Best banks in Florida for 2026

Key takeaways

- PNC Bank provides strong regional coverage with access to 60,000+ ATMs nationwide for frequent travelers.

- Wells Fargo leads Florida with the most branches statewide, offering convenient access across the Sunshine State.

- Suncoast Credit Union is Florida’s largest credit union, serving nearly 80 branches with low fees and competitive rates.

- TD Bank earned top customer service rankings for Florida in J.D. Power’s 2025 banking satisfaction study.

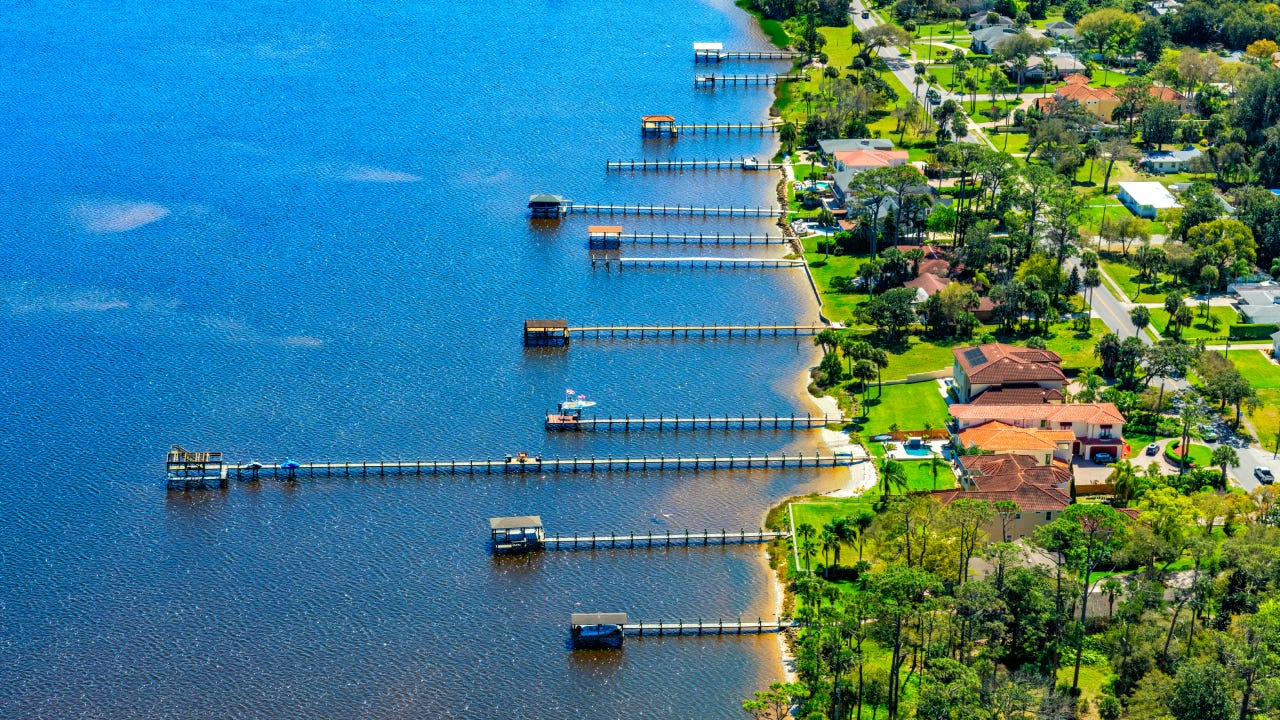

Florida’s diverse banking landscape offers everything from national banks with extensive branch networks to community-focused credit unions. Wherever you are in the Sunshine State, the right bank depends on your priorities — branch access, interest rates, or customer service.

Here are Bankrate’s top picks for the best banks and credit unions in Florida for 2025.

Our picks for best banks and credit unions in Florida

PNC Bank

-

PNC Bank stands out as Florida’s top regional bank choice, with nearly 200 branches in the state and more than 2,000 across the Northeast, South and Midwest. PNC maintains a robust ATM network with about 60,000 nationwide, so even when you’re away from home or traveling outside PNC’s regional footprint, you’ll have fee-free access to your cash. PNC offers all standard deposit accounts, from checking and savings to money market accounts and CDs.

-

Pros

- Virtual Wallet product combines checking and saving services

- Huge ATM network

Cons

- Virtual Wallet’s best annual percentage yields (APYs) aren’t available in Florida

- PNC’s high yield savings account isn’t available in Florida, and standard savings rates are paltry

- Steep $36 overdraft fee

Wells Fargo

-

Whether you’re at the tip of the state in Tallahassee or by the water in Miami, Wells Fargo probably has a branch nearby, as it maintains the most branches of any bank in Florida, according to the Federal Deposit Insurance Corp. (FDIC).

The bank’s reach extends well beyond Florida, with branches in 35 other states and approximately 11,000 ATMs nationwide. This extensive network means you can access your money and banking services whether you’re at home or traveling across the country. Wells Fargo offers a complete range of consumer accounts including CDs, savings, and checking accounts.

-

Pros

- Complete range of account offerings

- Competitive yields on promotional CDs

Cons

- Rock-bottom earnings on savings accounts

- Steep $35 overdraft fee

Suncoast

-

Suncoast Credit Union holds the distinction of being Florida’s largest credit union and the tenth largest in the nation. With nearly 80 branches throughout Florida, it offers the most extensive credit union network in the state. The credit union’s branches concentrate on Florida’s western side, though members get access to more than 30,000 ATMs nationwide through shared networks.

Membership is open to those who live, work, or worship in select Florida counties, making it accessible to most residents. The credit union provides a full range of deposit accounts.

-

Pros

- No monthly maintenance fees on deposit accounts

- Free interest-bearing checking account

- Free overdraft protection on Smart Checking accounts

Cons

- Savings account APY is below the national average

- Higher yields are available at other banks and credit unions

TD Bank

-

Our pick for the bank with the best customer service in Florida is TD Bank, which tied with PNC Bank in J.D. Power’s 2025 U.S. Retail Banking Satisfaction study. We’re featuring it over PNC Bank because it has a slightly higher Bankrate Score and its branches are open seven days a week. The J.D. Power survey measures satisfaction across seven key areas including trust, account offerings, digital channels, and problem resolution.

TD Bank mobile app also receives high marks from users, with strong ratings from over 330,000 reviews across iOS and Android platforms.

The bank offers plenty of account options, from CDs to checking, supported by more than 1,000 branches across 16 states.

-

Pros

- Extended hours at bank branches

- Rapid replacement of lost debit cards

- Rates above national averages on CDs

Cons

- Smaller ATM network than other featured banks

- Hefty service fee on Complete Checking Account (though there are ways to waive it)

- Large $35 overdraft fee

How to choose the right bank for you

The right bank for you depends on your financial goals and priorities, with options ranging from traditional banks to online banks and credit unions. Consider these tips when choosing a bank:

- Look for banks with low or no fees, especially for common charges like monthly maintenance fees, ATM fees and overdraft fees.

- When considering accounts to stash your savings, look for banks with competitive APYs.

- Consider the convenience of local branches and digital features, like mobile banking and the ability to lock your debit card.

- Read the fine print and understand the terms and conditions of your chosen bank, including potential promotional deals and federal insurance coverage.

- Research bank reviews and consider managing accounts at multiple banks or credit unions for a more tailored banking experience.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.