The Trump administration’s trade wars are whipping Fed policy back and forth

President Donald Trump’s trade wars just might prompt the Federal Reserve rate cut he’s been clamoring for — but for the wrong reasons.

Weeks after the White House slapped higher duties on Chinese imports and threatened new ones on products from Mexico, Fed officials have made it known that they’re monitoring the situation and are prepared to lower borrowing costs if it’s needed to soothe an ailing economy.

St. Louis Fed President James Bullard said Monday that a rate cut “may be warranted soon,” if these looming threats to the outlook hinder growth, while Vice Chair Richard Clarida told CNBC on Tuesday that the Fed would “put in place” policies that not only “achieve but sustain” maximum employment and price stability.

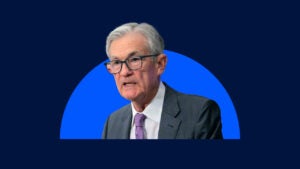

Markets, however, ran with comments later from Fed Chairman Jerome Powell, who, on Tuesday at a conference, made a point to specifically address the deepening disputes between the U.S. and its largest trading partners.

“We do not know how or when these issues will be resolved,” Powell said at a conference in Chicago. “We are closely monitoring the implications of these developments for the U.S. economic outlook, and as always, we will act as appropriate to sustain the expansion.”

Stocks jumped the most since January on the remarks, while the S&P 500 had its best day in five months. The words were music to investors’ ears, who haven’t been shy about betting that the Fed will ease rates this year.

Though the comments don’t explicitly state that a rate cut is coming, they illustrate that the U.S. central bank’s make-no-move policy might be at a crossroads. And as economists, businesses and trade groups alike voice concerns about the damage the trade wars could do, these words confirm that U.S. central bankers are worried, too.

“The Trump administration is testing the Fed’s patience, without a doubt,” says Joe Brusuelas, chief economist at RSM. “We’re not quite to the point where the Fed is ready to engage in a regime change in terms of how it formulates policy and communicates to the market and the public, but the Fed is really stuck between a rock and a hard place.”

Why Fed officials are so concerned about the trade war now

Since White House officials announced plans to slap tariffs on Mexican imports, the voices calling for rate cuts have grown in number — and they’re not just coming from the trading pits.

In a note to clients, J.P. Morgan’s chief U.S. economist and prominent Fed watcher Mike Feroli said he was now forecasting two cuts, one in September and one in December, after initially estimating the Fed would be on hold until 2020.

“Even if a deal is quickly reached with Mexico, which seems plausible, the damage to business confidence could be lasting,” he wrote.

That’s because Mexico is the U.S.’s third-largest trading partner after China and Canada. Businesses have spent the last 25 years deepening their supply chains, since the North American Free Trade Agreement (NAFTA) was enacted, and its close proximity to the U.S. makes it an important economic partner.

“We have a very integrated manufacturing and agriculture system with Mexico, and this uncertainty creates issues,” says Wayne Winegarden, senior fellow at the Pacific Research Institute. “Imagine yourself a manufacturer. Are you going to invest in new supply chains right now? Are you going to open a new manufacturing plant? Whether or not these tariffs go through, the fact that it keeps coming up is going to create pause, and that’s problematic.”

Trump tweeted May 30 that he would impose 5 percent tariffs on all goods coming to the U.S. from Mexico as a means to stop illegal immigration. Each month, the tariffs would go up by 5 more percentage points, until the issue appeared to be remedied, “at which time, the tariffs would be removed,” Trump posted.

“There’s no dispute that the U.S. has an immigration and humanitarian problem, some might say a crisis, at the southern border. Congress has failed to grapple with the issue, no doubt,” says Mark Hamrick, Bankrate’s senior economic analyst. “But wielding tariffs in an attempt to resolve an immigration problem is like fielding a baseball team for a football game. It doesn’t compute and is likely counter-productive.”

The conflict could jeopardize the future of the revised NAFTA, now dubbed the U.S.-Mexico-Canada Agreement. Congress has yet to ratify the deal, and the increased tensions cast its future into doubt.

It would also be a double-hit for the U.S. economy, given that a trade war is also pervading with China, its No. 1 trading partner. If the Trump administration follows through with its plans to impose 25 percent tariffs on $300 billion of imports, that would mean that virtually all imports from the two countries are subject to tariffs.

“Putting tariffs on China is just as bad as putting tariffs on Mexico,” Winegarden says. “Beat me with a stick, or beat me with a knife. In the end, I’m still hurt.”

Morgan Stanley’s chief economist, Chetan Ahya, wrote in a Sunday note to clients that the global economy could see a recession in just three quarters, if the Trump administration follows through with these additional tariffs on China. The consensus that it could harm growth is shared by other experts.

That, along with the tightening of financial conditions and the inverted three-month and 10-year Treasury yield, spells trouble for the U.S. economy ahead.

“This latest policy monkey wrench comes amid a sharp plunge in Treasury bond yields, reflecting investor distaste for risk, if not outright fear,” Hamrick says. “Similar uncertainty among business leaders dampens the desire to make spending decisions on equipment and labor. If this chill persists, it will bleed into the job market, hurting hiring and further threatening the longevity of the expansion.”

What the trade wars mean for the Fed’s dual mandate

The Fed will be closely eyeing how these trade wars impact its dual mandate: stable prices and maximum employment, Brusuelas says. That means seeing whether the trade wars lead to job losses or increased price pressures — and they’re expected to do both.

Economic consulting firm The Perryman Group estimated in a June 3 note that the initial 5 percent tariff on imports from Mexico could lead to the loss of 400,000 jobs in the U.S., with 29 percent of those in Texas. That number will only go up, if tariffs on Mexican imports increase, the firm said.

Major retailers and food chains are also saying that the tariffs will leave them with no choice but to hike prices, creating more price pressures. Chipotle, for example, mentioned that they’d have to raise the cost of burritos if Trump slaps tariffs on Mexico.

Tariffs on imports from Mexico could also increase the prices on tequila, beer and avocados, Hamrick says. Prices are also most likely to go up on air conditioners, cameras, televisions, mattresses and lamps from the tariffs on China.

[READ: Here’s how much Trump’s tariffs on China could cost consumers]

But the most pervasive problem is the prospect that it could cause growth to slow. The trade war with China is expected to shave half a percentage point off of gross domestic product (GDP), while the conflict with Mexico could cost 0.4 percentage points, according to Tom Porcelli, chief economist at RBC Capital Markets.

U.S. economic growth was already expected to level off this year, as the fiscal stimulus from the Trump administration’s 2017 tax cuts fades.

The central bank “faces an economy that is expected to grow more slowly going forward, with some risk that the slowdown could be sharper than expected due to ongoing global trade regime uncertainty,” Bullard said Monday.

How the Fed will juggle those two sides

But those developments could all be complicated for the Fed to juggle.

Central bankers cut rates to stimulate the economy, job creation and growth, when the fundamentals are looking weak. When inflation is up, however, the Fed typically chooses to raise rates to keep price pressures at bay.

The Fed is likely not going to worry about these added price pressures from tariffs, Porcelli says. Officials are more likely to dismiss it as a one-time event.

“In the first month, when you have the full-blown impact from the tariffs, you’ll get this big rise in the price index, but then, that impact goes away,” Porcelli says. “Calling it transitory is exactly the right way for the Fed to characterize it.”

The Fed could also cheer it, a recent speech from Fed Governor Lael Brainard suggests. Brainard said on May 16 that the Fed could use the added price pressures to demonstrate that U.S. central bankers are truly committed to having a symmetric target.

In other words, that means they could show the public that they won’t overreact to inflation overshooting their 2 percent objective, just as they haven’t overreacted to inflation undershooting that target for most of this expansion.

“The Federal Reserve could use that opportunity to communicate that a mild overshooting of inflation is consistent with our goals and to align policy with that statement,” Brainard said.

Inflation has been undershooting the Fed’s 2 percent target for much of the expansion, and at the Fed’s last policy meeting, it was a key reason for why officials decided to continue remaining on hold.

[READ: Here’s why low inflation has the Fed concerned right now]

But there is something that could potentially make this aspect more complicated. If tariffs on Mexico continue to increase a mechanical 5 percentage points each month, the data could reflect a mechanical, sustained rise in inflation as well.

“They have to discriminate between a one-time bump in the price level because of the tariffs versus a sustained increase in inflation,” Winegarden says. “But if you’re phasing in new tariffs every month, you’re phasing in smaller price increases all along, which sends some very complicated signals. The Fed’s job is being made more difficult. The chance of a mistake by the Fed increases simply because the environment they’re working in has a lot more noise to it.”

But for now, it appears the Fed is going to be more concerned with slowing growth and the second-order effects of tariffs — such as how the added import taxes slow capital expenditures and consumer spending, due to both higher costs and heightened uncertainties.

“Confidence, especially business confidence, is fragile. It’s our job as policymakers to try to support it,” Richmond Fed President Tom Barkin said at a May 15 speech. “I don’t discount the idea that we could talk ourselves into a recession.”

That’s because it tends to lead to a much bigger problem.

“If sharply increased taxes and prices follow within six to nine months, the world really begins to slow,” Brusuelas says. “At that point, are you worried about inflation? You’re not. You’re worried about growth. Once the economy enters into contraction terrain, you’re going to see prices fall.”

When the Fed is most likely to cut (if it does)

Powell’s Tuesday comments were a signal of a rate cut, Brusuelas says. “That’s what the Fed is likely setting up, as a precautionary motive in case the trade war intensifies.”

The markets think so, too. Investors are now betting that there’s a near 26 percent chance that the Fed could cut rates at its next meeting in two weeks, according to CME Group’s FedWatch. That outlook looks even more certain the further into the future you go. Nearly 99 percent of investors bet the Fed will lower interest rates at its December meeting.

But to Porcelli, this interpretation of Powell’s comments might be a bit overblown. “The Fed is always willing to cut rates if things really start to go too far,” he says.

This isn’t the first time officials have acknowledged that a hypothetical policy easing would be necessary, should conditions start to rapidly deteriorate. Chicago Fed President Charles Evans said in a March 5 speech that, if activity slows “policy may have to be left on hold — or perhaps even loosened — to provide the appropriate accommodation to obtain our objectives.” Since the Trump administration ramped up these trade wars, Evans has explicitly stated that the economy is not quite to the point that requires a rate cut.

The Fed will not want to act preemptively, Brusuelas says, whose base case now calls for two Fed rate cuts, one in September and December.

“They run the risk of damaging their credibility, should there be a trade deal right after the rate cut,” he says. “We haven’t thrown taxes on the other $300 billion of Chinese goods. We could go all the way to 25 percent on items from Mexico. I wouldn’t be surprised to see further policy changes at the White House. There’s a lot of risks on the table here.”

President Trump and President Xi Jinping of China are set to attend the gathering of world leaders at the G-20 summit on June 28 and 29 in Japan, just a week after the Fed’s meeting. Fed officials may be hopeful that the two leaders could strike a deal then, he says.

But regardless, tariffs on all items from Mexico start Monday, meaning they’ll start to “show up in showrooms and shopping centers in August,” Brusuelas says. “Around the time the Fed meets in September, they’ll have gotten firsthand information from all of their contacts.”

What this means for you

Stocks are rallying globally, with many investors cheering the U.S. central bank’s response that a cut could be coming. But it’s important not to get too focused on the individual headlines and maintain a focus on your financial goals: paying down high-cost debt and saving for emergencies.

If the Fed does cut rates, that’s because conditions indeed have worsened.

“From a financial standpoint, this is the time to stabilize your financial situation, while unemployment is low and incomes are high,” says Greg McBride, CFA, Bankrate’s chief financial analyst. “Pay down debt, boost savings and create some breathing room in your monthly budget. Just be financially better prepared for the eventuality of an economic downturn, whenever that might come and whatever the cause may be.”

Learn more:

- Watch for these 6 indicators to know when a recession could be coming

- Nearly half of Americans say Washington politics is the biggest threat to the economy

- Survey: 40% of top economists expect the Fed to cut rates over next year

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Fed lowers interest rates with surprising jumbo half-point cut