September Fed Meeting Live Updates: What the Fed’s big half-point cut means for you

Bankrate’s expert staff has a combined 43 years of experience following the U.S. economy, dissecting the Federal Reserve and breaking down what it all means for your wallet. After the Fed’s first interest rate cut since 2020, follow along to see what our team of reporters, writers, editors and financial experts are watching.

Thanks for following our live blog!

9/18/24, 5:05 p.m. ET

By Sarah Foster, principal U.S. economy and Federal Reserve reporter

Thanks for joining us. We hope you enjoyed today’s live blog and learned something new. Shameless plug: We don’t just cover the Fed during high-profile meetings. Rate hike, rate cut or rate pause (the Fed equivalent of “Rain or shine,” if you will), you can count on our content for insights on how the world’s most powerful central bank could impact your finances.

The Federal Reserve and your money

Get insights from Bankrate experts on the Federal Reserve’s first rate cut since 2020 and its impact on your financial goals.

Learn more9/18/24, 4:55 p.m. ET

By Sarah Foster, principal U.S. economy and Federal Reserve reporter

The Fed learned their lesson and took out insurance against falling behind the curve again by cutting interest rates by half a percentage point right out of the gate.— Greg McBride, CFA, Bankrate chief financial analyst

Even after sending a strong signal that rates should be coming down through 2025, Federal Reserve officials will continue to depend on incoming economic data. Powell sought to caution against making assumptions about the future pace of rate cuts just because they had a ‘strong start’ with a reduction of one-half of 1%.— Mark Hamrick, Bankrate Senior Economic Analyst

The most significant aspect of today's Fed meeting is that the FOMC's median expectation is for another half-point of cuts this year, a full point next year and a half-point in 2026. The cumulative effect will bring borrowing costs down significantly.— Ted Rossman, Bankrate Senior Credit Card Analyst

We all wondered where the labor market-focused Fed went the past few years as it fought inflation with rapid rate hikes, and the Fed’s latest decision reveals that it never left. We compare this period a lot to the Fed in the 1980s, but this is a very different U.S. central bank that we have today. Officials don’t want to harm the economy, and notably, they don’t believe they have to, to get the inflation job done.— Sarah Foster, Bankrate Economic Analyst

9/18/2024, 4:50 p.m. ET

By Andrew Dehan, writer, home lending

Now that the Fed has decided to cut its federal funds rate, the majority of our rate watchers predict mortgage rates to stay flat over the next week.

9/18/2024, 4:50 p.m. ET

By Jeff Ostrowski, principal writer, home lending

Mortgage rates fell again this week, with the 30-year fixed rate falling to 6.20 percent, according to Bankrate’s latest lender survey. The benchmark mortgage hasn’t been this low since September 2022, and forecasters say the downward trend could continue — at its meeting this week, the Federal Reserve announced a larger-than-expected rate cut, its first since the pandemic.

“It was a coin flip on whether it was going to be 25 or 50 basis points,” says Bill Banfield, chief business officer at Rocket Companies. “They gave us a little extra.”

Noteworthy: Bankrate’s numbers were collected before the Fed announced its cut. Rates have fallen all the way from 8.01 percent in October 2023 to 6.20 percent now.

Are personal loans a good option in a falling-rate environment?

9/18/2024, 4:40 p.m. ET

By Lauren Nowacki, senior loans writer

When rates go down, it can be less expensive to borrow. That could make it a good time to finance a big purchase, consolidate debt or complete a home improvement project using a personal loan.

Since personal loan rates are fixed, locking in when rates are low can ensure your interest stays low throughout the life of the loan despite market movements in the future. Even with falling rates, personal loans have higher interest rates than other financing options and may not be the right choice for all borrowers.

To get more affordable personal loan rates, borrowers should compare offers from multiple lenders for the best deal, strengthen their credit score and borrow the least amount of money for the shortest amount of time possible.

How lower rates from the Fed impact bond investors

9/18/2024, 4:30 p.m. ET

By Logan Moore, investing writer

After a challenging few years for long-term bondholders, a lower interest rate environment may finally offer the potential for gains. The Federal Reserve’s recent 50-basis-point rate cut could push long-term bond prices higher after a period of declining values.

While falling rates bring some opportunities for investors, it’s essential to maintain a diversified portfolio. Here’s what bond investors should know about how the Fed’s rate cut and how it impacts their portfolios.

9/18/2024, 4:20 p.m. ET

By Jim Royal, principal writer, investing and wealth management

-

The S&P 500 closed down about 0.3 percent, and the Nasdaq performed similarly.

-

Both indexes were unable to maintain their mid-afternoon gains in the hour following the Fed’s announcement that it was cutting rates.

-

It’s wise not to read too much into a couple hours of trading after one of the most anticipated Fed meetings in years and especially after stocks had a strong run in the last few weeks. We’ll watch how stocks trade in the coming days to get a more balanced view of what the market thinks.

9/18/2024, 4:15 p.m. ET

By Michele Petry, senior editor, home lending

Many prospective homebuyers have been sitting on the sidelines for a while now, waiting out the market and hoping for a significant drop in either home prices or mortgage rates. While home prices remain sky-high, the Fed’s rate cut has market-watchers eagerly awaiting its impact on mortgage rates. But how much can a single cut really help the affordability crunch? Is now a good time to buy, or is it better to keep waiting in the hopes of more dramatic change down the line?

What Does a Rate Cut Mean for Homebuyers?

Greg McBride, CFA, speaks with CNN’s Rahel Solomon

Watch the video9/18/2024, 4:00 p.m. ET

By Linda Bell, senior writer, home lending

The Federal Reserve’s half-point rate cut is welcome news for your home equity line of credit (HELOC) or new home equity loan.

Your HELOC’s fluctuating interest rate should fall, making your monthly payments easier to manage. And if you’re thinking of taking out a home equity loan, its fixed rate probably will be lower now, too.

But still, a larger question remains: Is now really the right time to tap into your housing wealth?

Credit cards scammers are excited for the rate drop, too

9/18/2024, 3:40 p.m. ET

By Ana Staples, lead writer, credit cards

Rate cuts mean lower interest rates on various types of loans. This presents an opportunity for folks to lighten their debt burdens — and for scammers to take advantage of the situation.

Riding the wave of the consumer’s excitement, scammers might come up with all kinds of appealing offers. They’ll tell you they can lower your interest rates on your mortgage or your credit cards. They’ll promise you a way to reduce your student loan debt. All you need to do is to provide your credit card information.

-

Expect to be scammed at all times. The sad truth is there’s always a chance someone out there is targeting you (and your financial information). Stay vigilant.

-

Pause before you click any links. Is that email really from your bank? Is the offer a little too good to be true? Perhaps it’s safer not to find out.

-

Go to the source directly. If you want to learn more about an offer, verify it directly with the lender or servicer. For instance, if a company promises to lower your credit card bill, call your card issuer. If someone claims they can reduce your student loan debt, get in touch with your loan servicer.

-

Be wary of high-pressure tactics. When someone is telling you to act fast, making big promises or catastrophizing the consequences of your inaction, they’re trying to engage you on an emotional level. Meaning, they don’t want you to think logically. That’s never a good sign.

9/18/2024, 3:30 p.m. ET

By Sarah Foster, principal U.S. economy and Federal Reserve reporter

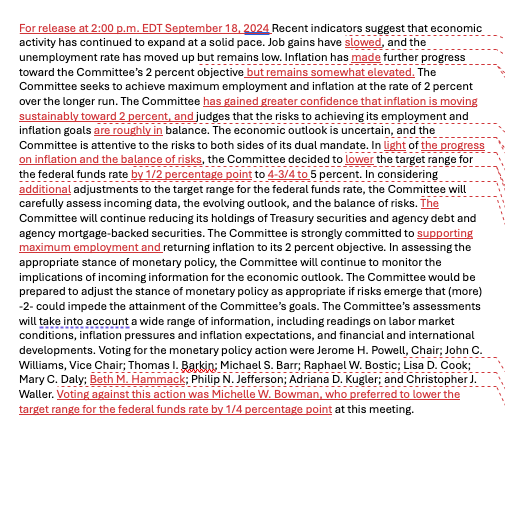

Fed officials release a post-meeting statement with every decision, providing color to their announcement. One of my favorite things to do as soon as the Fed releases it, is compare it to the prior meeting’s version. Sometimes, changes are immaterial and a snooze. Other times, there are big revisions.

The Fed’s September meeting was one of those instances.

-

The Fed now says job gains have “slowed” (last meeting, the word was “moderated”)

-

Fed officials added a new sentence: the FOMC has “gained greater confidence that inflation is moving sustainability toward 2 percent” (as a refresher, that’s their official target)

-

The Fed cut interest rates by half a percentage point “in light of the progress on inflation and the balance of risks”

If you want to peer behind the curtain even more, here’s what changed:

9/18/2024, 3:15 p.m. ET

By Sarah Foster, principal U.S. economy and Federal Reserve reporter

-

“The U.S. economy is in a good place, and our decision today is designed to keep it there.”

-

“Our patient approach over the past year has paid dividends.” (Powell is talking here about the progress they’ve seen on inflation).

-

“Anything in the low 4s is a really good labor market.” (He means the unemployment rate).

-

“I do not think anyone should look at this and think, ‘Oh, this is the new pace.’” (Powell is referring to the size of the Fed’s rate cut this time).

9/18/2024, 3:05 p.m. ET

By Jim Royal, principal writer on investing and wealth management

-

Investors are cheering lower interest rates, since they help support businesses and boost stock prices.

-

Potential borrowers also benefit from lower rates. Mortgage rates have been falling for months now, too.

-

Those with variable-rate debts such as credit cards and HELOCs should see a quick drop in their rates.

-

Savings accounts and CDs, however, will price in lower rates. And with more cuts expected, banks should continue to pay less interest over the coming year.

Historically, half-point cuts have been a big deal

9/18/24, 2:55 p.m. ET

By Sarah Foster, principal U.S. economy and Federal Reserve reporter

I want to dwell here on the size of the Fed’s rate cut: half a percentage point. The Fed has kicked off a rate-cutting regime with a larger half-point rate cut before — but in those instances, the U.S. economy was clearly facing a downturn. They did it in the early recession of the 1990s, the dotcom bust in the early 2000s, the Great Recession and then the coronavirus pandemic. All other times, they’ve opted for 25 basis point reductions as their first move.

That’s not to say that we’re in a recession (growth has still been surprising to the upside). Rather, a half-point cut is the Fed’s “commitment not to get behind,” Powell said.

To consumers, though, the larger cut does little to change the borrowing environment. Interest rates are now back to 2023 levels. Before that, borrowing costs hadn’t topped their new level for over a decade.

9/18/2024, 2:50 p.m. ET

By Greg McBride, CFA, Bankrate chief financial analyst

An interest rate cut isn’t about pressing the gas and adding fuel to the economy, but rather lifting the foot off the brake so interest rates aren’t as high and are less of a headwind on the economy.— Greg McBride, CFA, Bankrate chief financial analyst

9/18/2024, 2:45 p.m. ET

By James Royal, principal writer, investing and wealth management

-

Major indexes including the S&P 500 and the Nasdaq jumped immediately following the Fed’s rate cut.

-

After an initial jump, these stock indexes have continued to hold most or all of their gains, though often the market does a “headfake” after Fed news.

-

A strong finish to the day would look great, and I’m looking for a strong follow-up tomorrow to gauge whether stocks may continue to rise in the near future, especially after the market’s last few weeks have already been strong.

9/18/2024, 2:40 p.m. ET

By Sarah Foster, principal U.S. economy and Federal Reserve reporter

The Fed’s rate cut ushers in a new era for monetary policy and the consumers who plan their finances around it. If you’re wondering what a rate cut means for your finances, here are some steps experts recommend. Spoiler alert, though: A lot of it’s similar to when rates were still at their peak. One interest rate cut, after all, is only taking borrowing costs back to levels last seen in 2023.

-

Keep chipping away at high-interest rate debt: Credit card rates are hovering around 21%. For that to change, it’s going to take a lot of rate cuts — and some the Fed might not yet be ready to pencil in.

-

Shop around for the most competitive borrowing rates: Lower interest rates subsequently mean lower borrowing costs on everything from a credit card to an auto loan. Some lenders might be more inclined to offer better deals than others to lure new customers. Financial experts typically recommend comparing offers from at least three lenders before locking in a loan.

-

Watch out for the right time to refinance: After peaking at about 8% last October, mortgage rates had already dipped 1.7 percentage point before the Fed had even touched interest rates. If you locked in a mortgage when rates were at their peak, the refinance window has swung wide open.

-

Think twice about big-ticket purchases, but you can’t always time the market: It might pay to wait on a big-ticket purchase. But if the car you rely on to get to work breaks down or the dishwasher breaks, rates might not fall low enough to make waiting worth it.

-

Work on boosting your credit score: Your credit score can impact you even more than the U.S. central bank itself. Lenders often reserve their best rate for the so-called “safest” borrowers: those with good-to-excellent credit scores and a reliable credit profile.

9/18/2024, 2:30 p.m. ET

By Sarah Foster, principal U.S. economy and Federal Reserve reporter

Most consumers are probably paying attention to how much the Fed cut interest rates in September. But officials also released a quarterly update on where they see unemployment, inflation and — perhaps most important — interest rates heading, all the way through 2027. It’s called the “Summary of Economic Projections.”

Here’s what to know from officials’ estimates. Just keep in mind: The future rarely evolves as Fed officials expect, so these projections may change. And as you look through these estimates, remember that interest rates are now in a target range of 4.75-5%, the unemployment rate is 4.2% and inflation (at least by the Fed’s preferred measure) is 2.5%.

-

Interest rates by the end of 2024: 4.25-4.5%

- End of 2025: 3.25-3.5%

- End of 2026: 2.75-3%

- End of 2027: 2.75-3%

-

Unemployment by the end of 2024: 4.4%

- End of 2025: 4.4%

- End of 2026: 4.3%

- End of 2027: 4.2%

-

Inflation by the end of 2024: 2.3%

- End of 2025: 2.1%

- End of 2026: 2%

- End of 2027: 2%

9/18/2024, 2:00 p.m. ET

By Sarah Foster, principal U.S. economy and Federal Reserve reporter

And just like that, we have our decision.

-

The rate cut: Half a percentage point (50 basis points)

-

The new target range: 4.75-5 percent

-

Dissents: One (Fed Governor Michelle Bowman, who preferred a smaller, quarter-point cut)

9/18/2024, 01:58 p.m. ET

By Mark Hamrick, senior economic analyst

Journalists are gathering for the news conference being held by Chair Jerome Powell. Some are out of the room in the so-called lock-up area where they get the announcement. The rest of us are waiting for the official release here where the news conference begins a-half hour later. It is well attended because of the high interest in this eagerly awaited decision.

9/18/2024, 01:35 p.m. ET

By Jim Royal, principal writer on investing and wealth management

-

Investors are poised for the Fed’s announcement, and stocks are stuck in a narrow trading range for the first half of the day.

-

FedWatch currently projects a 61% chance of the Fed lowering by 50 basis points, with a 39% chance of a cut of 25 basis points.

-

With only minutes to go before the announcement, the market is waiting tensely for the official change.

9/18/2024, 01:35 p.m. ET

By Jeff Ostrowski, principal writer, home lending

Mortgage rates have dropped dramatically without the Federal Reserve changing its benchmark rate a single basis point. At 6.31% last week, the benchmark 30-year loan is at its lowest since February 2023, according to Bankrate’s national survey of lenders.

It’s a strong reminder that the Fed doesn’t control mortgage rates. Stll, this shift presents an opportunity for homeowners to consider refinancing, replacing their mortgage with a cheaper one – especially if they happened to lock in their rate a year ago, when rates peaked at 8 percent.

It’s important to earn an APY that beats inflation

9/18/2024, 01:30 p.m. ET

By Karen Bennett, senior banking reporter

-

Top high-yield savings account rate: 5.30% APY

-

Rate of inflation: 2.5%

You can still find high-yield savings accounts with APYs above 5 percent, while inflation has come down to 2.5 percent. Even if savings yields come down as a result of Fed rate cuts, chances are you’ll still be able to earn a rate that beats inflation.

9/18/2024, 01:15 p.m. ET

By Troy Segal, senior editor, home lending

When the Fed changes the federal funds rate, it impacts all sorts of loans, including HELOCs (home equity lines of credit). The fluctuating interest they charge moves in tandem with that benchmark rate – so basically, your monthly HELOC payment will bounce too. Here’s more on how the Federal Reserve affects HELOCs and home equity loans (the HELOC’s fixed-rate cousin) and why, if you plan on getting one of these loans, you should keep an eye on how their rates react following a Fed meeting.

9/18/2024, 01:00 p.m. ET

By Mark Hamrick, senior economic analyst

I’ve attended the Federal Reserve Chair’s news conferences since they began in 2011 (that’s a long time ago!). This one should be well attended since it coincides with a historic shift in policy. There will be a lot of questions. I have a list.

At Bankrate, our commitment is to help people attain their financial goals and to better understand the complexities of the economy and personal finances. My goal is to ask a question that will help our audience navigate these issues and to succeed.

I’m thinking: What do people need to know that Chairman Powell isn’t addressing? He and his colleagues have a strategy for what they want to say. It is our job to ask questions on your behalf.

9/18/2024, 12:45 p.m. ET

By India Davis, editor, credit cards

Like most Americans in 2024, I have more credit card debt than I ever planned. I recently got the opportunity to purchase my first house. Amazing! Though it’s much more expensive than I anticipated, clearing out most of my savings. Unfortunately, life likes surprises, and a few months later, I needed to purchase a new car. I did my best to ensure both large purchases were affordable, but high interest rates undoubtedly stretched my budget. Because of this, my credit card debt, which was once manageable, stopped being the focus and is now an issue.

So, the Fed cutting interest rates is exciting, but I’m not getting my hopes too high yet. More than likely, rates will go down by a quarter or maybe half a point and cause a minimal change to my current payments. However, when I refinance later, any rate cut will make a measurable difference when combined with my good credit score. This cut may also be the start of a trend of rate cuts. We can all hope for pre-pandemic rates, right?

But future cuts are all speculation. For now, I’ll be taking steps to lower my debt with an eye on the bigger picture, including possible financial opportunities

-

Restarting my budget: My previous budget did not include my new bills, and not having a full view of my expenses is only increasing my debt. If I know where my money is going, I’ll know how to manage it properly.

-

Consolidating my debt: I’m combining my debts wherever I can to simplify and de-stress paying them. This will possibly include a balance transfer card, so I can use one card to track how much I need to pay off.

-

Being patient: I’m used to making on-the-fly decisions, so this will be the hardest step for me, but it’s also the most important. Taking my time not only gives the Fed time to lower rates more (fingers crossed!), but it also helps refine my goals, keep my credit score in a good position and allows me to start building my savings again.

Pros and cons of a balance transfer

Is a balance transfer right for you? Consider the pros and cons of balance transfers before committing to a new card.

Read more9/18/2024, 12:30 p.m. ET

By Michele Petry, senior editor, home lending

With a rate cut on the horizon, many hopeful homebuyers may be thinking, finally! After such a long stretch of waiting, a cut might seem like a magic bullet to make home purchases more affordable again. But the impact of a single rate cut on the housing market may actually be minimal — and in fact, rates have already come down in anticipation of this meeting’s cut.

When will car interest rates drop?

9/18/2024, 12:15 p.m. ET

By Lauren Nowacki, senior loans writer

Those waiting for auto loan interest rates to drop might celebrate a Fed rate cut, but a decrease in the benchmark rate may not have the expected impact. Other factors also drive rates, such as bond yields, yield spread and the borrower’s credit score.

Besides that, interest rates aren’t the only barriers to buying a car. Vehicle prices have increased exponentially over the last few years, making it harder to afford a new ride, even if interest rates decline.

To get the best auto deal, borrowers should shop around and consider other ways to save, like buying a fuel-efficient car or cashing in on EV incentives by driving electric. One of the best moves to make is strengthening your credit. The better your score, the better the terms – no matter what rates are doing.

9/18/2024, 12:00 p.m. ET

By Greg McBride, CFA, chief financial analyst

Greg McBride, CFA, joins Schwab Network’s “Futures”

As the Fed embarks on a rate cut cycle, it's important to remember that today's move is only the beginning, says @BankrateGreg.

🎥 McBride shares his expectations for today's Fed decision and how it may impact the economy with @FuturesBenL: https://t.co/plhEdrkHRs

— Schwab Network (@SchwabNetwork) September 18, 2024

9/18/2024, 11:45 a.m. ET

By Karen Bennett, senior banking reporter

Market watchers anticipate the Fed will cut rates today, and such a move could result in many banks lowering their yields on savings accounts and certificates of deposit (CDs). It’s impossible to predict how soon banks would react to a rate cut — or by how much they’d lower their rates — although the fact is yields on competitive deposit accounts remain historically high at this time.

Locking in an annual percentage yield (APY) now on a fixed-rate CD ensures you’ll earn that same APY until the CD matures, even if the bank starts to lower the going rates on its new CDs. This can be a real boon for savers in a falling-rate environment.

5 CDs to consider before a rate cut

By locking in a high rate now, you’ll continue to earn that APY throughout the CD’s term, even if your bank starts to lower the yields on new CDs it issues.

Learn moreHow the Fed impacts student loans

9/18/2024, 11:30 a.m. ET

By Lauren Nowacki, senior loans writer

Though the Fed may be changing rates, current borrowers with federal student loans won’t be impacted. However, if you have private student loans or you plan to borrow in the future, you may be impacted.

Like many types of loans, student loans come with an interest rate that can be affected by the Federal Reserve (the Fed)’s key rate. If you have a variable-rate loan, your payment and overall cost of the loan could go up when the Fed raises rates. On the other hand, you could save money when rates go down.

-

If you already have federal student loans, those have a fixed rate and will not change.

-

If you already have private student loans with a fixed rate, your interest rate will not change.

-

If your private loans have a variable rate, your rate could change with the Fed’s decision.

-

If you’re taking out a new student loan – whether private or federal, fixed or variable – your interest rate may be lower than it would have been previously, depending on the current benchmark rate set by the Fed.

If a rate change affects your loans, you may consider refinancing to get a new interest rate and repayment terms, but make sure it makes sense for your situation. If you have a variable rate or plan on getting student loans soon, you’ll want to keep an eye on rate changes to create the best plan for your future.

9/18/2024, 11:15 a.m. ET

By Troy Segal, senior editor on home lending

Well — it’s complicated. The Federal Reserve doesn’t directly set mortgage rates. In fact, fixed-rate mortgages don’t even mirror the Fed’s moves — at least not as directly as other consumer loans do. Still, the central bank’s changes in interest rates do ultimately impact how much borrowing to buy that dream house will cost you.

How is the U.S. economy doing?

9/18/2024, 10:51 a.m. ET

By Sarah Foster, principal U.S. economy and Federal Reserve reporter

Federal Open Market Committee (FOMC) meetings — the official rate-setting gatherings that lead to announcements like these — are a two-day event. According to the former Fed officials who I’ve talked to over the years, the first day is majorly reserved for what U.S. central bankers like to call an economic “go-round.” The name pays homage to how Fed governors and regional Fed bank presidents literally go around the room and discuss how they currently view economic and financial conditions. This rundown tees up the rate debate, which is probably happening right now, as you’re reading this.

Overall, Fed officials are likely characterizing the current economy as slowing but not cracking.

-

The unemployment rate: 4.2% (August), highest since 2021 but down from 4.3% in July

-

Jobs created: 142,000 (August), up from 89,000 in July

- Three-month moving average: 116,000, down from 267,000 six months ago

-

Inflation (Consumer price index, or CPI): up 2.5% from a year ago (August)

-

CPI, excluding food and energy: 3.2%

-

The Fed’s preferred inflation gauge, the personal consumption expenditures (PCE) index: 2.5%

-

PCE, excluding food and energy: 2.6%

-

Retail sales, the engine of the U.S. economy: up 2% from a year ago (August)

-

Gross domestic product (GDP), the biggest scorecard for U.S. economic growth: 3% (Q2 2024), 3% (Estimates for Q3 2024 from Atlanta Fed)

While the headline for today’s expected interest rate cut will inevitably focus on whether it is one-quarter or one-half of 1% (aka 25 or 50 basis points), the future trajectory of the federal funds rate as well as the FOMC’s forecasts on the possible endpoint are more meaningful. The place to find those forecasts is the so-called Summary of Economic Projections, including the famous graph called 'The Dot Plot.'— Mark Hamrick, senior economic analyst

What the Fed’s meeting means for credit cards, those with credit card debt

9/18/2024, 10:30 a.m. ET

By Ted Rossman, credit card senior industry analyst

Credit card rates are near record highs and will remain elevated for quite some time

Credit card rates are so high that a quarter-point cut here or a half-point cut there won’t make much difference. The average credit card charges 20.78 percent, just shy of a record set last month. If you make minimum payments toward the average credit card balance ($6,329, according to TransUnion) at 20.78 percent, you’ll be in debt for about 18 years and will owe roughly $9,500 in interest. A quarter-point cut trims that total interest expense by $122 and a half-point lowers it by $244. On a monthly basis, the savings are less than a single cup of coffee.

The Fed is expected to cut rates several times in the months and years to come, and a sustained rate-cutting campaign will bring some relief to credit card borrowers – but it still won’t change all that much. Even if the average credit card rate fell 3 percentage points (a process that could easily take a year or more), the minimum payment math would still be pretty brutal. Making minimum payments toward a debt of $6,329 at 17.78 percent would take more than 17 years to pay off, and it would incur over $8,000 in interest charges.

The best way to use a credit card is to pay in full every month, enabling you to avoid interest and allowing you to take full advantage of rewards programs and other perks. Half of all credit cardholders carry debt from month to month. If you’re among them, don’t be ashamed. Take action. My favorite tip is to sign up for a credit card with a generous 0 percent balance transfer promotion. Some of these deals last as long as 21 months. Working with a reputable nonprofit credit counseling agency is another good option. Or you could take on a side hustle, sell stuff you don’t need or cut your expenses. Whatever you do, do something. Credit card debt isn’t going to go away on its own. It’s probably your highest-cost debt by a wide margin and Fed rate cuts aren’t going to change that.

9/18/2024, 10:15 a.m. ET

By Sarah Foster, principal U.S. economy and Federal Reserve reporter

Bankrate’s Sarah Foster breaks down what’s most important for borrowers and savers surrounding the Fed’s first interest rate cut since 2020.

@accidental.economist Me: Can’t sleep because I don’t know whether the Fed is going to cut by 50 basis points or 25 basis points. Jerome Powell: That’s that me, espresso #federalreserve #personalfinancetips ♬ original sound – Sarah Foster

9/18/2024, 10 a.m. ET

By Andrew Dehan, writer, home lending

Buying a house now is a difficult task for many due to high prices and elevated mortgage rates. Home prices took off during the COVID-19 pandemic and have continued to do so, reaching record highs. At the same time, to combat inflation in the market, the Fed began raising rates — that string of rate hikes was reflected in mortgage rates, putting a home purchase further out of reach for many.

Now that the Fed is poised to start cutting rates, what will happen to the housing market? Are we in for another climb, or a fall that will put our hearts in our throats? (Or, hopefully, somewhere in between?) Here’s what the experts have to say about whether Fed rate cuts will stop the housing market roller coaster:

What *actually* happens when the Fed cuts interest rates

9/18/2024, 9:45 a.m. ET

By: Sarah Foster, principal U.S. economy and Federal Reserve reporter

The Fed’s work is mind-bendingly complex. Even so, it has a more direct line to your wallet than maybe any other policymaker in Washington, D.C., making it important for consumers to keep an eye on.

When the Fed changes interest rates, though, it’s not as if it goes out to every lender in the U.S. economy and dictates how much they’re allowed to charge someone to borrow money. To put simply, the Fed controls a key benchmark interest rate that acts as a lever for pretty much every other financing cost consumers pay (albeit, mortgages, a little more indirectly), from credit cards and auto loans to personal loans and home equity lines of credit.

-

When the Fed’s interest rate falls, so, too, do borrowing costs. Interest rates you can get for new loans will drop relatively immediately. Meanwhile, if you already have debt with a variable interest rate, you might see a difference reflected within one-to-two billing cycles. Fixed-rate borrowers won’t feel an impact.

-

Yields on savings accounts and CDs also mimic the Fed’s rate. They’ve already been falling in anticipation of rate cuts, and they’re poised to drop further once the Fed signals that this rate cut is the first in a series of more cuts.

-

The Fed has a major influence on your purchasing power and job security. High rates weigh on inflation. Americans may decide to delay a purchase or investment that requires financing, weighing on consumer spending. But it’s a blunt tool: High interest rates can also lead to joblessness if the economy slows too much. Without a paycheck, consumers have the least amount of buying power at all. The cycle repeats.

6 ways the Fed impacts you

The Federal Reserve influences almost every financial decision you make, from buying a home or car to looking for a new job.

Learn moreInterest rate cut supports stocks and investors

9/18/2024, 9:35 a.m. ET

By Jim Royal, principal writer on investing and wealth management

-

The Fed’s rate cut helps support stocks, which have already been notably strong performers in the weeks leading up to the decision.

-

A lower interest rate makes stocks look like a more attractive investment.

-

The rate cut makes it cheaper for business and individuals to borrow, stimulating economic activity

-

With the cut, investors are shifting to a mentality of increased liquidity, as this Fed move should be the first of several (many?) cuts over the coming year or more.

9/18/2024, 9:20 a.m. ET

By: Ted Rossman, senior industry analyst, credit cards

Senior Industry Analyst Ted Rossman joins NYSE-TV

9/18/2024, 9:00 a.m. ET

By: Sarah Foster, principal U.S. economy and Federal Reserve reporter

I’ve been covering the Fed since 2018, and I’ve witnessed a lot of exciting moments. My first assignment was reporting on the Trump administration’s attempts to jawbone U.S. central bankers into cutting interest rates. In 2019, I covered the Fed’s three “insurance” rate cuts after it humbly declared that it had made a mistake and didn’t need to raise interest rates as much as it thought it did post-financial crisis. Oh, and then there was 2020 and the Fed’s go-big-or-go-home efforts to rescue the economy from the devastating coronavirus pandemic.

Yet, none of those events have measured up to how exhilarating it’s felt covering the Fed’s forceful post-pandemic inflation fight. There have been many surprises, a rarity on the Fed beat. Fed watchers will never forget where they were in June 2022, when the Fed pivoted at the last second to raise interest rates by three-quarters of a point, rather than half a point. After all of that, my colleagues and I at Bankrate feel the Fed’s September meeting is going to be the most exciting one in years. The start of new eras (in this case, rate cuts) are always that way. Just ask Taylor Swift.

For the everyday consumers we’re trying to help at Bankrate, the first cut is the least consequential. What matters most is how much, and how quickly, the Fed cuts rates.

-

Will the Fed cut by a quarter of a percentage point or half a percentage point? Hello uncertainty, my old friend! Whichever way the Fed leans, the takeaways for consumers will remain the same: pay off high-interest debt and keep an eye on refinance opportunities. Borrowing costs are still going to be high. Yet, the path the Fed takes will tell us a lot about how worried they may be about the slowdown in the job market we’ve seen so far this year.

-

How much does the Fed expect to cut interest rates this year? Alongside today’s rate decision, Fed officials are going to reveal how much they’re expecting to cut rates throughout the rest of 2024, as well as in 2025, 2026 and 2027. The further out you go, though, the greater the margin of error.

-

When do officials think inflation will hit their 2% target? The Fed is also going to release new economic projections. Last update, they penciled in high inflation until at least 2026. Has that changed at all?

-

Do officials expect a broader economic slowdown? Unemployment has risen faster than the Fed thought it would. Could rate cuts help, or should consumers brace for an even slower job market?

-

Will there be any dissents? The choice between a 25 basis point cut and a 50 basis point cut is bound to be a close call, experts have been telling me this week. Dissents under Fed Chair Jerome Powell’s tenure are rare, but it’ll be interesting to see whether officials were divided.

Get ready for the Fed’s September meeting

The Fed is poised to cut interest rates. Here’s what to watch.

Learn moreWhy we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.