Federal Reserve leaves interest rates unchanged, sees no more hikes this year

The Federal Reserve left interest rates unchanged and dialed back projections for further rate hikes in 2019, as inflation remains tame and economic growth slows.

The U.S. central bank voted unanimously Wednesday to maintain its benchmark interest rate in a range of 2.25 percent and 2.5 percent, a widely expected move after officials stressed that they would be “patient” and flexible” before deciding to adjust borrowing costs again.

Officials also updated their economic projections, trimming the number of increases they foresee in 2019 from two to zero.

The policy-setting Federal Open Market Committee (FOMC) said the labor market is “solid,” adding that inflation “has declined.” Officials also removed language saying that the labor market “has continued to strengthen” from their post-meeting statement, following the release of the February employment report, which showed the slowest pace of job creation since September 2017.

“The reason we’re on hold is that we think our policy is in a good place, and the economy’s in a good place, and we’re watching carefully,” said Fed Chairman Jerome Powell in a press conference following the two-day gathering. “It’s a great time for us to be patient and watch and wait and see how things evolve.”

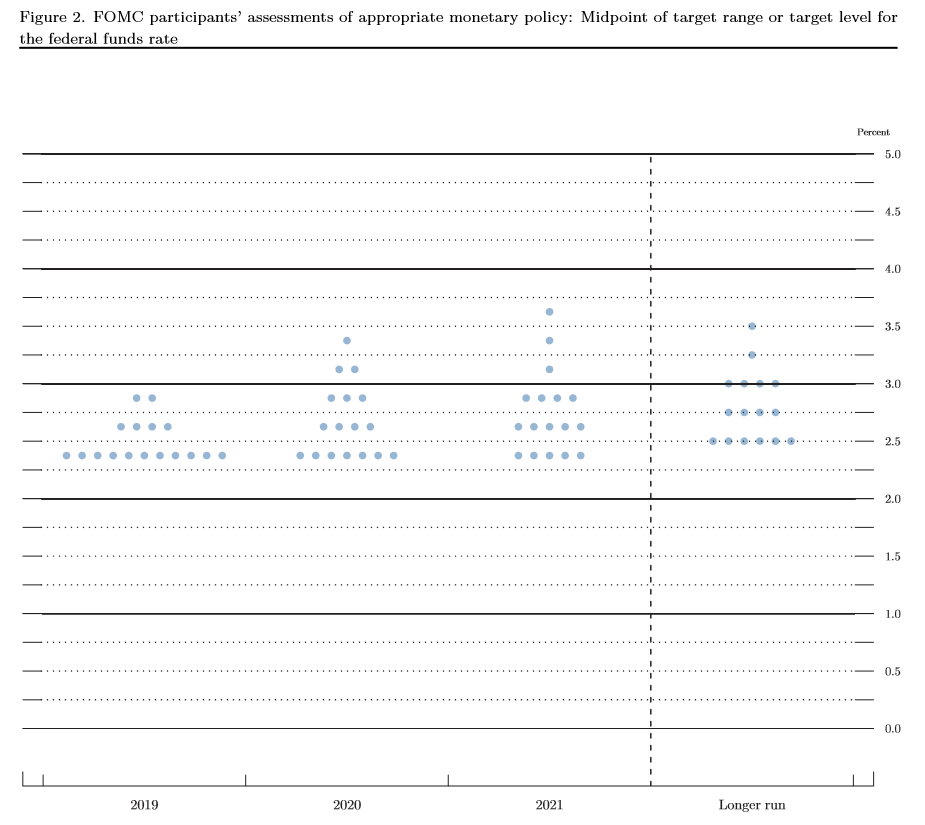

Fed’s interest rate outlook

This marks the second-straight meeting that the Fed has held borrowing costs steady, signaling that its sweeping pivot in January was more than an about-face to volatile financial markets and presidential animosity but an act of hitting the pause button on its gradual tightening of monetary policy.

The Fed started lifting rates in 2015, after years of aggressive interventions to keep the labor market and economy afloat in the aftermath of the financial crisis. It has since hiked rates nine times, as it transitions from stimulating economic growth to stabilizing it. Four of those upward adjustments occurred last year.

The Fed’s updated projections, however, signal that no more increases are in store for this year, showing that the central bank’s patience could last through the rest of 2019. Officials are bracing for choppiness from Brexit, unresolved trade tensions, slowing global and domestic growth, as well as subdued inflation from falling energy prices.

These downgraded projections supported market expectations. Investors are predicting that the Fed will remain on hold for the remainder of the year, according to CME Group’s FedWatch tool.

While officials were expected to downgrade their forecast for more rate hikes, they weren’t expected to downgrade them this much, says Robert Brusca, chief economist at Fact and Opinion Economics who used to work for the New York Fed.

“Whether at the Fed or the private sector, the most dangerous thing that you can do as an economist is change a forecast, because the worst thing that could happen is to find out that the forecast you had before was correct,” Brusca says. “This is a risky change that they’ve made. In some sense, they really seem to have made up their mind that conditions have changed.”

In their updated forecasts, the FOMC projected a median federal funds rate of 2.375 percent by the end of 2019, down from the 2.875 percent that they previously estimated in December. Four officials expected one increase this year, while two officials expected two more increases.

But don’t read too much into the dots, says Bill English, finance professor at Yale University who worked for the board of governors for more than 20 years. They’re a better illustration of the broader picture.

“You can’t obsess about one rate hike in a year or two years or three years because it just doesn’t make sense. It will change over time as new data comes in,” English says. “You want to kind of step back and look at the big picture, and the big picture he was painting today is that they still think the outlook is positive, but there are risks that they’re attune to.”

(READ: The Federal Reserve’s dot plot explained — and why you might want to ignore it for now)

Powell emphasized that the committee’s primary form of communication is through its post-meeting statement, rather than its dot plot. Still, that report showed that policymakers downgraded their descriptions of the economy, says Greg McBride, CFA, Bankrate’s chief financial analyst.

“No rate hikes to see here, just move along,” McBride says. “There are no less than six downgrades of various aspects of the economic assessment in the first paragraph of the Fed statement, and projections of slower economic growth, lower inflation and higher unemployment than what was put forth in December.”

Economic forecasts lowered

Policymakers also lowered their expectations for gross domestic product and inflation, but expect the unemployment rate to edge up to 4.3 percent over the longer run.

The median estimate among Fed officials calls for economic growth in 2019 to be around 2.1 percent, down from the 3 percent previously estimated in December.

This doesn’t differ much from the fourth quarter reading of GDP, which showed that the economy expanded by 2.6 percent, according to the Department of Commerce. It may, however, be a bit overly optimistic, says Michael Pearce, senior U.S. economist at Capital Economics.

“Most forecasts are expecting first quarter GDP growth to be well below 2 percent,” Pearce says. “Even though they cut those projections, they still imply that growth will pick up over the rest of the year.”

The Fed expects to see the jobless rate at 3.7 percent at the end of the year, while inflation is expected to continue holding below the Fed’s 2 percent objective.

Plans to finish balance sheet normalization by September

The Fed also further defined the edges surrounding its balance sheet normalization process. Officials plan to start tapering down the reduction of its holdings in May and completely finalize the process by September, a separate statement said.

The balance sheet’s total size will be $3.5 trillion, or approximately 17 percent of GDP, Powell said, adding that it will mostly be composed of Treasuries. The balance sheet currently totals $3.97 trillion, according to figures from the Federal Reserve’s board of governors.

(READ: Everything you need to know about the balance sheet — and what it means for you)

The Fed started large-scale asset purchases of mortgage-backed securities and Treasuries to stimulate the economy after the Great Recession, hoping to push down long-term interest rates even more after slashing borrowing costs to virtually zero.

Investors had expressed concerns that shedding those assets could have the opposite effect, but Powell said the committee does not view its balance sheet normalization process as a form of monetary policy tightening.

“We’re returning the balance sheet to a normal level over the course of the next few months, and we’re not really thinking about those as two different tools of monetary policy,” Powell said.

The balance sheet will be larger than the pre-crisis era to account for the increased amount of reserves that banks hold in accounts at the Fed, according to the Fed.

“Banks just had a near death experience during the crisis,” English says. “Even independent of whatever regulatory rules they face, they want to hold a lot more reserve balances because they’re more attuned now to the risks they could face.”

Next steps for consumers

The Fed’s latest move and updated forecasts gives borrowers an extra chance to catch their breath, but consumers shouldn’t sit still.

“Two of the possible outcomes are, the economy continues to expand and the Fed has to later raise interest rates, or the economy slows and fears of an eventual recession grow,” McBride says. “In either case, you’ll be happy to have dispatched with your debt rather than still be lugging it around.”

Learn more:

- Here’s what top economists say will be the biggest risks to economic growth this year

- Three-fourths of business economists are predicting a recession by 2021

- Alexandria Ocasio-Cortez’s 70 percent tax plan: How investors could protect their portfolios

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Mortgage rates rise despite Fed cut