How to deposit a check

Key takeaways

- There are many ways to deposit a check, including through a bank branch, ATM, smartphone, online or through the U.S. Postal Service.

- Precautions should be taken when depositing checks, such as endorsing the check and using valid identification.

- It is important to confirm the legitimacy of a check before depositing it.

Online bill pay and peer-to-peer payment services have reduced the need to use checks as a form of payment, but occasionally you might still need to deposit a check.

Checks are a paper form of payment that can be deposited in a bank account in several ways, including through traditional and digital methods. Here are five ways to deposit a check and the steps necessary for each.

1. At a bank branch

One traditional way to deposit a check is at a bank or credit union by:

- Endorsing the check: On the back of the check, there’s an area that says “endorse here” or something similar. At the bank or credit union, sign in this area to endorse the check.

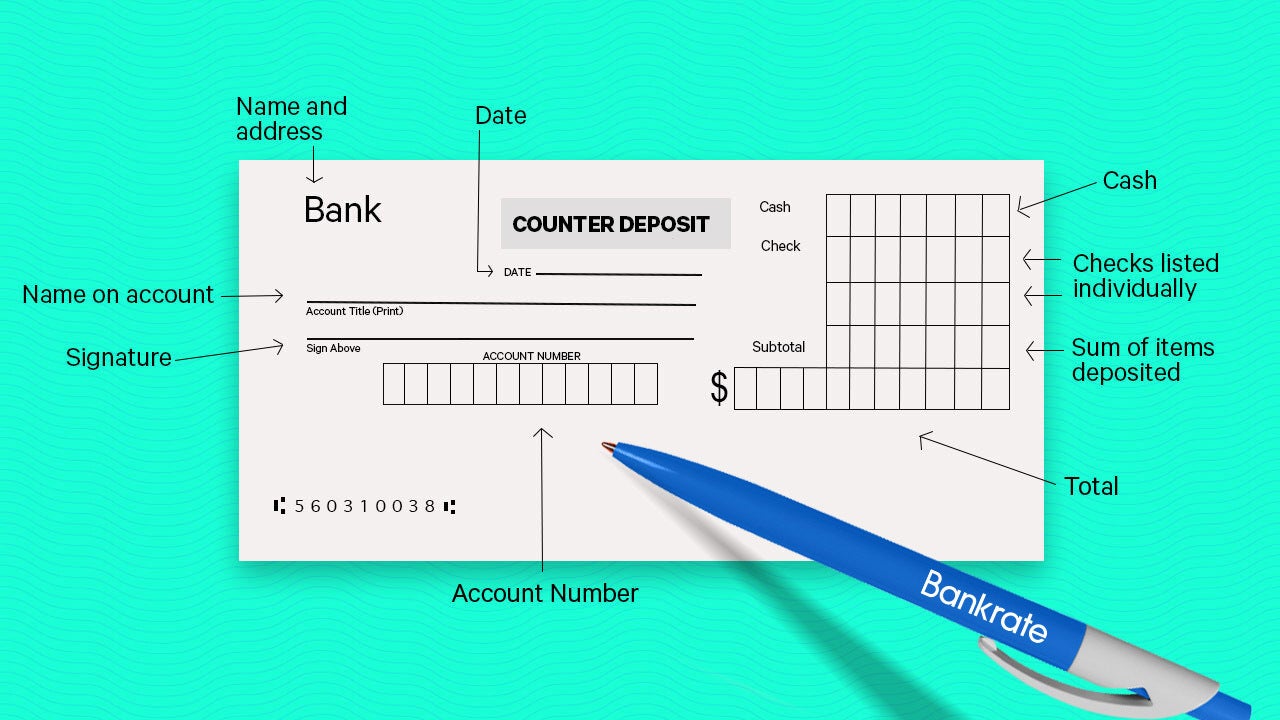

- Filling out a deposit slip: The deposit slip shows the teller what you want to do with your check. You can get this at a bank branch, or there may be deposit slips in the back of your checkbook. On the slip, provide your name, account number and the cash amount of the deposit. If you’d like to receive any of the check amount in cash, note that too. If you’re receiving cash, make sure to sign the slip.

Going to a teller: Present the check and deposit slip to the teller. The teller may ask for a driver’s license or other form of ID. Once the banker deposits the funds, you should receive a receipt. Keep the receipt until the funds have cleared into your account, which can take a couple business days.

Illustration by Bankrate

2. At an ATM

An alternative to going to the bank if you can’t make it during business hours is to deposit a check at an ATM. Not all ATMs allow customers to deposit checks, so check with the bank to see if its ATMs provide this service.

To deposit a check at an ATM:

- Gather the necessary items: Have your debit card and the signed check prepared beforehand.

- Insert your debit card and enter the PIN.

- Select the deposit account: In most cases, the funds will be deposited into a checking account or savings account until the money is needed.

- Enter the deposit amount: Unless it’s an ATM that automatically scans checks, type the exact dollar amount of the check.

- Insert the check into the ATM’s slot.

- Confirm the dollar amount: You’ll see a dollar amount on the screen and be asked to verify the number. Depending on the ATM, there may be a few more questions to answer before the deposit is confirmed.

- Take the receipt and your debit card.

Money tip: Looking to give your checking account an extra boost? Consider an interest-bearing checking account. Find the latest top-yielding rates by visiting Bankrate's list of high-yielding checking accounts. Many top-yielding accounts are available at online-only banks and credit unions.

3. With a smartphone

A convenient and fast method for depositing checks is through mobile check deposit, through your bank’s mobile app (if offered). Using this feature, it’s possible to deposit a check from the comfort of your home by:

- Open the bank’s mobile app.

- Signing in with your credentials and finding the option for depositing checks.

- Endorsing the check: Sign the check as you would to deposit it at a bank. Also, make sure to either check the “For Mobile Deposit” box, or, if the check doesn’t have this option, write “For Mobile Deposit Only” beneath the signature line.

- Taking a photo: Find good lighting, a flat surface and position the check in the camera’s frame. The app will likely show guidelines on the phone screen for positioning the check correctly. Once positioned, either you snap a picture or the app automatically does this. Repeat the process for both sides of the check.

- Providing some information: Enter the amount on the check in the app, and confirm that the app has read the account and routing numbers correctly.

4. Online

Like mobile check deposits, online deposits can be made at any time without having to go to a branch. But unlike mobile deposits that only require a smartphone camera lens to capture the check’s image, online check deposits require a scanner.

The steps to deposit a check online are:

- Log in to the bank or credit union’s website, and find the online deposit tab. A high speed internet connection works best.

- Endorse the check: Sign the check before scanning it. Your bank or credit union may also require you to write “For Online Deposit Only,” “For Mobile Deposit Only” or something similar, which will likely be stated on the check deposit page.

- Scan both sides of the check: Unlike mobile check deposit, you can’t take a picture of the check with a phone for online deposit; it must be scanned. But, if you have an iPhone, it’s possible to scan the check using the Notes app.

- Choose the deposit account, and upload the scanned check images.

- Enter the check amount and submit.

Bankrate’s take: An online-only checking account offers such conveniences as 24/7 account access, mobile deposit and transaction alerts available from your computer or smartphone. View Bankrate's picks for the best online checking accounts for 2025.

5. At a U.S. Postal Service Office

Some banks and credit unions allow customers to deposit checks by sending the check through the mail by:

- Endorsing the check: Sign the check as you would with other deposit methods in the “endorse here” area. The bank may require the payee to write their account number and “For Deposit Only” or something similar below the signature as well.

- Fill out a deposit slip: You will need to send a deposit slip along with the check, which includes information such as the account number of the account to be deposited into, your name and the deposit amount.

- Address the check and deposit slip to the bank’s processing center: Make sure to address the envelope to an address provided by the bank for sending checks to, which can be found on the bank’s website or by calling a bank representative.

- Bring the envelope to a U.S. Postal Service office: Hand it to a postal worker rather than dropping it in the mailbox to ensure its safest transfer to the Postal Service. Send the envelope using certified or express mail, which requires someone to sign for the check when it’s delivered and provides confirmation that it was safely received by the bank.

Tips for safely depositing checks

Here are some tips for safely depositing checks:

- Bring a valid ID: When depositing a check at a bank branch, ensure you have a valid form of identification, such as a driver’s license or passport.

- Use mobile deposit wisely: Ensure your banking app is downloaded from a trusted source like Google Play Store or Apple App Store to avoid fraudulent apps. Capture clear, well-lit images of the check on a flat surface.

- Confirm the deposit: After submitting a mobile deposit, keep the physical check until you confirm that the funds have been credited to your account. This can usually be done by checking your account statement online.

- Securely store or destroy the check: Once the check clears, store it securely for a few days (typically five to 14 days) before shredding it to prevent any potential misuse.

Keep in mind: Concerned about the safety of banking online? Online-only banks are typically insured by the Federal Deposit Insurance Corp., or FDIC, for up to $250,000 per depositor, per insured bank, per ownership category. Read Bankrate's “Do online banks offer financial security?

Bottom line

Depositing a check is relatively similar no matter which method you choose. Always endorse the check, and you may need to write an extra note below the signature if the check isn’t being directly handed to a bank teller. The check may take a couple of days to clear before the funds become available.

Make sure the check is legitimate before endorsing and depositing it by confirming that the amount is correct and that it is issued by a legitimate bank. If you suspect a fake check, report it to the Federal Trade Commission.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.