Fed Meeting Live Updates: What comes next for the Fed’s rate cut plans?

Since its inception in 1976, Bankrate has been the top source for information on interest rates and the Federal Reserve. With the Fed expected to cut its key borrowing benchmark for the second consecutive meeting, follow along to see what our expert staff of reporters, writers, editors and financial analysts are watching.

11/7/2024, 5:00 PM EST

Thanks for following our live blog

Bankrate is here to help you make sense of one of the most complicated financial institutions in the world.

Read more of Bankrate’s Fed coverage

The Fed impacts almost every financial decision you make, big or small.

Follow along

11/7/2024, 4:50 PM EST

Some closing thoughts from Bankrate’s Fed watchers

Federal Reserve Chair Jerome Powell emphasized that both the economy and their monetary policy stance are in a good place. The economy is performing well enough that nothing is compelling them to act aggressively in cutting interest rates. Despite the solid economic performance, the Fed cut interest rates again because rates are still at restrictive levels – something that could weigh on the economy if left in place.— Greg McBride, CFA, Bankrate chief financial analyst

Pressed on the future direction of interest rates, including the timing of further rate cuts, Chairman Jerome Powell told reporters that the central bank doesn’t want to provide specific forward guidance. Translated: That means he and his colleagues want to keep their options open.— Mark Hamrick, Bankrate senior economic analyst

The biggest takeaway for consumers is that interest rates are still high. A quarter-point drop isn't going to lower the cost of buying a car or financing your holiday shopping by very much. Rates are going to be slow to come down, so take matters into your own hands to reduce the cost of your debt (for example, by signing up for a credit card with a generous 0% balance transfer term).— Ted Rossman, senior industry analyst

It feels like the Fed is standing at a crossroads, feeling uncertain about which path it should take. Beyond election-related uncertainties, Powell didn’t rule out the December rate cut that officials had penciled in back in September, but he didn’t say it’s a done deal either. There are still two risks here: Cutting borrowing costs too fast and triggering more inflation, and cutting interest rates too slowly and harming the labor market.— Sarah Foster, principal U.S. economy reporter

11/7/2024, 4:47 PM EST

How lower rates from the Fed impact bond investors

While falling rates bring some opportunities for investors, it’s essential to maintain a diversified portfolio. Here’s what bond investors should know about how the Fed’s rate cut and how it impacts their portfolios.

11/7/2024, 4:45 PM EST

Stocks end the day roughly where they began

Stocks largely remained unchanged at market close on Thursday after the Fed announced a 25-basis-point interest rate cut.

The Dow Jones Industrial Average dropped ever so slightly, while the S&P 500 ended the session up 0.74% and the Nasdaq Composite gained 1.51%.

Treasury yields finished lower, with the 10-year Treasury yielding around 4.33%.

Bitcoin held steady in the late afternoon near $76,300.

The U.S. dollar index (DXY) fell 0.71%.

Earlier today, Fed Chair Jerome Powell noted it’s too soon to say what 2025 has in store, including how President-elect Donald Trump’s administration will shape economic policy and the broader market. One thing is clear, though: Investors seem to be enjoying the rally.

11/7/2024, 3:45 PM EST

Some key takeaways from the Fed’s post-meeting press conference

That might’ve been the shortest post-meeting press conference in a while (only 42 minutes).

Here are the key Powell quotes that stood out to me:

- On the election results: “It’s possible that any administration’s policies or policies put in place by Congress could have economic effects over time that would matter for our pursuit of our dual mandate goals,” Powell said. He later added that there’s nothing to model right now because they don’t know what the next administration’s policies will officially be. “In the near term, the election will have no effects on our policy decisions. … We don’t guess, we don’t speculate, and we don’t assume.”

- Fed independence: When asked if he would resign if the president-elect asked him to, Powell said one word: “No.”

- Inflation: When asked why officials removed language from the statement that referenced how the committee had “gained greater confidence” that inflation is on a path back to 2 percent, Powell said it wasn’t meant to send a signal that officials were no longer confident. Rather, officials removed it to acknowledge uncertainty about the pace of future rate cuts.

- Path for December: Will they cut or will they hold? Powell said some of the downside risks facing the economy have “diminished” since the Fed’s September meeting, while later adding: “We’re going to be looking at the incoming data and how that affects the outlook.” Powell, though, stopped short of ruling whether a cut was “out or in.”

- Path for 2025: “There’s a fair amount of uncertainty. … The path that we’re on, we do know where the destination is, but we don’t know the right pace and we don’t know exactly where the destination is. The point is to find the right pace, the right destination as we go.” The CEOs Powell talks to, meanwhile, tell him that they expect “next year could be even stronger.”

11/7/2024, 3:30 PM EST

Mortgage rates to keep rising in the near term

Mortgage rates should trend upward in the next week despite a Fed cut, according to rate watchers polled by Bankrate.

“Bond yields are making another leg up and mortgage rates will too,” says Greg McBride, CFA, chief financial analyst for Bankrate.

11/7/2024, 3:25 PM EST

Powell’s message to the President-elect: I’m not leaving early and can’t be fired

Chairman Jerome Powell told reporters that he intends to serve the remainder of his term even if President-elect Donald Trump doesn’t want him to continue in the post. Powell, who was initially nominated to the top post by Trump in his first term, said that the law doesn’t allow him to be fired by the president and he has no intention of leaving early. Powell’s term expires in mid-2026.

11/7/2024, 3:05 PM EST

Bankrate’s Greg McBride, CFA, reacts to the Fed’s rate decision

The Federal Reserve continues to lift the foot off the brake pedal, cutting interest rates by one-quarter percentage point, as expected. The solid pace of economic growth means the Fed can abandon the urgency seen with the half-point cut in September and take a more deliberate, quarter-point pace with this and future rate cuts.— Greg McBride, CFA, Bankrate chief financial analyst

11/7/2024, 3:04 PM EST

Impact of Fed rate cuts on personal loans

Don’t expect rates to fall immediately with two consecutive cuts

Fed rate shifts don’t impact personal loan rates as dramatically or directly as other forms of debt. In fact, personal loan rates held steady at 12.43 percent for most of October — up from 12.35 percent at the start of September — and have only just started to tick down.

While we have started to see a very small drop to 12.38 percent as of Nov. 6, this second rate drop isn’t likely to move the needle very far. Overall economic health has more of an influence on personal loan rates than moves made by the Fed. And those most likely to benefit first from rate drops are those with excellent credit.

11/7/2024, 3:00 PM EST

Where will the Fed’s key interest rate end up?

Senior Industry Analyst Ted Rossman joins CNBC’s The Exchange in-studio to discuss interest rates and the state of the consumer

11/7/2024, 2:52 PM EST

Powell says the election won’t have any impact on policy in the near-term

Speaking with reporters, Federal Reserve Chairman Jerome Powell said the election will have no impact on monetary policy in the near-term. He also noted that the recent rise in bond yields has been related to stronger U.S. economic growth and fewer downside risks. Powell noted the yields are not as high as they were a year ago and added “we’ll see where they settle.”

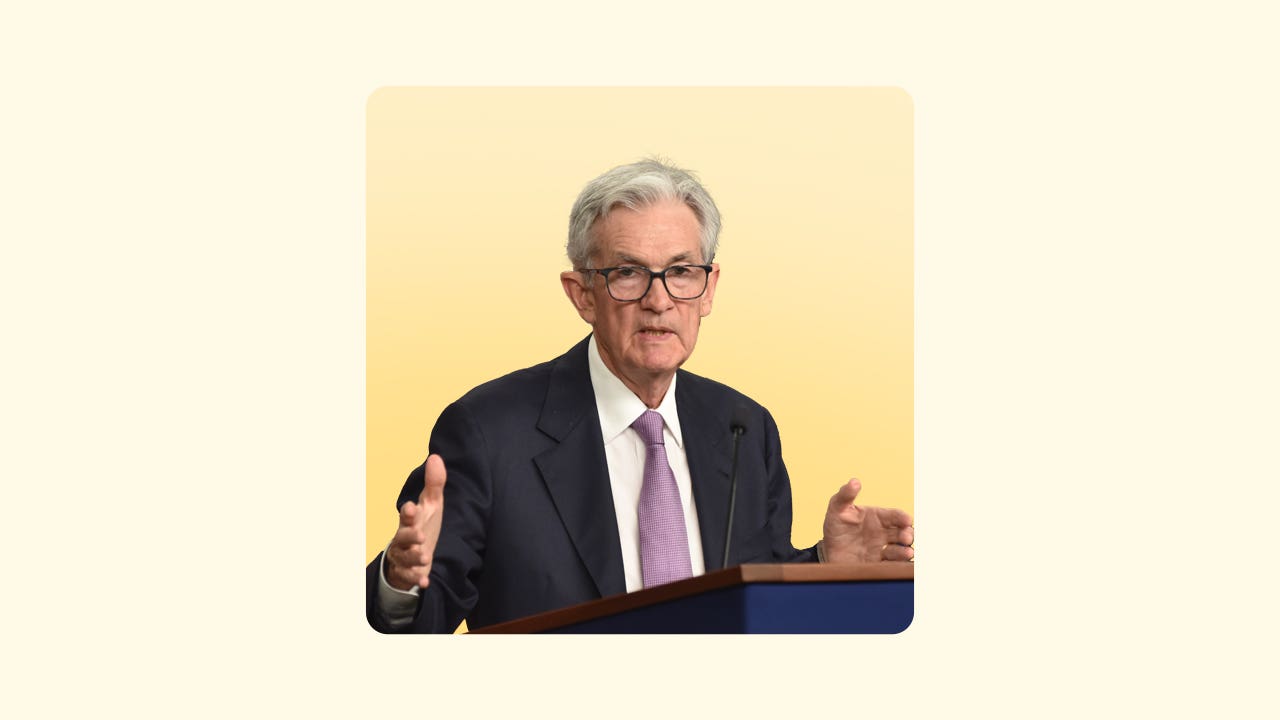

Here’s Fed Chair Jerome Powell speaking live at the U.S. central bank’s November post-meeting press conference.

11/7/2024, 2:43 PM EST

Stocks hold steady as Fed’s rate cut arrives

- Stocks largely remained unchanged Thursday afternoon after the Fed announced a 25-basis-point interest rate cut.

- The Dow Jones Industrial Average declined slightly, while the S&P 500 continued a modest climb and Nasdaq Composite rose 1.45%.

- Treasury yields slipped lower, with the 10-year Treasury yielding around 4.36%.

- Bitcoin held steady near $76,000, close to yesterday’s record high.

- The U.S. dollar index (DXY) was down 0.56%.

Bottom line: Investors, so far, are responding positively to both the Fed’s rate cut and President-elect Donald Trump’s victory. The CBOE Volatility index (VIX) — seen as a barometer of market volatility — declined 6% Thursday afternoon.

11/7/2024, 2:23 PM EST

Fed follows through, cutting interest rates by a quarter of a percentage point

The Federal Reserve cut interest rates for the second consecutive meeting on Thursday, this time by a smaller quarter of a percentage point. The Federal Open Market Committee (FOMC)’s move brings the Fed’s new key target range to 4.5-4.75 percent, back to levels last seen in the spring of 2023.

This decision was an easy one. Labor market conditions have “generally eased,” officials wrote in their post-meeting statement. Inflation has “made progress” toward the Fed’s 2 percent objective.

Here are some key takeaways:

- Many borrowing costs across the market — which have already been on the descent since the Fed first cut interest rates by half a percentage point in September — will continue edging lower.

- Consumers, however, are likely still going to feel the pinch of historically pricey financing rates. Before the Fed’s rapid post-pandemic inflation fight, borrowing costs hadn’t hit a level this high since 2006. The urgency to pay off high-cost interest rate debt remains.

- The smaller rate cut means returns on saving accounts and certificates of deposit (CDs) are poised to fall, just less sharply.

- Mortgage rates might follow a different journey. The 30-year fixed-rate mortgage has risen every week since the Fed cut interest rates on Sept. 18, jumping from 6.2 percent to 7 percent in the week that ended on Nov. 7, according to Bankrate data. Treasury yields have continued to rise in the days since former President Donald Trump was reelected, likely contributing more upward pressure to the key home-financing cost.

11/7/2024, 2:17 PM EST

Winners from rate cut: investors, borrowers and more

Lower rates from the Fed boost stocks and lower costs for borrowers.

- Lower interest rates help support businesses and boost stock and bond prices.

- Those with variable-rate debts such as credit cards and HELOCs should see a drop in their rates soon.

- Savings accounts and CDs, however, will factor in lower rates. With more cuts expected, banks should continue to pay lower interest over the coming year.

11/7/2024, 1:45 PM EST

What do interest rate cuts from the Fed mean for you?

The Fed’s decision is now just 15 minutes away

What Greg McBride, CFA, is watching at the Fed's November meeting.

McBride joins Local News Live to preview today’s announcement from the Fed.

Watch here

11/7/2024, 1:15 PM EST

Expect even lower HELOC rates as Fed cuts continue

The first Federal Reserve interest rate cut since the pandemic set the stage for home equity rates to fall, with variable-rate HELOCs retreating to their lowest level in more than a year. For homeowners, there’s a lot to leverage here — some $17.2 trillion in collective equity, according to ICE. With another cut on the horizon, more homeowners could take out these types of loans, which are often cheaper than credit cards or personal loans. Here’s a look at what’s been driving the recent moves in home equity rates.

11/7/2024, 1:00 PM EST

What the Fed might — or might not — say about the election

We’re now just an hour away from the Fed’s November decision. At the post-meeting press conference to follow, don’t expect Fed Chair Jerome Powell to say much about President Donald Trump winning his reelection bid — if anything at all.

Commenting on politics and the world of fiscal policy is not a line the Fed likes to tread. Policymakers make decisions independent from Congress, a separation that research has suggested leads to better outcomes for the economy.

But here are three ways the election could make its way into today’s discussion:

- The elections are partially why Fed officials moved their meeting

This interest in “staying out of it” is one of the reasons why Fed officials moved their rate-setting meeting today to Thursday. Federal Open Market Committee (FOMC) meetings typically take place every six weeks and conclude on a Wednesday.

It’s not the first time Fed officials have adjusted that protocol, a look at past Fed meeting schedules reveals. The Fed in November 2018 announced its interest rate decision on a Thursday to stay clear of the U.S. midterms and it did the same in November 2020. Only in 2010 did the Fed keep its interest rate meeting announcement scheduled for the Wednesday after Election Day. All other years, it didn’t host a meeting during Election Week. - Years from now, we might learn that Fed officials talked about Trump policies today

Over the years, I’ve talked to several former Fed officials about what it’s like to be in the room, during the meeting. Politics never comes up in the discussion, they’ve all said. But election outcomes can have varying impacts on the U.S. economy that ultimately end up altering the Fed’s plans.

I dug back through the transcripts of the Fed’s December 2016 meeting to see how Fed officials discussed Trump’s presidency, immediately after his first election. Check out this key quote:

I will also note that many proposals for taxes and spending are currently being discussed, but there is considerable uncertainty about what the Congress may eventually pass, and that we do not intend to act preemptively based on guesses about future policy even though some of us have incorporated such guesses into our Summary of Economic Projections (SEP) submissions.— Former Federal Reserve Chair Janet Yellen

History could be repeating itself. Estimates from economists suggest that the tariffs and tax cuts proposed by Trump on the 2024 campaign trail could exacerbate inflation. And if price pressures reaccelerate, it might lead the Fed to cut interest rates less than currently expected.

Proposals, however, are different than law, and the Fed will likely want to see evidence of how it impacts their two economic goals: stable prices and maximum employment.

- Powell will likely be asked about the Fed’s independence

Since about the 1990s, presidents followed the same “social norms” about avoiding commenting on Fed policy, too — until President Donald Trump entered the White House.

Trump routinely commented on monetary policy, insisting that the Fed cut interest rates when it was still on the sidelines and grow its balance sheet when policymakers were in the process of shrinking it. On Twitter, Trump called Chair Powell, whom he appointed, an “enemy,” deemed the Fed “the biggest threat” to the U.S. economy and called officials “boneheads.”

On the campaign trail, Trump has gone as far as suggesting that the president should “at least have [a] say” in interest rate decisions, though he later clarified that he would not “order” a move.

It’s true that presidents can shape the Fed, especially if they have a shot at appointing multiple members to its board of governors, who get a permanent vote on interest rate decisions. Yet, those picks have to be approved by the Senate Banking Committee and then clear the Senate.

Expect Powell to likely reiterate what he’s done in meetings past: That Fed officials have a duty to do what’s best for the economy. Yet, experts over the years have long told me: the Fed gets its independence from Congress, meaning those guardrails could be taken away.

We’re always going to do what we think is the right thing. We’re never going to take political considerations into account or discuss them as part of our work.— Jerome Powell, Federal Reserve Chairman

11/7/2024, 12:45 PM EST

You haven’t missed your chance to lock in a CD

Yields are still outpacing inflation, even if they’ve fallen

CDs are still a wise option — if you have money that you won’t need during the term and you want to keep that money safe — because since it’s possible savers won’t see annual percentage yields (APYs) this high for a while. Money within Federal Deposit Insurance Corp. (FDIC) guidelines is insured in case of a bank failure.

Yes, you’ve likely missed the absolute top yields during this rate cycle. But just like a mortgage, it’s difficult to time something like this perfectly.

11/7/2024, 12:30 PM EST

The Fed can’t save you from credit card debt

Declining rates are good news for consumers, but the reality is that Fed changes won’t save you from the negative impact of high-interest credit card debt.

-

First, tighten up your budget in a way that’s aligned with your values. Unplanned purchases — even small ones — can add up and keep you in debt if you aren’t diligent about budgeting.

-

Next, get familiar with your cards’ terms. Know the different interest rates you might be charged and how long it’ll take you to pay off your debt if you only make minimum payments (Bankrate’s Minimum Payment Calculator can help).

-

Finally, if your credit is good, look into balance transfer credit card offers. Giving yourself 15+ months without accruing interest can help you make a major dent in your balance — if not get out of debt entirely.

11/7/2024, 12:15 PM EST

0% APR car loan offers are back

With or without rate cuts, shopping for promotional car deals is a smart way to find a competitive vehicle deal.

Even as interest rates trickle down, auto loan borrowers won’t feel any concrete impact on their wallets overnight. Remember, the Fed’s benchmark rate does not directly drive auto loan rates. Instead, it has a domino effect on borrowing costs. But moves made by the Fed are not the only route to feeling relief on your vehicle payments. Looking for vehicle incentives can help you find a competitive loan even without a low federal funds rate.

Are 0% car loans back?

We’re entering the best time of the year to buy a car. Here’s how you can take advantage.

Read moreOne route is 0 percent car loans. While they are not as ubiquitous as they were during the pandemic, qualified borrowers can find them with some research. I sat down with industry experts who shared three tips on taking advantage of one of these money-saving promotions:

- Be flexible with vehicle type. Deals vary by vehicle brand and type. Opt for the non-luxury, less popular options to increase your chance of a discount.

- Shop at the end of the promotional year. Plan to head to dealerships in the fall and winter months when automakers are trying to sell off last year’s fleet of vehicles.

- Improve your credit. These types of offers tend to be reserved for those with strong credit. Work to improve your score before car shopping.

Consider these tips when trying to find a competitive deal — with or without interest rate drops.

11/7/2024, 12:00 PM EST

How has the U.S. economy been doing since the Fed cut interest rates?

Here’s a read-out on how the U.S. economy has been since the Fed cut interest rates in September:

- The unemployment rate: 4.1% (October), down from 4.2% in August

-

Jobs created: 223,000 (September).

- Employers created just 12,000 jobs in October, but that’s suspected to be impacted by hurricanes and a strike among workers at Boeing.

- Three-month moving average of job growth: 148,000 a month (excluding October’s figures), up from 113,000 a month when the Fed last met

-

Inflation (Consumer price index, or CPI): up 2.4% from a year ago, a slight slowdown from 2.5% during the Fed’s last meeting

- CPI, excluding food and energy: 3.3%, up from 3.2%

-

The Fed’s preferred inflation gauge, the personal consumption expenditures (PCE) index: 2.1% (down from 2.5% when the Fed last met)

- PCE, excluding food and energy: 2.7% (was 2.6%)

- Gross domestic product (GDP), the biggest scorecard for U.S. economic growth: 2.8% (Q3 2024)

When the Fed adjusts interest rates, research shows that it takes a full year — if not longer — for the impacts to fully filter through the entire economy. All that’s to say, it’s too soon to attribute the pick up in economic growth to the Fed’s bold actions in September.

11/7/2024, 11:55 AM EST

Does the president actually control the U.S. economy?

Senior Economic Analyst and Washington Bureau Chief Mark Hamrick covers the impact of the president on the economy, including the Federal Reserve.

11/7/2024, 11:45 AM EST

Fed cuts and lower mortgage rates haven’t helped home prices — here’s why

In any normal housing market, a doubling of mortgage interest rates would have pushed home prices down. Yet, prices kept rising even as rates shot from 3 percent in 2021 to 8 percent in late 2023.

“We have 50 million people in this country who are between 30 and 40 — peak homebuying years,” said Michael Fratantoni, chief economist at the Mortgage Bankers Association, at the group’s annual meeting last week. “We just have this enormous cohort of people who are looking for housing. We have been underbuilding, and we have been underbuilding by a lot.”

Another culprit is the lock-in effect: Homeowners with 3 percent mortgages know moving would force them to give up their historically cheap deal. Because demand for homes outpaces supply, home prices keep reaching record levels. The Case-Shiller index hit another high in August, and the National Association of Realtors reported that September home prices hit a record, too.

11/7/2024, 11:30 AM EST

What’s happened with car loans since the Fed’s last meeting?

Auto loan rates have been on a small but steady decline since the Fed cut rates in September. Based on Bankrate’s weekly survey, the average 60-month car loan had an interest rate of 7.51 percent at the end of October, down from 7.76 percent in August. It may not seem like much, but this 0.25 percent drop is what some lenders offer as an autopay discount — and it can make a significant difference in your monthly payment.

That said, we’re still far from pre-pandemic numbers. The average new vehicle interest rate was 4.60 percent at the beginning of 2020, and by the end of 2021, 60-month auto loan rates had fallen to a 20-year low of just 3.85 percent. While we can likely expect rates to stay on the decline — provided the Fed continues cutting borrowing costs— don’t count on another record low any time soon.

| Date | New car auto loan rates |

|---|---|

| 11/6/24 | 7.56% |

| 10/2/24 | 7.48% |

| 9/4/24 | 7.61% |

| 8/7/24 | 7.82% |

| 7/3/24 | 7.91% |

| 6/5/24 | 7.84% |

| Source: Bankrate’s national rate survey | |

11/7/2024, 11:15 AM EST

How APYs have changed since the Fed’s last meeting

A liquid savings account allows easy access to your money, with the added perk of earning some interest. It’s still possible to find a high-yield savings account with an annual percentage yield (APY) of over 5 percent, although the top APY available has fallen around a quarter percentage point since the Federal Reserve’s Sept. 18 rate cut.

Unlike variable-rate savings accounts, top CD rates began decreasing in late 2023 as banks anticipated Fed rate cuts. Leading CD APYs have dropped about 20 times since the September Fed cut, with highest APYs coming down an average of 24 basis points since then, across common CD terms ranging from three months to five years. Here are a few examples:

| Savings product | APY on 9/17/2024 | APY on 10/29/2024 | Difference |

|---|---|---|---|

| Top-yielding 1-year CD | 5.1% | 4.59% | -51 basis points |

| Top-yielding 2-year CD | 4.58% | 4.29% | -29 basis points |

| Top-yielding 5-year CD | 4.25% | 4% | -25 basis points |

| Top-yielding Savings | 5.31% | 5.05% | -26 basis points |

| Source: Bankrate’s national rate survey | |||

11/7/2024, 11:10 AM EST

Stock market slightly higher ahead of Fed decision

Investor enthusiasm subsides a bit Thursday following post-election highs

- Investors are ready for the Fed’s announcement, and stocks are modestly higher after President-elect Donald Trump’s victory pushed all three major indexes to new highs on Wednesday.

- The Dow Jones Industrial Average opened lower on Thursday before rising again. The S&P 500 and Nasdaq continued to climb.

- Treasury yields slipped lower, with the 10-year Treasury yielding around 4.34%.

- Bitcoin declined to $75,000, down from yesterday’s record high.

- The U.S. dollar index fell 0.85% after hitting a four-month high on Wednesday.

Here’s more information on how stocks perform after the Fed cuts interest rates.

11/7/2024, 11:00 AM EST

Why did mortgage rates rise after the last Fed cut?

A strange thing happened on the way to the wonderland of lower mortgage rates: The Fed slashed its benchmark interest rate in September, then mortgage rates promptly rose. This episode illustrates how the Fed can influence mortgage rates, but not control them. In fact, rates have been rising amid stronger-than-expected economic data, along with concerns about rising federal debt. Bankrate analyzes these movements every Wednesday in our weekly survey — see the latest here.

11/7/2024, 10:45 AM EST

Credit card rates only down slightly since last Fed cut

Just before the Fed announced a 50 basis point rate decrease on Sept. 18, the average credit card rate was 20.78 percent (1 basis point shy of a record set in August). It has since edged down to 20.39 percent. Here’s how the 109 cards that we survey weekly have responded to the rate cut:

- 74 have passed along the full 50 basis point cut to cardholders

- 21 have lowered rates by a smaller amount

- 14 haven’t changed their rates at all

So why hasn’t the full half-point cut moved through the market? For starters, these things take time. Even though most credit card rates move in tandem with the prime rate (plus a profit margin), some card terms and conditions are written in such a way that issuers can drag their feet passing on rate cuts. The terms sometimes include language like “the prime rate on the first day of the previous month.” Also, card issuers have a lot of flexibility in adjusting offers to new cardholders (which our weekly survey measures), even though it’s harder for them to avoid passing prime rate dips along to their existing customers.

If you have credit card debt — and half of cardholders carry balances from month to month – the drop from 20.78 percent to 20.39 percent isn’t saving you much money. Minimum payments toward $6,329 in credit card debt (the average balance, according to TransUnion) keep someone in debt for 217 months and cost them $9,314 in interest at 20.39 percent. That’s only one month shorter and $190 less in interest compared with the 20.78 percent scenario. If you have credit card debt, make a plan to knock it out ASAP regardless of what the Fed decides to do with interest rates. My favorite tip is to sign up for a balance transfer card with a generous 0 percent interest term (some last as long as 21 months).

11/7/2024, 10:15 AM EST

Mortgage rates, the housing market and the Fed

Principal Writer and Housing Analyst Jeff Ostrowski spoke with Cheddar about the latest on mortgage rates leading up to the Fed’s November meeting and what the presidential elections could mean for the housing market.

Jeff Ostrowski, Mortgage & Housing Analyst at Bankrate, discusses mortgage rates in America and how the housing market will change under a second Trump term. https://t.co/5IJxk5F6CX

— Cheddar (@cheddar) November 6, 2024

11/7/2024, 10:00 AM EST

What happened to mortgage rates after the Fed’s last meeting?

Remember those lower mortgage rates in August and September? When the Fed cut its benchmark rate two months ago, many expected mortgage costs to fall or stay flat. Instead, the average 30-year fixed mortgage went from a low of 6.2% up to 7% as of Nov. 6.

Still, mortgage rates remain below historical averages. As the Fed prepares for another rate cut, here’s a look at how these rates have shifted over the years.

Learn more: Mortgage rate history: 1970s to 2024

11/7/2024, 9:45 AM EST

This is the easiest way to think about how the Fed impacts you

The Fed’s November meeting is a special one for me. It marks my eighth year on the Federal Reserve beat.

I was told my whole life that I was a writer and wouldn’t like economics, so you can imagine how surprised I was when I fell in love with the world of central banking. They’re the stewards of the U.S. economy, I’d catch myself justifying with my equally-as-shocked friends and family members. They orchestrate the world’s largest financial system and rarely get any of the credit (or blame) when things go right (or wrong).

The Federal Reserve is really like the center of our personal finance solar system; every decision revolves around it. Did you buy a home when mortgage rates were at record lows in 2020? Did you job hop during the “Great Resignation” of workers in 2021? Have you been holding off on making a big-ticket purchase this year until you can find a cheaper deal and lower interest rate? All of those decisions come back to what’s been happening at the U.S. central bank.

11/7/2024, 9:30 AM EST

What the November decision could mean for investors

Lower interest rates are a positive sign for stocks and investors

An interest rate cut by the Fed generally spells good news for stocks and other investments. Here’s why.

Cheaper borrowing for companies

Businesses often finance their operations and growth through borrowing, whether it’s taking out loans, issuing bonds or other forms of debt. When the Fed lowers interest rates, the cost of borrowing gets cheaper for businesses. Because companies are spending less on interest payments, they have more capital to reinvest into operations or return to shareholders via dividends or stock buybacks.

It’s also important to remember that positive overall sentiment can drive stock prices higher, even if there’s no immediate changes in earnings or fundamentals.

Increased consumer spending

Lower interest rates also reduce borrowing costs for consumers, which can lead to more spending on goods and services. If interest rates stimulate the economy this way, it can benefit companies that heavily rely on consumer spending, such as retailers and restaurants.

Riskier investments may seem more appealing

When interest rates are low, investors may be more willing to take on risk in search of higher returns because the rates on safer investments (like CDs) are dropping rapidly. This can lead to increased demand for stocks and other risky assets, like cryptocurrency.

The ‘Trump Trade’ pushes investments higher post-election

Stocks and cryptocurrency rallied Wednesday following confirmation of President-elect Donald Trump’s win in the 2024 presidential race. Meanwhile, bond prices pushed higher as expectations of tariffs on imported goods drove worries about inflation.

Trump’s promises to extend or enact major tax cuts while loosening regulations drove optimism about economic growth in the business community. The S&P 500 index hit a new all-time high, with major gains in small-cap stocks and banks — two sectors positioned to benefit from Trump’s anticipated lighter regulatory touch.

11/7/2024, 9:15 AM EST

Why the Fed is likely to cut interest rates by a smaller amount this month

The economy doesn’t look like it needs as much as saving as it did when the Fed last met in September

You might as well say the Fed’s surprising jumbo half-point interest rate cut was the equivalent to taking out some insurance against an economic slowdown. Fears were swirling that the U.S. job market was rapidly deteriorating, after data from over the summer showed that unemployment unexpectedly surged to 4.3 percent and job growth slowed massively. To lower the risk of being behind the curve, Fed officials decided to kickstart their new, lower-rate era by moving forcefully out of the gate.

But the U.S. economy looks a bit brighter these days — and it’s too soon to chalk it up to the Fed’s rate cut, since it takes almost a year, if not more, for lower rates to filter through the economy. Really, what’s happened is, slumps in job growth from over the summer were revised up. Meanwhile, the U.S. economy grew a healthy 2.8 percent pace last quarter, bolstered by strong consumer spending.

Inflation has slowed massively since it peaked at four-decade high in the summer of 2022. Prices rose 2.1 percent in September, roughly in line with the Fed’s 2 percent target, according to the Fed’s preferred inflation gauge, the personal consumption expenditures (PCE) index. It’s giving the Fed the clearance to continue cutting interest rates, yet stronger than expected growth is making them more cautious.

11/7/2024, 9:00 AM EST

Here’s what to watch at the Fed’s November meeting

Prepare for another interest rate cut

Today’s the day: The Federal Reserve is about to announce what it decided to do with interest rates at its November meeting.

We already know what the Fed is likely to do: Cut interest rates by a quarter of a percentage point. The move would bring the key benchmark borrowing rate that impacts the price consumers pay to borrow money down to 4.5-4.75 percent, the lowest since the spring of 2023.

Still, the moment is fraught with uncertainty that could impact policymakers’ next moves. For starters, Fed officials are lacking clarity on the U.S. economy when they need it most. U.S. employers created just 12,000 jobs last month, an unexpectedly weak number that could’ve been distorted by strikes and hurricanes.

On the other hand, fears about a rapid deterioration in the job market have calmed since the Fed’s September gathering. Another wrinkle: President Donald Trump won his bid for reelection on Tuesday, and his proposals for more corporate tax cuts and tariffs could interrupt recent declines in inflation, economists say.

Here are the four biggest questions I have surrounding the Fed’s September meeting

- Is a rate cut in December a done deal? Policymakers say rates are not on a predetermined course. Economists I talk to say the resilient economy raises the likelihood of the Fed cutting less than expected.

- What would get the Fed to *not* cut interest rates? Officials have said they wouldn’t abandon rate cuts just because the economy and job growth are strong. What would they have to see to justify not cutting interest rates?

- When will they want to pause its rate cuts? Speaking of a pause, we know it’s coming eventually. Fed officials projected only four rate cuts across its eight meetings next year. Officials would likely need to feel comfortable with where interest rates currently stand if they were to make that decision. But that requires answering an even more complicated question: How high should interest rates be right now?

- Is inflation still on the descent? Fed officials would likely wait for the rubber to meet the road before changing their game plan in response to the tariffs and tax cuts that Trump promised on the campaign trail. Yet, estimates from Moody’s Analytics have projected that inflation could rise to at least 3% next year if Trump follows through with a universal 20% tariff and 60% levy on imports from China.

Read more: how interest rates can influence stocks, crypto and other assets.

Live coverage contributors

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.