Fed meeting live updates: Fed lowers rates by quarter point, pencils in just two for 2025

Bankrate’s expert staff has a combined 43 years of experience following the U.S. economy, dissecting the Federal Reserve and breaking down what it all means for your wallet. See what our expert staff of reporters, writers, editors and financial analysts are watching at the Federal Reserve’s final meeting of 2024.

12/18/2024, 2:17 PM EST

The Fed cuts interest rates a third time, but with some disagreement

Interest rates are now in a new target range of 4.25-4.5%

As expected, the Federal Reserve cut interest rates for a third time at its final meeting of the year, bringing its key benchmark interest rate down to a new target range of 4.25-4.5%.

Taken together, the move means the U.S. central bank has now slashed interest rates by a full percentage point in just a three-month span. U.S. central bankers lowered rates by half a point in September, a quarter point in November and now a quarter point this month.

But in a more notable move, officials revealed that they’re rethinking just how many more times they’ll be able to cut borrowing costs in 2025. Officials now expect to cut interest rates two times in 2025, half as fast as the four cuts officials penciled in just last September.

Fed officials are also now starting to diverge over the path ahead. Another noteworthy signal, Cleveland Fed President Beth Hammack dissented from the Fed’s decision to cut borrowing costs, preferring to keep them steady. Three other Fed officials — presumably those who don’t have a vote on Fed policy this year — appeared to have preferred keeping interest rates steady in December.

This announcement is what we like to call a “hawkish” cut. And what’s got Fed officials feeling this way? Inflation has been even more stubborn than expected, rising every month since the Fed’s September cut.

The Federal Reserve makes a third straight rate cut but casts doubt on 2025 cuts

Inflation has majorly improved but remains stubbornly above target.

Read more

12/18/2024, 5:00 PM EST

Thanks for joining our live blog

Thanks for following along with our live coverage of the Federal Reserve’s December meeting. For more information on how the Fed impacts you, read more of Bankrate’s Fed coverage.

The Federal Reserve and your money

Get insights from Bankrate experts on the Federal Reserve’s third interest rate cut and the steps you should take next.

Learn more

12/18/2024, 4:55 PM EST

Closing thoughts from Bankrate’s Fed experts

The big takeaway from this Fed meeting goes beyond the quarter-point interest rate cut put into effect. This may prove to be the last rate cut for a few months. The economy has continued to surprise to the upside from a growth perspective, with Fed Chair Jerome Powell even referring to the U.S. economy as ‘remarkable.— Greg McBride, CFA, chief financial analyst

There's a fair bit of uncertainty ahead — especially on the political front — but the good news is that recent economic data has generally come in better than expected. Inflation has been stubborn and the Fed's not going to be in a rush to bring rates down.— Ted Rossman, senior industry analyst

Chairman Powell said he and his colleagues are still in the recalibration phase with interest rates, but the December meeting involved a stronger twist of the monetary policy dial. Based on their collective predictions, members of the FOMC see interest rates being high for longer. To cap things off, Powell said one cannot completely rule out the possibility of a rate hike in 2025. It will be an interesting year given the intersection of monetary policy and what the new administration wants to do.— Mark Hamrick, senior economic analyst

12/18/2024, 4:40 PM EST

HELOCs hit new low as Fed lowers rates again

Borrowing against your home’s equity became more affordable in 2024, especially after the Federal Reserve began cutting rates this fall. Since then, variable-rate HELOCs have declined from an average of about 10 percent to 8.52 percent (as of Dec. 18), a new low for the year.

Still, while the Fed cut rates again today, the sustained strength of the economy could change that policy in 2025 — and keep HELOC rates elevated.

12/18/2024, 4:20 PM EST

How lower rates from the Fed impact bond investors

As exciting as falling rates may seem, it’s crucial to maintain a diversified portfolio. Unexpected events — from economic shocks to potentially higher inflation — can disrupt bond performance.

Here’s a look at how lower rates from the Fed impact bond investors and what you should know.

12/18/2024, 4:15 PM EST

Mortgage rates to head higher after Fed cut

Mortgage rates should trend upward in the next week despite a Fed cut, according to rate watchers polled by Bankrate.

“The mantra for 2025 is ‘higher for longer,’” says Greg McBride, CFA, chief financial analyst for Bankrate. “Compared to three months ago, the Fed doesn’t plan to cut interest rates as often and they don’t expect inflation to come down as quickly.”

12/18/2024, 4:14 PM EST

Stock market closes lower after Fed cuts rates a quarter point, slates two more for 2025

- Stocks closed lower Wednesday afternoon as investors digested the Federal Reserve’s decision to cut interest rates by a quarter point. The Fed also announced there would be two more cuts in 2025.

- The Dow Jones Industrial Average closed in the red. The S&P 500 and Nasdaq also ended the trading session lower.

- Treasury yields rose, with the 10-year Treasury yielding around 4.49%.

- The price of Bitcoin fell to $100,000, down from its recent record high of $108,000.

- The U.S. dollar index climbed 1.18%.

12/18/2024, 3:17 PM EST

What the Fed’s interest rate cut means for personal loans

Personal loans don’t see the same level of movement as other personal finance products when the Fed cuts rates. After the initial cut in September, average personal loan rates dropped slightly from 12.43 percent to 12.31 percent in mid-November. They held steady until Dec. 12 before dropping to 12.29 percent. Personal loan rates are more closely tied to overall economic health, so if the outlook improves we may see average rates fall even further.

12/18/2024, 3:15 PM EST

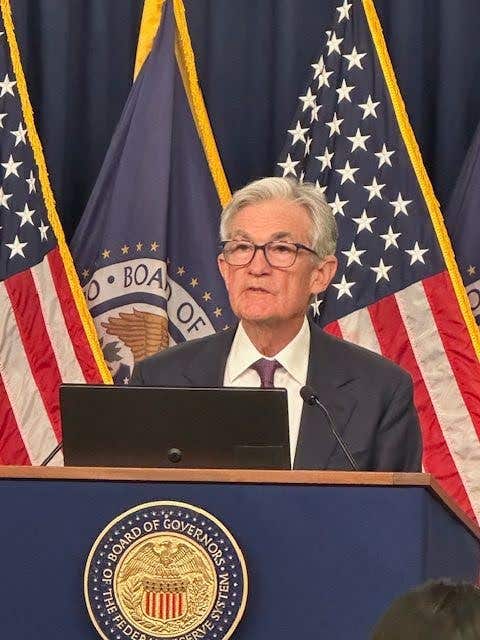

Chairman Jerome Powell presides over his final scheduled news conference of the year

The Fed’s benchmark rate is less restrictive now, Powell notes

Chairman Jerome Powell begins his news conference saying the economy is strong overall, and that the job market remains solid, but has cooled. He adds that inflation remains “somewhat elevated” compared to their 2% target, and their favorite inflation measure core PCE was up 2.8% over the past year. Their newly updated outlook suggests only a modest decline next year to 2.5% in the core PCE price index.

12/18/2024, 3:05 PM EST

What’s next for auto loans after the Fed’s interest rate cut

There are quite a few factors that determine market rates, and without another rate cut, there likely won’t be significant change for auto loans. Unfortunately for many borrowers, the new normal seems to be an APR that is solidly in the 7 percent range.

| Date | New car auto loan rates |

|---|---|

| 12/11/24 | 7.53% |

| 12/4/24 | 7.59% |

| 11/6/24 | 7.56% |

| 10/2/24 | 7.48% |

| 9/4/24 | 7.61% |

| 8/7/24 | 7.82% |

| 7/3/24 | 7.91% |

12/18/2024, 2:53 PM EST

A look at the Fed’s new interest rate projections

Officials now expect to cut borrowing costs just two times in 2025

Released along with the Fed’s decision to cut interest rates is its quarterly “dot plot” chart. It’s as noteworthy as it is complicated.

The Fed’s dot plot records each Fed official’s projection for the central bank’s key short-term interest rate, the federal funds rate. We don’t know who each dot is, but we know each one represents one Fed official — from Fed Chair Jerome Powell and Vice Chair for Supervision Michael Barr, to New York Fed President John Williams and Chicago Fed President Austan Goolsbee.

It’s not a strong predictive tool (more on that in our explainer), but it does reveal how officials are responding to incoming data. As a Fed reporter, I also look to it as an indication of where the Fed’s bias may lie.

Here’s what the latest update shows:

- One official sees rates remaining unchanged in 2025

- Three officials see one cut next year

- Ten officials see two cuts (the median estimate for next year!)

- Three officials now see three cuts

- One official sees four cuts (the median estimate for 2025 back in September)

- One official sees five cuts

- No official sees six cuts

We can clearly see here that hotter-than-expected inflation and a stable economy have caused the Fed to tear up their previous game plan for borrowing costs. For consumers, the message is: Interest rates are going to stay higher for even longer.

12/18/2024, 2:48 PM EST

The Fed just cut rates. Here’s what steps to take, from a CFP

I’m doing these four things with my finances, now that rates are lower again

As a certified financial planner, I’m always thinking about how to optimize my money — especially when markets shift. With the Fed’s latest rate cut, here are my recommendations to put on your to-do list:

- Open a CD. Consider locking in a high yield before they fall after this latest rate cut.

- Invest in Treasurys. Yields on government bonds have become more compelling as the Fed has lowered rates.

- Rebalance your portfolio. The Fed’s stance reinforces my view that both stocks and bonds have a role to play in a diversified portfolio. I’m using this event to make sure my asset mix still aligns with my long-term goals.

- Evaluate your loans. Shop around to see if you can refinance any of your outstanding debts, such as your auto loan or mortgage, at meaningfully lower rates before they potentially begin to rise again in the future.

- Reposition your cash. For money I can’t lock up in a CD, I’m looking for the most competitive yields I can find on high-yield savings accounts and money market accounts.

These moves might seem small, but they can really add up. By being proactive, you can all set yourself up in any rate environment.

12/18/2024, 2:46 PM EST

Stock market dips after Fed announcement

After a modestly positive start to the day, stocks sharply reversed on the news that the Fed was lowering interest rates by 25 basis points but was likely to slow the pace of future cuts.

- Major indexes including the S&P 500, the Nasdaq and the Dow Jones Industrials turned quickly lower following the Fed’s announcement.

- After the initial fall, stock indexes continued to hold their losses, though the market often does a “headfake” in the few minutes after any Fed news.

- We’ll see if the market gets its mojo back tomorrow and finishes with a solid Santa Claus rally to cap one of the strongest years ever for stocks.

Here’s how stocks perform after the Fed starts cutting rates. (It’s pretty good.)

12/18/2024, 2:41 PM EST

Bankrate’s Greg McBride, CFA, reacts to the Fed’s rate decision

A slower pace of interest rate cuts in 2025 means borrowers will have to continue doing the heavy lifting of aggressive debt repayment. Borrowing rates for variable rate debts such as credit cards and home equity lines of credit are high and won’t come down fast enough to provide meaningful relief.— Greg McBride, CFA, Bankrate chief financial analyst

12/18/2024, 2:25 PM EST

Winners from rate cut include investors, borrowers

- Investors are cheering lower rates, since they help support business and boost stocks.

- Would-be borrowers benefit from lower rates, though homebuyers have not, since mortgages have risen because they track the 10-year Treasury, not the fed funds rate.

- Variable-rate accounts such as credit cards should see a quick drop in rates.

- Rates on savings accounts and CDs have been trending lower for a while, though savvy shoppers can still find attractive rates from banks across the nation.

12/18/2024, 2:10 PM EST

The Fed’s third interest rate cut makes it cheaper to borrow money, but only slightly

Interest rates are now back to late 2022, early 2023 levels

By no means will the Fed’s third interest rate cut make the price of borrowing money cheap again. Simply put, it only walks back some of the U.S. central bank’s historic post-pandemic increases throughout 2022 and 2023 to control inflation.

The Fed’s cut today brings its key benchmark interest rate back to a target range of 4.25-4.5%, a level last seen in late 2022 and early 2023. Before that, rates hadn’t been this high since 2007.

That’s all likely to keep the financing rates you see on the market elevated, too.

12/18/2024, 1:30 PM EST

Should homebuyers wait for more Fed cuts?

Timing the housing market is a tough thing to get right — even tougher if you’re trying to time getting a mortgage around a Federal Reserve rate cut. There’s no guarantee that home prices or mortgage rates will come down; in fact, home prices are unlikely to fall, and virtually no one expects mortgage rates to dip much below 6 percent for the foreseeable future. Our contributor David McMillin delves more into whether to buy a house now or wait.

12/18/2024, 1:25 PM EST

Could the Fed’s interest rate cut today be its last for a while?

Senior Industry Analyst Ted Rossman joins CBS News New York in-studio to preview today’s Fed announcement and the outlook for 2025.

Rossman: What the Fed says today about future interest rate cuts will be key

Meanwhile, even as the Fed has been cutting short-term rates, long-term rates have gone up, Rossman adds.

Watch here

12/18/2024, 1:15 PM EST

What has happened to credit card rates since the last Fed meeting?

Let’s face it: Credit card rates are high, and they’re going to stay high

The Fed has cut rates by 75 basis points since September, yet the average credit card rate has only dipped 43 basis points from 20.78 percent to 20.35 percent. The drop has been especially miniscule (from 20.39 percent to 20.35) since the Fed announced a quarter-point cut on Nov. 7. What gives?

The most interesting explanation is that some card issuers have actually raised rates. For instance, in late November, Discover changed the rate structure on several of its popular cards to the Prime Rate (which is typically three percentage points higher than the federal funds rate) plus 10.74 percent to 19.74 percent. On those cards, Discover previously charged the Prime Rate plus 9.74 to 19.74 percent.

Our weekly rate surveys examine offers to new customers, and credit card issuers have more latitude to change rates on new customers. Also, when rate cuts get passed through to existing customers, many cardholder agreements are written in such a way that it can take a month or two (sometimes even longer) for the changes to take effect.

The bottom line is that credit card rates are high and they’re going to stay high. A year from now, there’s a very good chance the average credit card rate will be between 19 and 20 percent. That’s high-cost debt, and it’s just the average. Many cardholders will continue to pay 25 percent, 30 percent… sometimes even more. Due to these high costs, it’s critical to prioritize credit card debt payoff. My favorite way to do that is to sign up for a balance transfer credit card with a generous intro 0 percent APR term. Some of these offers last as long as 21 months.

12/18/2024, 1:00 PM EST

Fewer middle-class families can afford homeownership. Will Fed cuts help?

For middle-class Americans still struggling to get their piece of the American Dream, higher home prices, higher mortgage rates and other factors have impacted their ability to build — and pass down — wealth through homeownership. While the Federal Reserve doesn’t directly set mortgage rates, its decisions do play a role in housing affordability. As the central bank moves along this rate-cutting cycle, I recently explored the hows and whys of the middle-class homeownership problem.

12/18/2024, 12:45 PM EST

What’s been happening to CDs, savings accounts since the Fed’s last meeting

Top-yielding accounts remain competitive

Since the last Federal Reserve rate decision in November, the top savings annual percentage yield (APY) tracked by Bankrate has decreased from 5 percent APY to 4.85 percent APY as of the week of Dec. 12.

As of this morning, it was still possible to find at least one money market yield at 5 percent APY or higher.

As of the week of Dec. 12:

- The top-yielding one-year CD tracked by Bankrate is at 4.59 percent APY and hasn’t changed since the week of Nov. 7

- The top-yielding five-year CD tracked by Bankrate is at 4.25 percent APY and actually increased 25 basis points since the week of Nov. 7. This can happen, but generally, top-yielding CDs haven’t been increasing in this environment.

Bottom line: The Fed raised rates a total of 525 basis points between 2022 and 2023, keeping the target range at 5.25-5.5 percent until September. If the Fed does as expected and cuts by 25 basis point today, rates will have decreased by 100 basis points since the Fed started paring back on rate three months ago. Nevertheless, rates are still generally at their highest levels in more than a decade.

It’s still a great time for savers. With inflation at 2.7 percent, any yield above that is helping you preserve your purchasing power.

12/18/2024, 12:30 PM EST

How often should you compare mortgage rates?

The marching orders about how many mortgage offers to shop are clear: Get at least three bids, preferably five.

How often should you check on rates, though? That’s a tougher question. Unlike some other financial products, mortgage rates regularly fluctuate up and down. Depending on what’s happening in the broader economy, these moves might be minor or major. Keeping tabs on these trends can help you determine the right time to buy a home or refinance.

Yet, it’s really hard to time mortgage rates. If you see a rate you like, it’s probably best to just grab it. If you’re worried rates will rise, take advantage of a rate lock to guarantee today’s rate for 30 to 60 days, sometimes even longer.

Learn more in Bankrate’s guide: How often should you compare mortgage rates?

12/18/2024, 12:15 PM EST

Could the Fed’s latest rate cut spark a stock market correction?

Investors should stay diversified as markets digest another Fed move

Stocks have been on a tear this year, with the S&P 500 on track to post gains of over 20% for the second year in a row.

Will the trend continue in 2025? Or is the market due for a pullback? While the Fed’s rate cuts have been a key bolster for stocks, the central bank’s more neutral outlook could make it harder for the market to keep up its rapid ascent.

That doesn’t mean a correction is necessarily coming, but it does suggest that investors should be prepared for more normal ups and downs after a smooth ride in 2024. Plus, there’s additionally uncertainty about how the incoming administration’s policies could impact financial markets and the economy in the year to come.

The key is to stay focused on your long-term goals and resist the urge to overreact to short-term swings. By keeping a diversified approach, you’ll be better equipped to handle whatever twists and turns the market takes next.

12/18/2024, 12:00 PM EST

How is the U.S. economy doing these days?

The U.S. economy remains resilient, but cracks are forming underneath the surface

There’s something for everyone in U.S. economic data these days. Economists have just as much to make them feel gloomy (unemployment is rising, it’s taking longer for Americans to find new positions) as upbeat (that once widely forecasted recession has yet to rear its ugly head, and the economy continues to grow despite the Fed hiking rates to the highest level in 23 years). That mixed picture is part of the reason why Fed officials are finding their next moves uncertain and tricky.

Here’s the latest snapshot of the U.S. economy:

- Unemployment rate (November): 4.2%, remaining near 2021 highs and up from a half-century low of 3.4 percent (from April 2023)

- Inflation rate (November): 2.7% (up from 2.4% in September but down from a peak of 9.1% in July 2022)

- Gross domestic product (Q3): 2.8% (1.8% is currently viewed as a “goldilocks” level of growth)

- Retail sales (November): up 4.1% from a year ago, fastest since December 2023

Read more on Inflation slightly accelerated last month — here are the prices rising most.

12/18/2024, 11:45 AM EST

I’m a CFP. Here are some CD strategies I recommend in a falling-rate environment

As the Federal Reserve prepares to lower interest rates for the third consecutive time, CD rates will continue to ease off the highs we saw in 2023. But if you act quickly, you can still snag some great returns:

- Shop around and look beyond the biggest banks. Online banks and credit unions often pay much higher rates than the megabanks.

- Yields are likely to keep falling in the coming weeks as banks adjust to the new rate environment. The sooner you lock in, the better.

- Building a CD ladder with different maturity dates allows you to take advantage of higher long-term rates while still giving you some access to your cash.

The key is to be proactive and strategic in finding places to store your cash.

12/18/2024, 11:30 AM EST

Rate cuts could affect your big purchase next year

If you’ve got a big expense looming for 2025 — like a new fridge, international flight or cosmetic procedure — you might wonder if the Fed’s rate cuts affect when you should borrow money to pay for it.

Don’t bank on credit card interest rates dropping enough to make it worth carrying a balance for a big purchase — a credit card is still an expensive form of debt. I’d only suggest applying for a 0 percent intro APR card and paying it off before the intro period ends.

But keep an eye on things like personal loans and buy now, pay later (BNPL). Personal loan rates might drop over time as it becomes more affordable for banks to lend you money. The cuts may also increase your chances of getting a 0 percent BNPL plan.

The best way to fund a big purchase is to start saving ahead of time. Even if high-yield savings account rates drop, it’s still better to earn money on top of your money — rather than paying to borrow it.

12/18/2024, 11:15 AM EST

While the Fed focuses on cuts, conforming loan limits have gone up

Home values keep increasing, and that trend has been reflected in the ever-rising loan limits for so-called conforming mortgages. For much of the U.S., the divide between conforming loans and jumbo mortgages in 2025 has increased to $806,500 — a 5.2 percent step-up from the 2024 limit of $766,500. In pricier places like New York City, Alaska and Hawaii, the limit has increased to just over $1.2 million.

12/18/2024, 11:00 AM EST

Stock market slightly higher ahead of Fed decision

Major indexes were slightly higher ahead of the final Fed rate decision of the year

- Stocks were a bit higher Wednesday morning as investors anticipated the Federal Reserve’s interest rate decision. Inflation remains above the Fed’s 2% target. There’s been some discussion that President-elect Donald Trump’s policies regarding trade, immigration and taxes could continue to fuel economic growth.

- The Dow Jones Industrial Average was up slightly. The S&P 500 and Nasdaq were also somewhat higher.

- Treasury yields also inched up, with the 10-year Treasury yielding around 4.41%.

- Bitcoin declined to $104,000, down from its recent record high of $108,000.

- The U.S. dollar index rose 0.06%.

12/18/2024, 10:50 AM EST

The Fed is cutting rates. Interest on credit cards is still stubbornly high.

Senior Industry Analyst Ted Rossman speaks with CNN’s Vanessa Yurkevich to discuss the relationship between Fed rate cuts and credit card interest rates.

What does a third interest rate cut mean for credit card borrowers?

Bankrate's Rossman shares tips on what Americans with credit card debt should do ahead of the Fed's December meeting.

Watch here

12/18/2024, 10:45 AM EST

Ways to tap home equity as the Fed cuts rates

The rates on fixed-rate home equity loans and variable-rate HELOCs haven’t been this affordable in more than a year, and with the Federal Reserve set to continue rate cuts, now might be a good time for homeowners to tap their equity with one of these loans.

A HELOC works just like a credit card, allowing you to borrow what you need during the draw period, then repay it over time with interest over the repayment term. A home equity loan gives you a lump sum with fixed payments. Both of these options involve putting your home on line as collateral.

12/18/2024, 10:30 AM EST

How to choose the right CD in a falling-rate environment

Two factors to consider are where rates are headed and your own financial goals

Ultimately, the right CD term for you when rates are dropping depends on both your expectations and your goals. When it comes to APYs, shorter-term CDs are currently out-earning longer-term ones. Plus, shorter-term CDs allow you to reinvest the funds sooner for a more competitive yield if APYs start to increase in the meantime.

On the other hand, locking in a longer-term CD now could possibly better hedge against further rate drops by guaranteeing a competitive APY for longer.

Regardless of where the market might be headed, don’t forget to factor in when you’ll want access to the money again (such as for a planned purchase or reinvestment), as most CDs charge a penalty for early withdrawals. As a rule of thumb, always keep money earmarked for emergencies in a place that’s more accessible, such as a high-yield savings account.

12/18/2024, 10:15 AM EST

Rate cuts won’t do much to alleviate high credit card interest rates

Used strategically, balance transfer credit cards can save you hundreds on interest charges

All this talk about interest rates may have you thinking about consolidating some existing credit card debt. A balance transfer card can be a handy financial tool to give you some wiggle room in your budget. Many of them offer at least a year of 0 percent interest, with the best cards presenting up to 21 months with an intro APR — nearly two full years to get caught up.

They’re useful as long as you make a plan to pay off your balance before the promo rate expires, otherwise you’ll be right back where you started. A few are even worth keeping as daily-use cards because of rewards and other ongoing benefits. Here’s how to choose a balance transfer card to save on interest in the new year.

12/18/2024, 10:08 AM EST

Breaking down the Fed’s December interest rate decision

Bankrate’s Sarah Foster breaks down the biggest questions surrounding the Fed’s final rate-setting meeting of the year and what comes next.

@accidental.economist 💡 What prediction or trend in finance and the economy do you expect to have the biggest impact in the next 12 months? And why?

♬ original sound – Sarah Foster

12/18/2024, 9:45 AM EST

A look-back at mortgage rates this year

As we gear up for what’s likely to be another Fed rate cut, let’s look back on the ride mortgage rates took this year. For most of 2024, the average 30-year fixed-rate loan hovered near the 7 percent mark, hitting a high in May at 7.39 percent, and a low in September at 6.20 percent.

That’s pretty in line with the historical norm of roughly 7.2 percent:

While homebuyers might be wishing for the lower rates of the past, keep in mind, more Fed cuts might not drive them back down significantly. Here’s more on historical mortgage rate trends, plus some predictions for 2025.

12/18/2024, 9:37 AM EST

What Bankrate’s Greg McBride is watching at today’s Fed meeting

Chief Financial Analyst Greg McBride, CFA, joins Local News Live to explain the impact of a potential third rate cut in 2024.

'Rates are coming down much slower than they went up'

In the year ahead, Fed officials are going to cut interest rates at a slower pace, McBride says.

Watch here

12/18/2024, 9:35 AM EST

Falling rates are generally good news for stocks, crypto

Another rate cut could heat up an already hot stock market

An interest rate cut by the Federal Reserve is generally positive news for stocks and other investments.

Here’s why:

- Lower rates make borrowing cheaper for businesses, reducing their interest expenses and freeing up capital for dividends or stock buybacks.

- A rate cut can also push stock prices higher, even without immediate changes in fundamentals.

- Low rates make safer investments like CDs less attractive, leading investors to seek higher returns in riskier assets like stocks or cryptocurrencies.

12/18/2024, 9:30 AM EST

What the Fed’s third interest rate cut means for these 5 key aspects of your personal finances

Pretty much every financial decision you make comes back to what’s happening at the Federal Reserve — but its work is mind-bendingly complex. Here are the key ways the U.S. central bank shows up in your financial life:

- Borrowing costs: The Fed’s interest rate decisions have a domino effect on almost all forms of borrowing. When rates rise (or fall), so, too, do borrowing costs on auto loans, credit cards, home equity lines of credit (HELOCs) and more. Fewer rate cuts, however, could bring borrowers less relief from a historically pricey era for financing big-ticket purchases.

- Savings yields: Lower rates also mean lower returns on your savings, but the Fed keeping interest rates higher for longer has been better news for savers than borrowers. Yields have already edged lower, but not as much as what was originally anticipated. Meanwhile, the highest-yielding banks on the market are still offering yields that eclipse inflation — a trend that’s expected to continue.

- Job security: One of the biggest corners of the economy impacted by higher interest rates is the job market. Expansions that seemed wise when money was cheap might be put on the backburner. New opportunities made possible by low interest rates are no longer on the table. If the Fed keeps interest rates too high for too long, it risks needlessly slowing down the economy or even forcing job cuts. Fear of a slowdown in the job market was part of the reason why Fed officials cut borrowing costs half a percentage point in September.

- Purchasing power: The Fed is cutting interest rates cautiously to make sure that it can keep weighing on inflation — or worse, to ensure it doesn’t reinvigorate price pressures. Expensive rates can cause both businesses and consumers to pull back on big-ticket purchases or hiring — and that loss of demand is ultimately what leads to a lower pace of price increases.

- Investments: High rates tend to weigh on stocks, as companies find it harder to finance expansions and investors grow wary of a broader economic slowdown. Yet, stocks this year have been “defying gravity,” with the S&P 500 surging almost 28 percent as the U.S. economy continued avoiding a recession in 2024. Still, volatility is to be expected. Keep focused on the long term, and tune out any day-to-day gyrations. Downdrafts in the market can be a significant buying opportunity for your retirement savings.

12/18/2024, 9:15 AM EST

All eyes are on the Fed’s updated ‘Summary of Economic Projections’

The Fed today is set to publish an update to its quarterly Summary of Economic Projections (SEP), a closely dissected chart that clues investors, consumers and economists into where each official expects interest rates to head over the next few years, currently through 2027.

Its last update in September projected that the Fed planned to cut interest rates four times in 2025. But given recent statements from Powell highlighting higher inflation and a stronger economy than previously anticipated, officials could very well revise those estimates to show fewer cuts.

You might be able to read between the lines (or should I say, connect the dots?!). For instance, Fed officials have eight meetings scheduled for next year, meaning four rate cuts suggest that the Fed expects to reduce borrowing costs at every other meeting. Fewer than that, however, might imply an extended pause.

Reading the Federal Reserve's economic projections

The Fed's projections offer important clues about the future, but they can be confusing. Here's how to decipher them.

Read more

12/18/2024, 9:00 AM EST

What to watch at the Federal Reserve’s December meeting

The Fed is expected to cut interest rates again. What comes next is the biggest question.

There’s a phrase that we Federal Reserve reporters use so much when describing Fed meetings that it might as well be a central banking cliche at this point: What matters most isn’t today’s interest rate announcement, but what the Fed suggests could come next.

It’s perhaps the most relevant way to describe the Federal Reserve’s final interest decision of the year (releasing today at 2 p.m. ET).

Fed officials are already widely expected to cut interest rates for the third time at their December meeting. Most economists and investors expect it because Fed officials made no effort to walk back those expectations leading up to today’s gathering, even after the latest data revealed that inflation has been stubborn and the job market has been stable.

What’s been missing, though, is evidence of a unified consensus on what the future could hold. Here are the key areas that are going to be most important to watch at the Fed’s final meeting of the year:

Could the Fed imply that it plans to skip a few rate cuts? Powell has said the data isn’t compelling officials to be in a rush with interest rate cuts. Officials are set to update their quarterly Summary of Economic Projections (SEP), which will reveal where they expect borrowing costs could head over the course of the next three years. Should officials project fewer than four rate cuts for 2025 (what they estimated back in September), it could signal that Fed officials think they’ll need to leave rates unchanged at multiple meetings — a far slower pace than what’s been happening over the past few months.

Will Fed officials stress that their outlook is even more uncertain? Fed officials are likely going to be even more guarded than usual with the guidance that they give. There’s a lot of uncertainty about what the path for inflation and the economy could look like next year. President-elect Donald Trump’s proposals to raise tariffs on U.S. imports and lower taxes could lead to higher inflation, economists say. Powell, however, will continue to stress that it’s too soon for the Fed to change its tune.

Get ready for the Fed’s December meeting

The Fed is poised to cut interest rates again. Here’s what to watch.

Read moreLive coverage contributors

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Fed remains on hold, keeps forecast for three rate cuts in 2024