12 most popular types of cryptocurrency

Key takeaways

- Bitcoin is the largest cryptocurrency in the world by market cap.

- Ethereum comes in second with a market cap that is roughly a quarter of Bitcoin’s.

- The crypto market as a whole has an estimated market cap of $3.92 trillion, according to CoinMarketCap.

Bitcoin gets all the headlines when people talk about cryptocurrencies, but there are literally thousands of other options when it comes to these digital currencies. In fact, cryptos that aren’t Bitcoin are usually considered an “also-ran” — what are called “altcoins,” or alternatives to Bitcoin.

While Bitcoin may have been the first major cryptocurrency to hit the market — it debuted in 2009 — many others have become highly popular, even if not quite as large as the original.

Here are the largest cryptocurrencies by the total dollar value of the coins in existence, that is, the market capitalization, or market cap. (Data is from CoinMarketCap.com as of Aug. 29, 2025.)

Largest cryptocurrencies by market cap

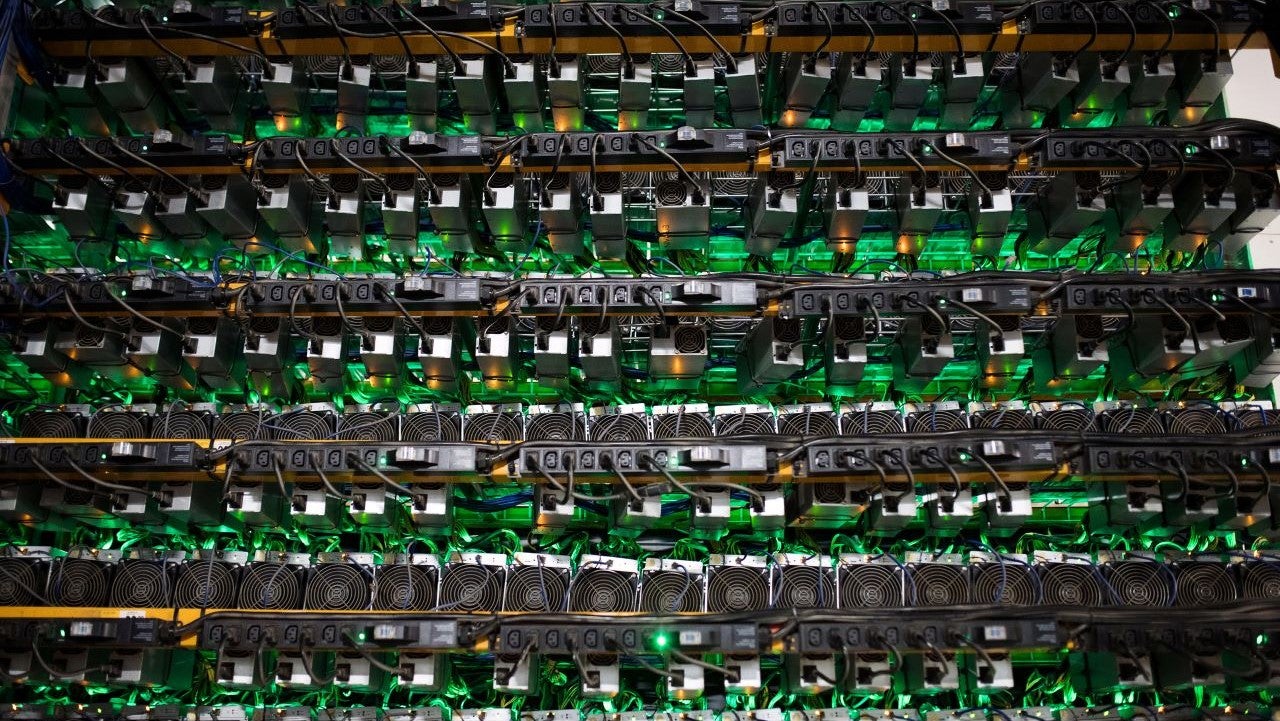

1. Bitcoin (BTC)

- Price: $110,568.18

- Market cap: $2.2 trillion

As the harbinger of the cryptocurrency era, Bitcoin is still the coin people generally reference when they talk about digital currency. Its mysterious creator — allegedly Satoshi Nakamoto — introduced the currency in 2009 and it’s been on a roller-coaster ride since then. However, it wasn’t until 2017 that the cryptocurrency broke into broader popular consciousness. In 2024, the Securities and Exchange Commission (SEC) approved the trading of ETFs that invest directly in Bitcoin, giving investors an easy way to bet on Bitcoin.

2. Ethereum (ETH)

- Price: $4,390.28

- Market cap: $529.94 billion

Ethereum — the name for the cryptocurrency platform — is the second name you’re most likely to recognize in the crypto space. The system allows you to use ether (the currency) to perform a number of functions, but the smart contract aspect of Ethereum helps make it a popular currency.

3. XRP (XRP)

- Price: $2.87

- Market cap: $170.96 billion

Created by Ripple in 2012, XRP offers a way to pay in many different real-world currencies. XRP can be useful in cross-border transactions and uses a trust-less mechanism to facilitate payments.

4. Tether (USDT)

- Price: $1.00

- Market cap: $167.41 billion

Tether’s price is anchored at $1 per coin. That’s because it is what’s called a stablecoin. Stablecoins are tied to the value of a specific asset — in Tether’s case, the U.S. dollar. Tether often acts as a medium when traders move from one cryptocurrency to another. Rather than move back to dollars, they use Tether. However, some people are concerned that Tether isn’t safely backed by dollars held in reserve but instead uses a short-term form of unsecured debt.

5. BNB (BNB)

- Price: $862.14

- Market cap: $120 billion

BNB is the cryptocurrency issued by Binance, one of the largest crypto exchanges in the world. While originally created as a token to pay for discounted trades, Binance Coin can now be used for payments, as well as purchasing various goods and services.

6. Solana (SOL)

- Price: $210.44

- Market cap: $113.8 billion

Launched in March 2020, Solana is a newer cryptocurrency and it touts its speed at completing transactions and the overall robustness of its “web-scale” platform. The issuance of the currency, called SOL, is capped at 480 million coins.

7. USD Coin (USDC)

- Price: $1.00

- Market cap: $70.65 billion

Like Tether, USD Coin is a stablecoin pegged to the dollar, meaning that its value should not fluctuate. The currency’s founders say that it’s backed by fully reserved assets or those with “equivalent fair value” and those assets are held in accounts with regulated U.S. institutions.

8. Dogecoin (DOGE)

- Price: $0.2175

- Market cap: $32.79 billion

Originally created as a joke after the run-up in Bitcoin, Dogecoin takes its name from an internet meme featuring a Shiba Inu dog. Unlike many digital currencies limiting the number of coins in existence, Dogecoin has unlimited issuance. It can be used for payments or sending money.

9. TRON (TRX)

- Price: $0.3398

- Market cap: $32.17 billion

TRON is a decentralized blockchain for creating applications that was established in 2017. Its native token is known as TRX. In 2018, the Tron Foundation acquired well-known peer-to-peer network BitTorrent.

10. Cardano (ADA)

- Price: $0.8365

- Market cap: $29.89 billion

Cardano is the cryptocurrency platform behind ada, the name of the currency. Created by the co-founder of Ethereum, Cardano also uses smart contracts, enabling identity management.

11. Chainlink (LINK)

- Price: $23.50

- Market cap: $15.94 billion

Chainlink is a cryptocurrency that powers the Chainlink network, which is used to pay operators for connecting smart contracts to real-world data, making it essential for DeFi apps.

12. Hyperliquid (HYPE)

- Price: $45.26

- Market cap: $15.10 billion

Hyperliquid is a decentralized exchange built on its own blockchain. It’s known for advanced capabilities like perpetual futures trading and margin trading. HYPE is the native coin to the platform.

Bottom line

The cryptocurrency market is a Wild West, so those speculating in these digital assets should not put in more money than they can afford to lose. It’s also important to note that individual investors often trade against highly sophisticated players, making it a fraught experience for novices.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.