Mobile Banking

Mobile banking allows consumers to access their banks and financial information from any mobile device. Read about online banking trends, the best money apps and mobile banking safety.

Explore mobile banking basics

These apps pair basic and advanced features to help you take control of your money.

Mobile banking apps aren’t just trendy, they can help you better manage your money.

Mobile apps make managing your money a snap and mobile alerts can help protect it.

Check out these mobile banking tips

Article

Mobile banking apps

Several mobile banking apps come with features that help to make saving money easier and keep it a priority on consumers’ radars.

Guide

Mobile check deposits

The mobile check deposit feature in your bank's app can be a time saver that's well worth the short learning curve.

TRENDS

Digital banking in 2024

Digital banking encompasses various banking tools and trends, but one thing is certain: Digital banking is on the rise.

Explore banking products

Latest articles

These expert tips can help keep your bank and financial accounts safe from hackers.

Digital banking makes it easy to access your personal finances from anywhere.

Ever heard of a neobank? If not, here’s what you need to know.

These five banking apps can help you save money even on a tight budget.

Finding the account of your dreams comes down to knowing what you want and the features you value most.

Getting answers to your banking questions doesn’t have to take forever.

Credit card mobile alerts help monitor your credit card even when you aren’t.

Challenger banks are embracing cash in a bid to better serve their customers.

There’s a light at the end of the tunnel, but the economic hardship won’t be over anytime soon.

The economy is nowhere close to being out of the woods.

Consumers should stick to the status quo.

Even with the economy staging a recovery, many Americans are earning less than before the pandemic.

It’s an “in case of fire, break glass” kind of moment.

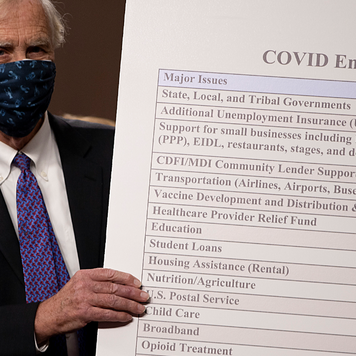

If passed, the Senate’s proposal would be the first major relief plan since March.

The Fed has more in its back pocket than just cutting interest rates.

Biden will be focused on handling the coronavirus pandemic and the recession.

The trusted provider of accurate rates and financial information