8 ways to help rescue the job market from coronavirus-driven unemployment crisis

Repair the economy, and you fix the job market: That’s been the tried-and-true recipe in recessions past for helping jobless Americans find their way back to work.

Not so much for today’s traumatized labor market, when ending the financial pain from the most devastating downturn in a lifetime — which put 1 in 4 U.S. workers out of a job at its worst — means addressing the virus that upended it and the new economic problems it opened up.

“The economy tanks when uncertainty goes up,” says William Spriggs, chief economist at the AFL-CIO. “Normally our economic collapses are from financial collapses. The uncertainty is that somebody messed up on Wall Street. But in this case, it’s the virus that’s creating the uncertainty, and if we do what we normally do, we get these spikes.”

Here’s eight possible areas that could help fix the worst unemployment problem since the Great Depression, driven by the coronavirus pandemic.

1. With schools and day cares closed, child care will be critical

While many schools plan to reopen for in-person instruction in the fall, others have announced plans to continue entirely online or a combination of the two. That’s going to pose a challenge for the nearly one-third of U.S. workers who have a child under 18 at home and an even bigger problem for single parents, individuals who can’t work remotely and others with younger kids. About 15 percent of the labor force belongs to one of those categories, according to an Aug. 2 research note from Goldman Sachs. It also disproportionately affects women and low-wage earners.

A lack of viable options for child care risks keeping workers unemployed for longer. An August Bankrate survey found that 15 percent of Americans would no longer be able to work and 22 percent would have to cut hours at work if schools adopt remote learning. Another near quarter (23 percent) say their career opportunities will be limited.

Even if child care centers reopen, they might not be equipped to handle the crunch. Ravaged by the shutdowns, about 1 in 5 employees in the industry have lost their jobs since August of 2019. Fear of spreading the virus also prevents parents from relying on grandparents or relatives.

Companies that have the means to expand paid leave resources for families will make a big difference, economists say, as will more flexible work arrangements. Larger firms such as Microsoft and Google have already expanded paid family leave opportunities. Meanwhile, school districts able to reopen safely with social-distancing measures while targeting which students can return to school will help alleviate the burden.

“Addressing child care needs is very important,” says Yelena Maleyev, an economist at Grant Thornton. “It doesn’t mean reopening schools at once or making it a ‘teachers, get your own mask’ kind of situation, but really thoughtful and data-based decisions on how to make sure the right groups that are maybe not as impacted by the virus return to school, so the parents can have a little bit more of that freedom to return to work.”

2. For workers afraid of going to work because of the virus, hazard pay could be an added incentive

As Southern states charged forward with reopening in early May, one conundrum became apparent: Some workers were so hesitant about catching the virus at work that they decided not to return at all, especially with a cushion from the supplemental $600 unemployment benefits.

Fear of catching the virus has proven to be a significant damper on the economy. Employers cut roughly 1.4 million positions in March, though states weren’t locked down for most of the month. Maleyev attributes some of that to the slew of cancelled conferences and meetings out of fear of the virus.

“We were already starting to see that pullback before the policy was put in,” she says. “That’s just human behavior because of fear of the contagion, having vulnerable populations being scared of going back to work, which is understandable.”

An antidote to that could be something like hazard pay, she says, or some other type of bonus provided upfront to essential workers when they get back on the job.

Some states, including Vermont and Pennsylvania, have used a pool of money totaling $150 billion set aside for states and local governments through the CARES Act to introduce some form of hazard pay for essential workers. And as both sides of the aisle work toward passing another round of coronavirus relief aid, it could wind up being on the list of provisions. The HEROES Act, passed in May by the House of Representatives, specifically allocated $200 billion in hazard pay for essential workers, though Senate Republicans didn’t include it in their own relief proposals.

“Even giving them a $1,000 check upfront for support to say, ‘Here, you need to go back to work,’ that could help a lot of people,” Maleyev says.

3. Paid leave options could help reduce the spread of the virus

But an extra check isn’t going to get rid of the risk of catching the virus at work. And some individuals who especially need the money will keep going to work, even when they’re sick. Research out of the University of Chicago’s National Opinion Research Center found that only 20 percent of those who reported three or more symptoms stayed home from work, according to a May 4-10 iteration of its Covid Impact Survey.

Economists say guaranteed paid sick leave that allows an individual to take time off while still keeping their job could be important, but it might only be effective if it’s widely available and enforced.

The CARES Act granted at least two weeks of paid sick leave, but those provisions only applied to firms of less than 500 employees, which barely makes up a majority of all U.S. workers. Meanwhile, a joint investigation from the nonprofit Center for Public Integrity and NBC News found that some McDonald’s and Marriott franchises didn’t provide any paid sick leave, among hundreds of other businesses.

“It’s the Titanic for them. The ship is sinking, they’re looking for a lifeboat and they’re desperate, so if they could get a job, they would take it if they could,” Spriggs says. “We have a set of people who are economically desperate, and what we really need to do is make sure they feel safe and therefore don’t work.”

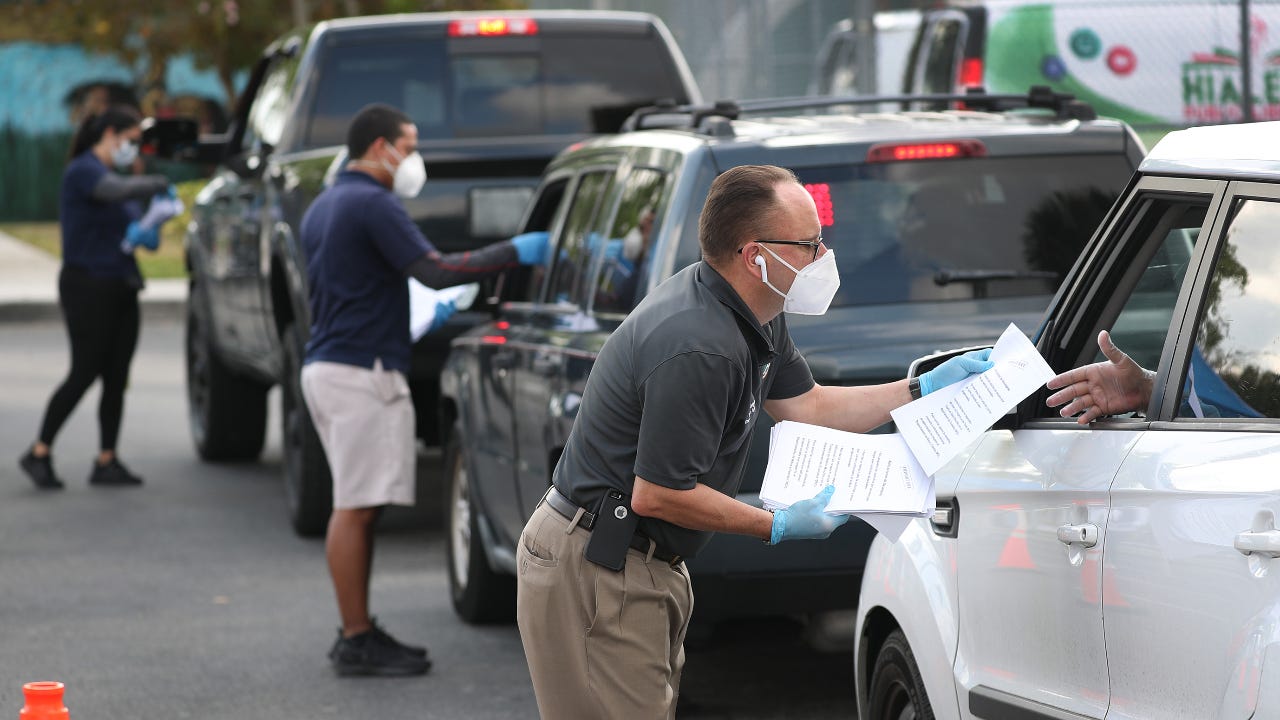

4. Rapid testing and contact tracing that leads to targeted lockdowns

Ample and rapid testing could help reduce consumers’ fears about catching the virus when they go out to dinner or to a movie. That could provide the rebound with more steam to keep businesses afloat. And if a person has tested positive for the virus, being able to identify where that person has gone and who that individual has been in contact with through what’s called “contact tracing” could help contain the spread.

All of that could pave the way for more targeted lockdowns and reopenings, according to research from Daron Acemoglu, a Massachusetts Institute of Technology economics professor. A report his team submitted to the National Bureau for Economic Research found that targeting reopenings by keeping the older, more vulnerable populations at home while letting others who’ve tested negative continue on with their normal life could improve the economic outlook substantially.

“It would allow for certain sections and regions to have more methodical reopenings,” Maleyev says. “For people making these purchasing decisions, it makes them feel a bit better if they know that everyone around them has been tested negatively.”

5. A lower-for-longer Fed policy, though that can only take the U.S. part of the way

The Federal Reserve has been at the center of the firefight to contain the economic carnage, and Chairman Jerome Powell has said that officials aren’t even “thinking about thinking about” raising interest rates.

When it comes to lifting rates again after the coronavirus crisis is in the rearview mirror, officials are going to be more focused on letting the labor market heal than dampening inflation. That means keeping interest rates at rock bottom for longer, which will aid the recovery even more. It gives the economy and the labor market more time to rebound and workers a chance to hop back into the labor market.

A chorus of voices on Capitol Hill, including former Vice President and current Democratic presidential candidate Joe Biden, are also calling on the Fed to target the Black unemployment rate instead of the overall, nationwide unemployment rate. Black unemployment has often been two times as high as white unemployment, even in boom times.

“Those are some ways that the Fed can really track and monitor rising inequality and the difference in how people are experiencing the end of the recession because not everyone is going to be experiencing it,” Maleyev says.

6. Direct payments, additional unemployment benefits

But an aggressive Fed response is only like running a one-legged race. That’s where Congress comes in, which can provide more targeted aid to those who need it.

Some of Congress’ most prevalent responses that have helped keep people employed so far have been the $1,200 (or more) stimulus checks and the Paycheck Protection Program (PPP).

Congress also enacted a $600 weekly boost to unemployment benefits that has helped keep consumers afloat and Americans indirectly employed. But that aid expired at the end of July, while talks to reinstate those benefits appear to be in limbo on Capitol Hill.

It’s going to be detrimental for Americans’ finances, as well as the broader economy, potentially leaving a hole in consumption. Research from JPMorgan Chase found that the extra $600 helped smooth out demand and consumption among households. Spriggs estimates that since the coronavirus crisis started, workers have lost a total of $795 billion in wages.

“This deadweight loss can turn into permanent scarring,” Spriggs says. “The $600 is vital because it’s highly targeted. It’s not going into outer space; we know it’s filling a void.”

7. An effective vaccine would likely be a game-changer

But at the end of the day, reducing unemployment might depend on eradicating the disease that exacerbated it. Yet, most economists say a vaccine will only be effective if enough people take it. Viable medical options could also be a big help.

“You just can’t,” Spriggs says, referring to whether the economy can fully rebound without the virus getting under control. “The reason people are not spending is because they have too much uncertainty about the virus and it’s lowered their activity.”

8. Once the pandemic looks to be behind us, a true ‘stimulus’ package might be needed

Even with a vaccine, the financial pain could still linger. Similar to the New Deal package during the Great Depression, economists have tossed around ideas of ramping up infrastructure spending on roads, highways and buildings that could create jobs once the coronavirus crisis is in the rearview. Others have brought up sending aid to state and local governments that could prevent layoffs within the sector, which makes up about 13 percent of all U.S. nonfarm payrolls.

“On the other side of this, once we’re out of the woods, it’s about looking at stimulus,” Maleyev says.

That could potentially be tricky, with the U.S. federal government already spending trillions of dollars to finance its current coronavirus response. All else equal, the federal deficit in the fiscal year 2020 is likely to balloon to $3.7 trillion and $2.1 trillion in fiscal year 2021, up from $984 billion in 2019, according to Congressional Budget Office forecasts from April. If Congress passes another package, that’s only likely to widen.

Powell, however, has indicated it’s not a concern worth worrying about until down the road.

“It’s been well-spent,” Powell said during a July press conference, referring to the money spent to prop up households and the economy. “It’s kept people in their homes. It’s kept businesses in business, and that’s all a good thing. I think in the broad scheme of things, that there will be a need both for more support from us and from more fiscal policy.”

Learn more:

- 7 ways to help recession-proof your finances

- 13 steps to take if you’ve lost your job due to the coronavirus crisis

- Here’s what to do if you’re still jobless by the time your coronavirus unemployment benefits run out

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.