How to prepare your home for a natural disaster

A natural disaster can be financially devastating. Thankfully, a standard home insurance policy can protect against much of the financial ruin that damage from a natural disaster can cause — still, some exposures will exist. Knowing what home insurance covers during natural disasters can help you be better prepared for the unexpected, and getting familiar with how to prepare your home for a natural disaster can help to minimize damage.

How prevalent are natural disasters?

Natural disasters can cause extensive damage to homes in their path, including broken windows and water or structural damage. The National Oceanic and Atmospheric Administration (NOAA) reports that in 2023, the U.S. experienced 28 billion-dollar severe weather events — the highest number in a single calendar year. The total estimated damages from these events are estimated to be around $93 billion, made up by the following:

- 1 winter storm, impacting the northeast U.S.

- 1 wildfire, impacting Lahaina on Maui Island of Hawaii

- 1 drought and heat wave, impacting the central and southern U.S.

- 4 floods, impacting California, Florida, eastern and northeastern U.S.

- 2 tornadoes, impacting central and southeast U.S.

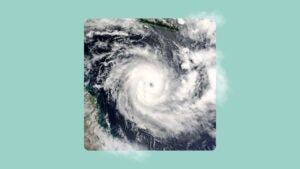

- 2 tropical cyclones, including Hurricane Idalia in Florida and Typhoon Mawar in Guam

- 17 severe weather and hail events throughout the U.S.

Tips to prepare your home for a natural disaster

The best time to prepare your home for a disaster is before it happens. Being proactive is key; building the home with wind-proof and fire-proof materials offers some of the best protection, but it is not essential. You can still fortify your home against natural disasters without needing to do a complete home renovation.

Reinforce doors and windows

During a hurricane or tornado, doors can fly off and loose debris can break windows. Consider installing wind-resistant doors and windows or storm-proof shutters to keep them intact during a storm. In a pinch, you can board up windows and doors with plywood before a storm is expected to hit.

Find water, gas and electrical lines

When a storm is on the horizon, you might receive emergency instructions to turn off the home’s water, gas and electricity connections to prevent flooding and fire hazards. Water and power lines, if left unchecked, can cause additional damage. If there is an evacuation order, disconnect water, gas and electrical lines before leaving.

Use sandbags

Sandbags divert water, and placing them around doors or in flood-prone areas is an effective way to keep flood water from seeping into a home during a hurricane. This can be especially crucial during a storm surge. The sandbags should be stacked at least one foot high for adequate protection. If you have the space for it in your garage, it may be worthwhile to have a couple on-hand before a storm is scheduled to hit to avoid a mad dash to the hardware store.

Secure outdoor furniture

If there is outdoor furniture on a porch or patio, make sure everything is tied down and secured before a storm hits. Loose items, like sporting equipment, grills or umbrellas should be moved inside, if possible. Double-check that toys, yard tools and other small items are not left outside before a storm. These items could easily cause additional damage to your property and possibly damage your neighbor’s property.

Prune large trees

Trees can cause major damage during a storm. Heavy branches that overhang the home’s roof can easily fall and cause significant problems, including injuries to people inside. To keep the roof safe, regularly prune large trees on the property and ask neighbors to keep any trees that cross property lines trimmed. If you are in a fire-prone area, consider creating a defensible space between your house and any foliage that could potentially catch a stray ember.

Secure heavy furniture to the walls

Earthquakes can be powerful enough to knock over heavy furniture, including appliances like a refrigerator. Items that fall can cause serious injuries, especially to young children. If the home is located on or near a fault line, secure heavy furniture to the walls with a bracket and be sure nothing near them can be damaged if they fall.

Practice fire-smart landscaping

Planting fire-resistant plants and keeping your yard and garden well-watered can help prevent a wildfire from spreading to your home. A well-maintained lawn that does not have overgrown, dried-out grass may also help mitigate your risk. However, it’s important to understand that almost anything will burn in certain circumstances.

Prevent pipe bursts during freezes

Exposed pipes are more likely to freeze and burst. If you live somewhere prone to extreme cold and know a cold snap is heading to town, insulating pipes could be a smart move. Pipe-wrapping products like foam tubing or heat tape can be purchased from hardware stores. For especially cold weather, experts recommend fully covering pipes with insulation and then wrapping them again with plastic, sealing the ends with tape. The insulation is meant to provide a barrier against the cold and helps prevent pipe contents from freezing and expanding.

Create an emergency plan and kit

Some items to keep in an emergency kit might include non-perishable food items and bottled water (in case stores are not open and the water supply is impacted), as well as medications, chargers for cell phones and radios for emergency alerts. Experts recommend keeping a physical document that includes evacuation routes, insurance policy information, local radio stations and a checklist for securing the home. Having a digital and physical version may prove useful in the event of a power loss. Every member of your household should ideally know the emergency plan for each type of disaster and where the supplies are located. If applicable, determine a safe meetup place or contact method for family members who may be outside of the house. Keep in mind that cell phones may not be available in the aftermath of a natural disaster.

Prepare for a power outage

Before a potential power outage, it can be helpful to make a list of the devices that are necessary to connect to an alternative power source. Having a backup mobile battery, battery packs, flashlights, headlamps and even a portable generator can help you prepare for an outage. Food can spoil in the fridge if the power is out for too long, so getting cooler packs can maintain lower temperatures for longer.

Consider a plan for pets

Creating an emergency kit for your pets can help you keep them safe, calm and comfortable during a natural disaster. Make sure you have a leash, harness, pet carrier or other way to transport your pets in case of an evacuation. Your kit should also contain food, drinking water, litter (if relevant), medication, medical records, food and water bowls and a bed (if it can fit).

What home insurance covers during natural disasters

A home insurance policy can financially protect against many — but not all — types of natural disasters. It will depend on what perils are covered in your policy. Under a standard HO-3 home insurance policy, you will likely be covered for:

- Thunderstorms

- Hurricanes

- Tornados

- Wildfires

- Blizzards

- Falling objects

- High winds

- Freezing temperatures

- Weight of snow and ice

Home insurance will usually cover damage to the home’s exterior and personal belongings inside and outside the home. If it becomes necessary to move out temporarily while the home is being repaired, loss of use coverage should pay for hotel and food expenses.

Several natural disasters are not covered by standard homeowners insurance policies, though, including flood or earthquake damage. Homeowners who live in areas where floods and earthquakes are common are encouraged to consider purchasing separate flood insurance and earthquake insurance policies. In some states, damage from hurricanes (particularly wind damage) might be covered, but there may be a hurricane or windstorm deductible that is separate from your normal damage deductible. In coastal towns or other areas prone to hurricane damage, this deductible is usually 1 to 5 percent of your home’s insured value. If you live in a wildfire zone, wildfire damage may not be included in your home insurance policy.

- This year’s hurricane season could be especially bad because of warmer ocean temperatures in the Atlantic, La Niña conditions in the Pacific and fewer trade winds in the Atlantic.

- Other experts say that 2024 will be a record-breaking year for hurricanes, predicting 23 named tropical storms. This is nearly 60 percent higher than the 1991-2020 average of 14.4 named storms.

- Colorado State University (CSU) predicts that 2024 hurricane activity will be around 160 percent of the average hurricane season.

Homeowners insurance typically covers some forms of hurricane damage, but does not cover flood damage. Homes in high-risk areas may need windstorm insurance and flood insurance to avoid potential gaps in coverage. When a hurricane approaches, most insurance companies put a moratorium on increasing coverage or lowering deductibles until the storm passes. Bankrate has several hurricane resources to help you understand how your home insurance coverage may financially protect you from storm damage. These guides also provide tips to prepare your home for a storm and resources on how to file a claim for hurricane-related damage.

Frequently asked questions

-

There are a variety of options available when it comes to choosing the best home insurance company. While it can help to get a sense of the average cost of homeowners insurance, large factors that influence your premium include your state and ZIP code. It’s a good idea to do some research to compare providers or speak with a licensed insurance professional to find the right company, coverage and price for you.

-

Ideally, a storm kit includes canned or nonperishable food, bottled water, first aid supplies, a radio, flashlight, spare batteries and personal hygiene supplies at minimum.

-

You can purchase flood insurance through the National Flood Insurance Program (NFIP) or through a private flood insurance provider. Most major insurance companies partner either with the NFIP or private providers to sell policies to homeowners. You can also go directly to the NFIP or a private flood insurance company of your choice to secure coverage. Flood insurance premiums are generally paid in full up front and there is typically a 30-day waiting period before new flood insurance takes effect. If you live in an area prone to flooding, you may want to strongly consider flood insurance because if there is already a storm in the forecast, it may be too late to secure coverage. Even if you aren’t in a high-risk area, flood insurance may be a good idea, as even a small amount of water in your home can cause devastating financial consequences.

-

Flood damage is the main type of natural disaster damage not covered by a standard home insurance policy. Floods are only covered if you purchase separate flood insurance through the National Flood Insurance Program or a private insurer. Without flood coverage, water damage from events like flash floods, storm surges or overflowing rivers would not be covered. Hurricane and tropical storm damage is covered under standard policies unless flooding is the main cause of damage. Earthquakes are also typically excluded from most insurance policies.

-

Yes, home insurance premiums typically go up after almost any covered claim. However, the rate increase depends on the severity of the claim and the cost of repairs. Homeowners usually have some options to help offset rate increases, including taking advantage of available discounts or adjusting coverage. It’s a good idea to speak with a licensed insurance professional to ensure that there is still adequate coverage before making any policy changes.

You may also like

12 ways to avoid hurricane damage

How to prepare your home for hurricane season

How to financially prepare and recover from a natural disaster