ally already offers a high-yield, fee-free online savings account.

At 1.6 percent APY, Ally’s online savings account is far from offering the highest yield (some high-yield savings accounts pay more than 2 percent APY). Still, few rate leaders have savings or budgeting features that top what Ally’s bringing to the table.

Creating savings buckets

Buckets are ideal for savers who have multiple savings goals. Let’s say you’re saving up for a new home, your next summer vacation and unexpected emergencies at the same time. With buckets, you can easily track how much money you’re socking away for each of these goals.

Existing Ally customers who log in to their savings accounts will see a bar at the top letting them know that there are new features to help them “organize and optimize their money.” From there, you can create up to 10 buckets within a single savings account.

Like Barclays and Capital One, Ally Bank already lets customers open multiple savings accounts and nickname them. With the new buckets feature, however, there’s no need to have two or three different accounts for savings when you can easily organize everything within one account.

Boosters: Automating your savings

Savings experts often emphasize the importance of automation. Very few people are good at manually moving money from their checking accounts to their savings accounts on a consistent basis. One of the best ways to save more money is to do it automatically.

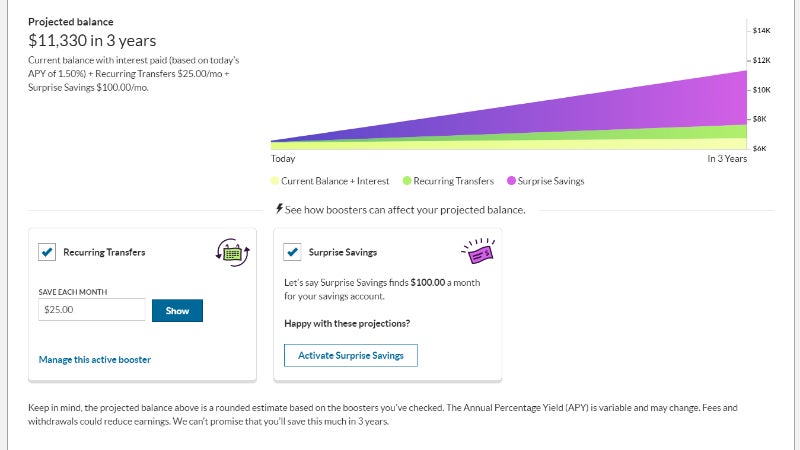

One option is to set up and schedule recurring transfers. You’ll decide how often you want money transferred to your savings account (weekly, biweekly or monthly) and specify the amount you want to be automatically transferred. Pop-ups let you know how much money you could save within one year based on the size of your transfer.

Next, you’ll select the checking account you’re transferring money from, even if it’s at a different bank. Ally will let you know the date when the first transfer will be delivered. And nothing’s permanent. You can always cancel your recurring transfer or change the amount or the frequency of money transfers. Also, if you’ve already organized your savings into buckets, you can have the money you’re transferring sent into different buckets.

Another feature now available allows for “surprise savings.” This booster looks at how much money is in your checking account, determines the amount you typically spend and sweeps any leftover money that could be saved into your online savings account at Ally. Here, it’s also possible to have money pulled from your primary checking account, even if it’s from an entirely different bank.

There are also rules to keep you from accidentally overdrawing your account. If you set up surprise savings, Ally promises to never move more than $100 at a time or make more than three automatic transfers per week.

Ally plans to release additional data to make it easier to analyze and track your progress toward boosting your savings. Beginning on Feb. 20, for example, Ally plans to have charts available to show the growth of accounts.

The verdict

Ally says it has data already showing how its new tools can make a difference in the lives of its customers.

“Early testing with real Ally customers shows that using just one of the boosters can accelerate savings by more than five times than interest rate alone,” says Anand Talwar, deposits and consumer strategy executive at Ally Bank. “The ease of saving helps cement a new habit, and the feeling of success and momentum that comes from watching your money grow creates a snowball effect that keeps people going.”

Some of the features, of course, are already available in other forms. The surprise savings functionality, for instance, is already available through apps like Digit (although Digit now charges a small monthly fee). Through your job, it may be possible to easily have money deposited automatically into a savings account every time you get paid, without opening a savings account with Ally.

One major competitor for Ally is Marcus by Goldman Sachs, which bought the startup Clarity Money back in 2018. Marcus customers can receive personalized insights and easily track their spending, check their credit score and set up recurring deposits. And Marcus currently pays savers a slightly higher yield (1.7 percent APY). So while it’s great to take advantage of any tools that help you save, you’ll also want to avoid leaving money on the table by earning as much interest as you can.

Learn more:

- How to save money: 10 easy tips

- 5 apps that help you save money

- Survey: Nearly 4 in 10 Americans would borrow money to cover a $1K emergency

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.