Need fast access to your savings? Automated savings app Digit adds instant transfer for bank accounts

Faced with an unexpected expense, quick access to your savings can help you avoid something costly: a short-term loan.

Now, Digit, a popular automated savings app, announced Tuesday a solution: it is starting to let users transfer their savings into their checking accounts within minutes.

For 99 cents per withdrawal, users can move money from their Digit account into another bank account within 30 minutes. Previously, users would have to wait one to three days after putting the withdrawal request in — the typical length of a standard bank transfer.

In fact, the feature is in response to Digit’s customers telling the company that the standard withdrawal is problematic for them, particularly when they need money for an unplanned expense or for things like rent and gas.

“This new feature gives our customers access to their money when they need it the most, and decreases the necessity for short-term borrowing,” Digit stated in an emailed response to Bankrate. “It also represents our continued effort in helping our customers move forward in their journey toward financial health.”

The new Digit feature is made possible through the fintech company’s partnership with JPMorgan Chase’s real-time payments network.

Digit is not the only fintech company that charges consumers a small fee to move their money faster. Venmo, a popular payments app owned by PayPal, also lets users pay a 1 percent fee to move their money to a debit card within 30 minutes.

How Digit’s instant withdrawal feature works

If you need immediate access to your savings on Digit, you can open the app and:

- Click “withdrawal” on your Digit fund.

- Pick the amount you want to withdrawal and select “instant” as the method.

- Confirm your transfer. Then, the money will post into your checking account within 30 minutes.

What Digit’s new feature means for you

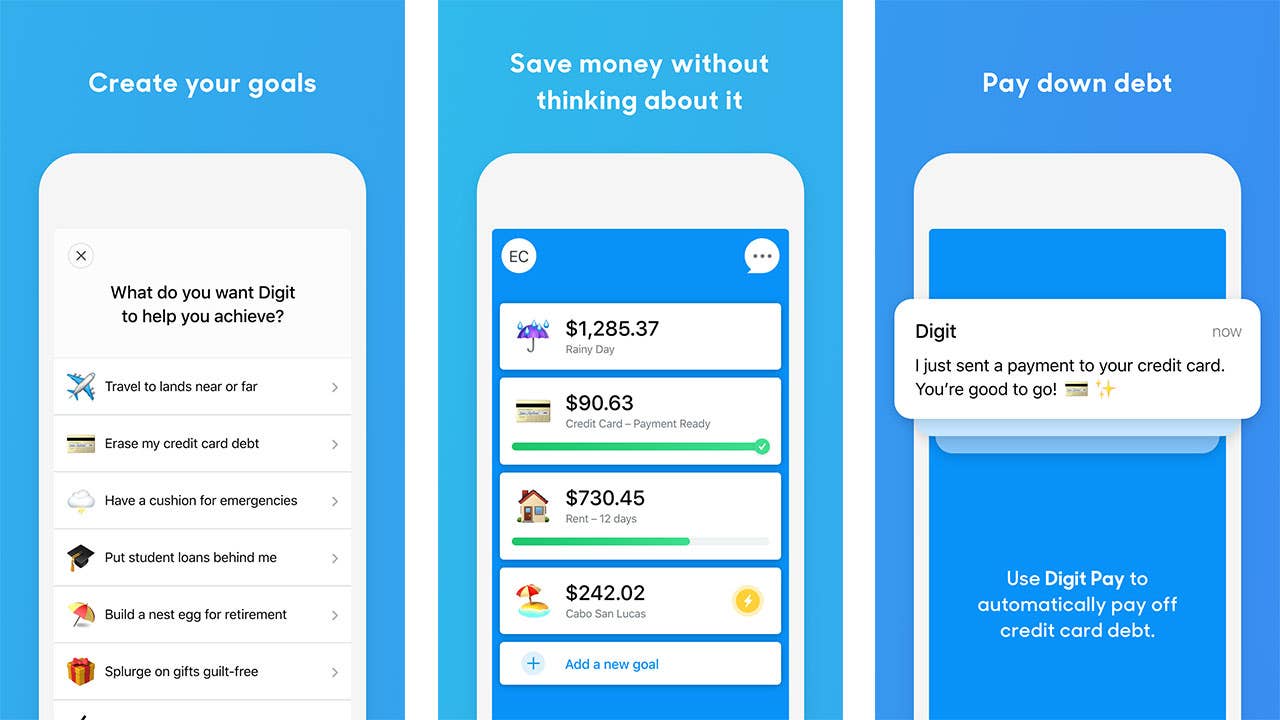

If you’re struggling to save, the Digit app is designed to help you. The app automatically moves small amounts of money from your checking into your savings based on what it thinks you can afford. The app also includes a feature designed to help users pay down their credit card debt through automation.

In an ideal world, your savings app is used to save. Yet, unexpected expenses inevitably come up, and you may need the money back quicker than one to three days. Paying 99 cents to make yourself liquid quicker can help bridge a cash-flow gap in a pinch. However, be cautious. Frequently moving money, especially small amounts, out of your savings can be hazardous to your wealth.

Using Digit, you will also pay a monthly fee. After letting you try the service for free for 30 days, Digit will then charge you $2.99 for a monthly subscription. On the other hand, Digit accounts don’t have a minimum account balance requirement or charge overdrafts.

While Digit announced the instant withdrawal feature today, it is not yet available to all users. The company says all users at eligible banks will have access to the new feature by the end of May.

To Digit, the feature represents its mission to make achieving and maintaining financial health effortless for everyone.

“We’re continuing to build innovative automated tools and are constantly exploring new solutions that will improve our customers’ financial well-being,” said Digit in an emailed response.

Learn more:

- Why Amazon, Acorns and T-Mobile suddenly want to offer checking accounts

- New wave of fintech firms are battling for your savings with high yields

- 5 fintech trends you should be paying attention to

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.