Survey: 93% of economists see the Fed lifting rates more than once in 2022

Interest rates have been at their lowest levels in history for the past two years — but that might not last much longer, according to the nation’s top economists.

Every participating economist polled in Bankrate’s Fourth-Quarter Economic Indicator poll sees the Fed raising interest rates this year, while nearly all (or 93 percent) expect more than one rate hike in 2022. The U.S. central bank influences interest rates on key consumer products from auto loans and credit cards to savings accounts and certificates of deposit (CDs).

Reflecting that outlook and a stronger economy, economists also see the 10-year Treasury yield rising to 2.15 percent a year from now, according to the average forecast. That reflects a 72 basis point increase from where the rate stood on Dec. 20, when polling ended for Bankrate’s survey. The yield matters for consumers because it’s a key benchmark for the 30-year, fixed-rate mortgage.

Forecasts and analysis:

This article is the third in a three-part series analyzing findings from Bankrate’s Fourth-Quarter Economic Indicator poll:

- Economists see unemployment sinking to near 50-year low in 2022

- Experts predict another year of decades-high inflation

- 93% of economists see the Fed lifting rates more than once in 2022

Why interest rates are expected to rise this year

Economists’ rate hike projections mark a notable shift from previous surveys. Nearly a third (or 32 percent) of economists in the third-quarter poll braced for a rate hike at some point over the next 12 months, while 28 percent of experts expected one in the second-quarter poll and 19 percent of experts penciled one in during the first-quarter survey.

That pivot highlights a hawkish shift at the Fed itself, with officials in their December 2021 rate projections penciling in at least three rate hikes for 2022 and three more for 2023. Earlier in 2021, officials saw interest rates holding at near-zero for at least two more years.

“Given the economic recovery is well underway, but inflation threatens to undermine it, there is no downside to the Fed raising rates at least a couple times in 2022,” says Robert Frick, corporate economist at the Navy Federal Credit Union. “A federal fund rate of 0.5-0.75 percent is well below the historical average and shouldn’t have a significant effect on GDP [gross domestic product] or job growth.”

Just one economist in Bankrate’s fourth-quarter poll penciled in a single rate hike for 2022.

Fed officials have been challenged by higher inflation, which has shown no signs of slowing down and broadened out to impact all corners of the financial system. Consumer prices in November soared 6.9 percent from a year ago, the fastest annual increase since 1982, as the cost of everything from apparel, groceries and rents grew more expensive. That’s after inflation a month earlier already rose by the most since October 1990.

“The broadening of higher inflation is a major concern — and the Fed will act if inflation doesn’t come down on its own,” says Scott Brown, chief economist at Raymond James Financial.

Officials initially believed that price pressures would slow later in 2021, as supply chain disruptions smoothed out and below-average readings from a year earlier faded. Inflation also wasn’t perceived as an immediate economic threat, mostly because officials thought the labor market was still scarred. About 3.9 million jobs are still missing from the economy, and 2.4 million Americans are on the sidelines of the labor force, according to the Labor Department.

Yet, employers since February 2021 have been trying to fill a near-record number of open positions, exacerbating those production delays. Meanwhile, companies are already raising wages to lure talent, suggesting competition for new workers is getting fierce. A domino effect of rising inflation coupled with higher wages could also create a wage-price spiral that leads to inflation getting more embedded in the economy.

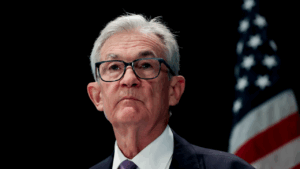

Fed Chair Jerome Powell indicated in December that officials are growing less patient with running the economy hot to entice more workers to reenter the labor force — especially as new strains of the virus such as the Omicron variant risk keeping virus-fearing workers out of the job market for longer. Officials in December decided to reduce its bond buying at twice the speed, a separate program that’s been stimulating the economy.

“Even with Omicron disruptions and a risk of a slowing economy in the first quarter, demand for goods and services will continue to boost inflation, especially as rents and housing prices are skyrocketing,” says Yelena Maleyev, economist at Grant Thornton. “Supply chain bottlenecks and lack of workers exacerbate inflationary pressures, while the labor market is on track to return to its pre-pandemic levels by mid-year.”

The economists’ poll mirrors Bankrate’s 2022 interest rate forecast. Chief financial analyst Greg McBride, CFA, sees two Fed rate hikes for the year. McBride, however, sees the 10-year Treasury yield peaking at 2 percent and then drifting down to 1.7 percent during the year.

What the experts are saying

— Bernard Markstein, president and chief economist, Markstein Advisors

With the economy continuing to show good growth and employment approaching full employment (under current conditions), the Fed recognizes the need to reduce the amount of stimulus it is currently providing the economy. The Fed will move closer to a neutral position and even slightly restrictive over the coming year as long as the economy continues to show solid growth. The need to put downward pressure on inflation will be a guiding principle for the Fed, but only if that does not undermine the continued rebound from the pandemic-induced recession.

— Ryan Sweet, senior director of economic research, Moody's Analytics

The next wave appears to be forming on the fast-spreading Omicron variant of the virus. We assume this wave will be less disruptive to the healthcare system and economy than Delta, but this is a tenuous assumption. The next few weeks will tell. Despite it all, the economy looks on track to return to full employment with inflation near the Federal Reserve’s target by this time next year.

— Odeta Kushi, deputy chief economist, First American Financial Corporation

The Federal Reserve signaled the end of the easy money era is near. Not only did the Fed make the decision to accelerate its tapering of bond purchases, but the December FOMC projections point to three rate hikes in 2022. These factors imply that there’s a strong likelihood of lift-off once the taper concludes. Sustained inflationary pressures and a tighter labor market support the FOMC’s interest rate projections.

Methodology

The Fourth-Quarter 2021 Bankrate Economic Indicator Survey of economists was conducted Dec. 13-20. Survey requests were emailed to economists nationwide, and responses were submitted voluntarily online. Responding were: Scott Anderson, executive vice president and chief economist, Bank of the West; Scott J. Brown, chief economist, Raymond James Financial; Ryan Sweet, senior director of economic research, Moody’s Analytics; Gregory Daco, chief U.S. economist, Oxford Economics; Yelena Maleyev, associate economist, Grant Thornton LLP; Odeta Kushi, deputy chief economist, First American Financial Corporation; Robert Frick, corporate economist, Navy Federal Credit Union; Tenpao Lee, professor emeritus, Niagara University; Robert Hughes, senior research fellow, American Institute for Economic Research; Kathryn Anne Edwards, economist, RAND Corporation; Robert A. Brusca, chief economist, Fact and Opinion Economics; Joel L. Naroff, president, Naroff Economics; John E. Silvia, founder and president, Dynamic Economic Strategies; Bill Dunkelberg, chief economist, National Federation of Independent Business; Mike Englund, chief economist, Action Economics; and Bernard Markstein, president and chief economist, Markstein Advisors.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.