Banking

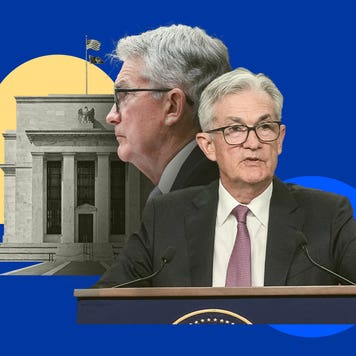

As Trump eyes Powell’s successor, the Fed moves toward another rate cut

7 min read

Interest rates are a little lower than they used to be, but they’re still near the highest levels in over a decade. Here’s what it means for your wallet.

“Americans who are hoping for lower borrowing costs should reset their outlook to a world of largely stable interest rates. Making financial decisions based on the assumption of imminent change is likely to lead to frustration.”

Every time the Federal Reserve adjusts interest rates, borrowing and savings rates move in lockstep. Compare Bankrate data to see how the latest Fed decision is impacting rates on key consumer products.

Our expert reporters and editors bring the news and analysis you need—backed by data and firsthand experience.

About Bankrate

Bankrate Financial Analyst

Principal U.S. Economy Reporter

Senior Economic Analyst

We appreciate your feedback

Thank you for taking the time to share your experience.